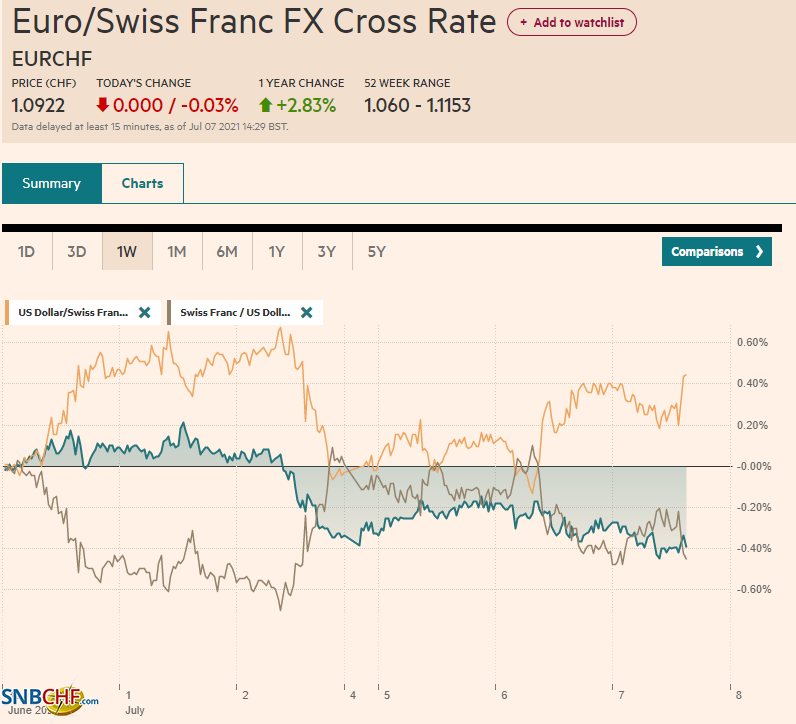

Swiss Franc The Euro has fallen by 0.03% to 1.0922 EUR/CHF and USD/CHF, July 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar has steadied after surging yesterday and has so far retained the lion’s share of its gains, though it remains lower against most major currencies today. The dollar-bloc and Norwegian krone are the best performers while the yen is underperforming. The freely accessible emerging market currencies, including the Russian rouble, Mexican peso, Turkish lira, and South African, are the strongest. The JP Morgan Emerging Market Currency Index is stabilized after falling nearly 1% yesterday. The bond market rally that took the US 10-year yield below 1.35% and the 30-year below

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brazil, China, Currency Movement, EUR/CHF, Featured, Germany, Japan, newsletter, Norway, Sweden, tax reform, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.03% to 1.0922 |

