Confederation and cantons to receive distribution of CHF 4 billion According to provisional calculations, the Swiss National Ban k will report a profit in the order of CHF 21 billion for the 2020 financial year. The profit on foreign currency posi ti ons amounted to CHF 13 billion. A valuation gain of CHF 7 billion was recorded on gold holdings. The net r esult on Swiss franc posit ions amounted to over CHF 1 billion. The allocation to the provisions for currency...

Read More »Swiss franc shrugs off being put on the naughty step by US

Switzerland was named a currency manipulator by the US Treasury in December 2020. © Keystone / Gaetan Bally For many foreign exchange traders, the US Treasury’s decision to designate Switzerland as a currency manipulator last month comes nearly six years too late and with a good dose of irony. The Swiss National Bank threw currency markets into full-blown chaos in January 2015 when it unexpectedly abandoned its cap on the franc’s value, within days of a senior...

Read More »Swiss balance of payments and international investment position: Q3 2020

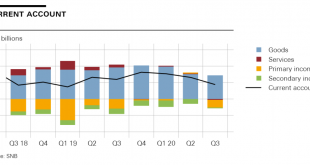

In the third quarter of 2020, the current account surplus amounted to CHF 9 billion, CHF 3 billion less than in the same quarter of 2019. This decline was particularly due to the lower receipts surplus in trade in goods and services. In the case of the goods trade, the decline was attributable to gold trading. This decrease was curbed by the expenses surplus for primary and secondary income, which decreased compared to Q3 2019. In the financial account, reported...

Read More »Krankenzusatzversicherer: FINMA sieht umfassenden Handlungsbedarf bei Leistungsabrechnungen

Die Eidgenössische Finanzmarktaufsicht FINMA stellt aufgrund ihrer jüngsten Analysen fest, dass Rechnungen im Bereich der Krankenzusatzversicherung häufig intransparent sind und zum Teil unbegründet hoch oder ungerechtfertigt scheinen. Die FINMA erwartet von den Versicherern ein wirksameres Controlling, um solchen Missständen zu begegnen. Zudem fordert die FINMA die Versicherer auf, die Verträge mit den Leistungserbringern zu überprüfen und wo nötig zu verbessern....

Read More »Monetary policy assessment of 17 December 2020

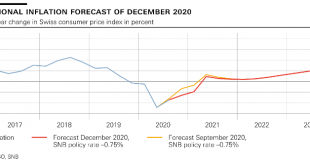

Swiss National Bank maintains expansionary monetary policy The coronavirus pandemic is continuing to have a strong adverse effect on the economy. Against this difficult backdrop, the SNB is maintaining its expansionary monetary policy with a view to stabilising economic activity and price developments. The SNB is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%. In light of the highly valued Swiss franc, the SNB remains willing to...

Read More »“Dirk Niepelt im swissinfo.ch-Gespräch (Interview with Dirk Niepelt),” swissinfo, 2020

Dirk Niepelt ist der Direktor des Studienzentrums Gerzensee und Professor für Makroökonomie an der Universität Bern. Hier im Gespräch mit Geldcast-Host Fabio Canetg. swissinfo.ch Swissinfo, December 14, 2020. HTML, podcast. We talk about CBDC, the Swiss National Bank, whether CBDC would render it easier to implement helicopter drops, and how central bank profits should be distributed. Dirk Niepelt ist weltweit einer der führenden Forscher auf dem Gebiet der...

Read More »Swiss National Bank accused of lagging behind in green investment

[caption id="attachment_603925" align="alignleft" width="400"] About 3-5% of the investments of 180 Swiss financial institutions taking part in a government climate compatibility test flow into fossil energies like oil, gas and coal, according to a new report Keystone / Larry Mayer[/caption] Swiss banks and retirement funds are still investing enormous sums in fossil fuel companies and thereby contributing to global warming. This is the conclusion of a...

Read More »BIS, Swiss National Bank and SIX announce successful wholesale CBDC experiment

A Swiss national flag flutters in the wind atop the Swiss National Bank SNB headquarters in Bern, Switzerland April 16, 2015. REUTERS/Ruben Sprich/File Photo - Click to enlarge Project Helvetia shows the feasibility of two proofs of concept (PoCs), using “near-live” systems to settle digital assets on a distributed ledger with central bank money. A PoC linking the existing payment system to a distributed ledger and another issuing a wholesale central bank digital...

Read More »Issuance calendar for Confederation bonds and money market debt register claims in 2021

The Swiss National Bank (SNB) and the Federal Finance Administration (FFA) advise as follows: The Federal Finance Administration plans to issue bonds with a face value of CHF 6.5 billion in 2021. Taking account of bonds maturing, the volume of bonds outstanding will increase by CHF 2.4 billion. The volume of outstanding money market debt register claims will rise by approximately CHF 4 billion and will be kept within a range of CHF 12 billion to CHF 18 billion....

Read More »Strategische Ziele 2021 bis 2024

Die Eidgenössische Finanzmarktaufsicht FINMA veröffentlicht ihre strategischen Ziele für die Periode von 2021 bis 2024. Diese wurden heute vom Bundesrat genehmigt. Die insgesamt zehn Ziele zeigen auf, wie die FINMA ihr gesetzliches Mandat erfüllen will und welche Schwerpunkte sie dabei setzt. Die Ziele betreffen verschiedene Bereiche des Kunden- und Systemschutzes, aber auch betriebliche Themen. Mit dem Jahr 2021 bricht für die FINMA eine neue Strategieperiode an....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org