EUR/CHF and USD/CHF, July 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

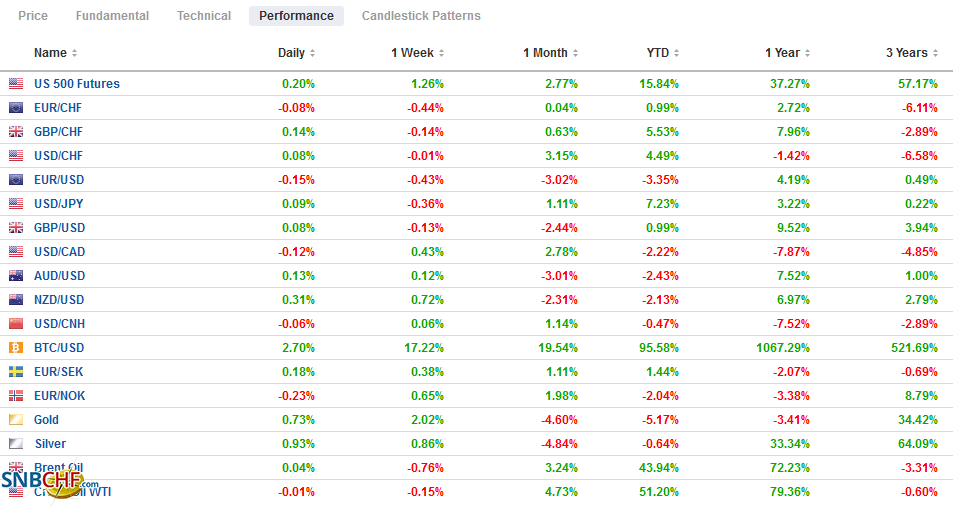

FX RatesOverview: The dollar has steadied after surging yesterday and has so far retained the lion’s share of its gains, though it remains lower against most major currencies today. The dollar-bloc and Norwegian krone are the best performers while the yen is underperforming. The freely accessible emerging market currencies, including the Russian rouble, Mexican peso, Turkish lira, and South African, are the strongest. The JP Morgan Emerging Market Currency Index is stabilized after falling nearly 1% yesterday. The bond market rally that took the US 10-year yield below 1.35% and the 30-year below 2.0% extended today by a few basis points but have stabilized. European bond yields are also softer, and several countries have seen their yields fall to fresh three-month lows. The MSCI Asia Pacific Index fell for the second session, though Chinese and Australian stocks gain. Europe’s Dow Jones Stoxx 600 is recouping yesterday’s loss in full, led by the information technology, materials, and energy sectors. US futures indices are posting modest gains after yesterday’s slide. Gold is back above $1800. Oil prices reversed yesterday’s early gains and tumbled almost 2.4% yesterday. August WTI is firmer today and back toward $75. The US crop report showed deteriorating conditions, especially for soy and wheat. The CRB Index snapped an 11-day rally yesterday with a 2.2% drop. |

FX Performance, July 07 |

Asia Pacific

Chinese officials signaled intentions of cracking down overseas listings. Many Chinese companies have used the “Variable Interest Equity Model” to issue equity offshore. Although Beijing accepted the procedure, it did not endorse it. Over the past decade, PRC-based companies have raised more than $75 billion in such offerings in the US. Meanwhile, the US is seemingly pushing in a similar direction. It has begun insisting that Chinese companies, like other listed companies, must share financial audits with US regulators. If not, they face possible delisting.

As suggested here yesterday, a supplemental budget in Japan is likely. We had arrived at that conclusion through observing Japan’s fiscal modus operandi, Prime Minister Suga’s low support ratings ahead of the October election, the poor showing of the ruling coalition in the Tokyo assembly, and the economic weakness seen in the first half of the calendar year. A Bloomberg survey found median expectations for around JPY20-30 trillion supplemental budget, with about JPY7.5 trillion of new bond issuance. Some of the funds may be targeted to helping the semiconductor industry, for which the US has also earmarked some monies for as well.

The Deputy Governor of the Reserve Bank of Australia and Deputy Head of the RBA board, Debelle, has been renominated for another five-year term. He is recognized as Governor Lowe’s likely successor. Lowe’s term is up in September 2023, though it could be extended. The takeaway is continuity at the RBA.

The dollar’s losses were extended to JPY110.40 earlier today, its lowest level since June 22, but it has found a bid and made new session highs in the European morning above JPY110.75. Talk that Toyko may announce another formal emergency appeared to weigh on the yen. There is an option for a little more than $1 bln, stuck at JPY111, that expires today. There are also chunky options at JPY111.25 that expire over the next two sessions.

The Australian dollar posted a big outside down day after posting a big outside up day after the US jobs data at the end of last week. Still, there was no follow-through selling and yesterday’s $0.7480 low held. There is an option at $0.7500 for around A$365 mln that expires today. Additional optionality in the $0.7530-$0.7550 area expires in the next could of sessions.

The Chinese yuan rose about 0.25% to recoup yesterday’s loss. The PBOC set the dollar’s reference rate at CNY6.4762, a bit firmer than recently against expectations (Bloomberg survey) for CNY6.4750. Separately, China reported a slight decline in the dollar value of its reserves for the first time in three months ($3.214 trillion vs. $3.221 trillion), which is hardly worth explaining and is easily accounted for by valuation shifts–a rounding error. Note too that the value of China’s gold reserves fell by about $9 bln last month.

Europe

German industrial production fell for the second consecutive month and the fourth time in the first five moves of the year. The Bloomberg survey found a median forecast of a 0.5% gain, and instead, the world’s fourth-largest economy reported a 0.3% decline, the same as in April, which had initially been reported as a 1% decline. This was the same pattern seen in yesterday’s factory orders–the May report showed an unexpected decline while the April figures were revised to show a 1.2% gain rather than a 0.2% loss.

Norway, where the central bank has signaled a rate hike will likely be delivered in September, reported a sharp acceleration of its economy in May. The month’s mainland GDP surged by 1.8%, twice what economists had projected after a revised 0.4% expansion in April (initially reported as 0.3%). The surge in activity took place even though industrial production and manufacturing output slipped. At the end of the week, Norway reports its June CPI figures. While the headline may drift toward 3.0%, the underlying measure, which adjusts for tax changes and excludes energy, is expected to be steady at 1.5%. For its part, Sweden reported a strong recovery in May’s industrial production and household consumption. The monthly GDP rose 0.4% in May after contracting by a revised 1.1% in April (initially a 1.4% contraction).

The euro recorded a marginal new low yesterday since early April, a little above $1.18. It has not been able to distance itself from this support area. It has been up to almost $1.1835 today but lacked much enthusiasm. That said, yesterday’s bearish reversal after $1.19 held has not seen follow-through selling today. The does not seem to be much near-term conviction. The bears cannot be happy that that $1.18 level is proving formidable, while the inability to overcome the $1.19 cap may give bulls a second thought.

Sterling fared better in yesterday’s dollar surge. It held well above last week’s lows (~$1.3735), and there also has been no follow-through selling after yesterday’s outside down day. Here too, narrow ranges prevail (sterling has been capped near $1.3815) as participants await clearer directional cues. A move above $1.3850 would lift the tone.

America

The FOMC minutes are one of those reports that often seem to be more discussed than read. Today’s minutes may be more closely scrutinized. We have emphasized that the market’s hawkish takeaway from last month’s FOMC meeting was due solely to the new individual economic projections, which were not even discussed at the meeting and then played down by Fed Chair Powell. The minutes are not an objective record of the FOMC meeting but must be understood as a channel of communication. We suspect the minutes will not be as hawkish as the dots. There is also much interest in the huge volumes being park overnight in the Fed’s reverse repo facility. Despite concern from some market observers, Fed officials seem to be taking it in stride. Powell addressed it specifically at his press conference and suggested that the facility is working as the Fed intended. It had increased the capacity of the reverse repo to absorb the excess reserves. It also had to appreciate that lifting the rate to five basis points in order to help ensure the lower end of its corridor was secure would draw marginal new funds into it.

There are doubts that the US Senate will vote to support a global tax treaty. Some countries have already balked at the proposals, and others may drop their indications of support when the details are worked out. Another wrinkle is emerging. It was hoped that the two-prong reform (a 15% minimum rate and greater sharing of the tax revenue to countries where the sales are made for the largest/most profitable companies) would replace the digital tax that several European countries and Canada have pushed. However, the dispute over the digital tax, which both the Trump and Biden administrations see as a thinly-veiled attempt to target US companies, has not gone away and is still a source of tension.

The US dollar found support ahead of CAD1.2300 for the past three sessions. After approaching it yesterday, the greenback surged to almost CAD1.25, its highest level since April 23. The reversal in oil prices, and commodity prices more generally, and the sharp sell-off in equities added pressure on the Canadian dollar. The US dollar is consolidating in a narrow range below CAD1.2475 today. The IVEY PMI on tap for today is not typically a market mover. The highlight of the week remains the June jobs data due Friday. After losing jobs in April and May, a strong report will likely allow the Bank of Canada (June 14) to continue its tapering campaign with an eye to wind it down by the end of the year. Separately, we note there is beginning to be talk again that Prime Minister Trudeau, who heads up a minority government, may be looking to call a snap election in the fall.

The dollar jumped above MXN20.00 in yesterday’s broad-based rally, but it stopped just shy of last week’s high (~MXN20.0810). It has been down a little through MXN19.95 today. Tomorrow Mexico reports June CPI. The market will be particularly sensitive to an upside surprise given the speculation of another rate hike as early as the next Banxico meeting on August 12. The greenback soared to BRL5.2160 yesterday, its highest level since the end of May. It surpassed the (61.8%) retracement of the decline since the last high on May 24 (~BRL5.3740), which is found near BRL5.19. Many fixed-income asset managers had local Brazil debt as among their largest overweight positions, and some may have joined the BRL sellers yesterday. Today sees May retail sales (expected another strong figure after April’s 1.8% monthly gain). Tomorrow, Brazil report IPCA June inflation, and another rise will cement expectations for another 75 bp rate hike at next month’s central bank meeting (August 4).

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brazil,China,Currency Movement,EUR/CHF,Featured,Germany,Japan,newsletter,Norway,Sweden,tax reform,USD/CHF