[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.] This chapter will provide a brief sketch of the historical context in which the Federal Reserve was founded, summarize some of the major changes to the Fed’s institutional structure and mandate over the years, and end with a snapshot of the Fed’s current governing structure. (Chapters 2 and 3 of this book cover more of the historical context, while chapters 5 and 7 explain the mechanics of Federal Reserve operations in much greater detail.) Historical Context After a bitter power struggle,1 President Andrew Jackson achieved his goal of “killing” the Second Bank of the United States when its charter expired in 1836. The year

Topics:

Robert P. Murphy considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.]

This chapter will provide a brief sketch of the historical context in which the Federal Reserve was founded, summarize some of the major changes to the Fed’s institutional structure and mandate over the years, and end with a snapshot of the Fed’s current governing structure. (Chapters 2 and 3 of this book cover more of the historical context, while chapters 5 and 7 explain the mechanics of Federal Reserve operations in much greater detail.)

Historical Context

After a bitter power struggle,1 President Andrew Jackson achieved his goal of “killing” the Second Bank of the United States when its charter expired in 1836. The year 1837 is considered the beginning of the so-called Free Banking era in the United States, because the federal government conferred no special privileges on individual banks, while some states — most notably New York — allowed relatively free entry into the banking industry.2 (It’s important to note that “free banking” in this context merely means that no special charter was required to open a new bank; the label does not mean that banks were unregulated or even that they were treated the same way as other businesses.3) The Free Banking era ended during the Civil War, after the National Bank Act of 1863 gave the federal government authority to charter national banks.

However, even the various rounds of National Bank Act legislation during the 1860s did not establish a single, central bank of the kind seen in Europe, the most obvious example being the Bank of England (established in 1694). Indeed, in January 1907, investment banker Paul Warburg — widely considered one of the intellectual architects of the Federal Reserve System — wrote:

It is a strange fact that, while in the development of all other commercial phenomena the United States has been foremost, the country should have progressed to so slight an extent in the form of its commercial paper. The United States is in fact at about the same point that had been reached by Europe at the time of the Medicis, and by Asia, in all likelihood, at the time of Hammurabi. Most of the paper taken by the American banks still consists of simple promissory notes, which rest only on the credit of the merchant who makes the notes, and which are kept until maturity by the bank or corporation that discounts them. …

In Europe … there are scores of banks … which give their three-months’ acceptance for the commercial requirements of trade, or which make it their specific business to indorse [sic] commercial bills. … This banker’s acceptance, or this indorsed paper, can be readily negotiated by the buyer at any time. … The holder will always be able to dispose of it, either through private discounting or, in case of need, by selling … to the Bank of England, the Banque de France, or the German Reichsbank [emphasis added].4

As Warburg’s discussion indicates, the original justification for the creation of another central bank — one with more power than the Second Bank of the United States had had — did not allude to the modern goals of “full employment” and “price stability.” Rather, the pleas of the time called for an “elastic currency” that would expand or contract according to the “needs of trade.”

Some nine months after Warburg’s essay appeared, a failed bid by speculators triggered a run on depository institutions and eventually swelled into the Panic of 1907. Insolvent banks collapsed, while solvent yet illiquid banks had to go hat in hand to private lenders such as J. P. Morgan. The experience bolstered calls for the creation of a publicly run “lender of last resort,” and conventional histories cite this episode as pivotal in building support for the creation of a new central bank.5 However, dissenting scholars argue that a group of powerful financial interests had been agitating for a US central bank for years — and Warburg’s essay indirectly confirms this.6

Much of the structure of what would become the Federal Reserve Act was laid out during secret meetings held at Jekyll Island (off the coast of Georgia) in November 1910. Present at the meetings were Senator Nelson Aldrich (and his secretary Arthur Shelton), Henry P. Davison (a J. P. Morgan partner), President7 Frank A. Vanderlip of the National City Bank of New York (now Citibank), Assistant Secretary of the Treasury A. Piatt Andrew, and Paul Warburg himself.8

These prominent figures from government and banking knew that they should keep a low profile, going so far as to book their travel to Jekyll Island under assumed names (so that the press wouldn’t begin wondering why such powerful men were meeting clandestinely). Such intrigue has understandably fueled an entire genre of commentary on the Fed. As journalist Roger Lowenstein put it during his Marketplace interview:

You gotta hand it to the conspiracy theorists, because, in fact, there was a conspiracy. … I call it a patriotic conspiracy, but there was a senator from Rhode Island, a guy named Nelson Aldrich. … [L]ate in his career, he decided we needed a central bank. So he organized — now I’m not making this up, it doesn’t come from Warner Bros. studio or anything — he organized a faux hunting trip to an island off the coast of Georgia [Jekyll Island] where there was an exclusive resort where J.P. Morgan was a member. [Morgan] made sure there was no one else in the club. And the senator, three bankers, the assistant secretary of the treasury — who, by the way, didn’t tell his boss — went down there for a week. They were plied with wild turkey, quail, stuffed oyster. They wrote what became the first draft of the Federal Reserve Act.9

The Federal Reserve Act of 1913On the Federal Reserve’s website, in its About section, the Fed describes its enabling legislation as follows: “The Federal Reserve Act of 1913 established the Federal Reserve System as the central bank of the United States to provide the nation with a safer, more flexible, and more stable monetary and financial system.”10 The original Federal Reserve Act was signed into law by President Woodrow Wilson on at 6:02 PM on December 23, 1913. (The fact that such a significant piece of legislation was enacted the night before Christmas Eve helps fuel the suspicion surrounding the Fed that we mentioned.) The previous day, the House had approved the final bill by a vote of 298–60, with the Senate approving it on December 23 by a vote of 43–25.11 |

|

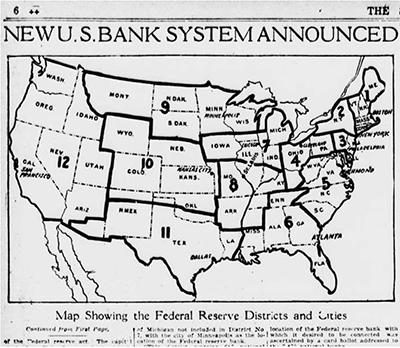

As is typical, the enabling legislation didn’t specify all the operational details of the new American central bank. As Sandra Kollen Ghizoni of the Federal Reserve Bank of Atlanta explains:

|

|

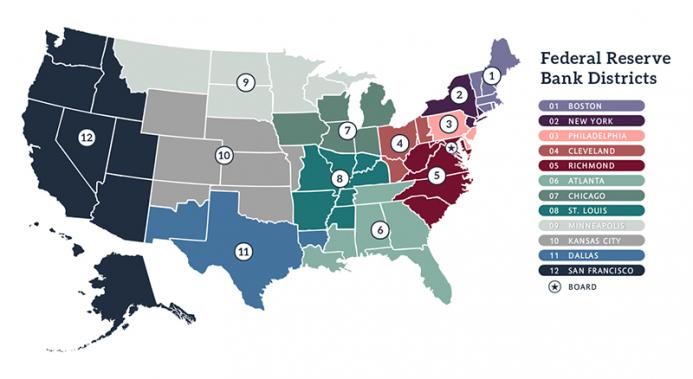

| NOTE: The district boundaries do not necessarily line up with state boundaries.

It is important to understand that originally each of the twelve Reserve Banks exercised considerable autonomy: each Reserve Bank, under the leadership of its respective governor, set its own policies. In contrast to our day, there was no such thing as “the Fed’s” discount rate but instead the discount rate charged by, say, the Reserve Bank of St. Louis or of Dallas.13 This would all change in 1935, as we will explain in the next section. |

Federal Reserve Bank Districts |

Major Amendments to the Federal Reserve Act

Congress has amended the Federal Reserve Act several times since its inception. In this section we will describe two of the most significant episodes.

The Banking Act of 1935

Although sweeping legislation affecting the American banking system was passed in 1932 and 1933 — including the famous Banking Act of 1933 (commonly known as Glass-Steagall) — the most significant changes to the structure of the Federal Reserve System itself came in the Banking Act of 1935.

This new legislation strengthened the overall power of the Federal Reserve System and consolidated it in Washington, DC, away from the Fed’s own reserve banks. However, the Banking Act of 1935 also served to make the Fed more autonomous from the federal government. As Gary Richardson, the Fed’s official historian at the Reserve Bank of Richmond, explains in a coauthored essay,

The reorganization included cosmetic and consequential changes. … The leader of the Board of Governors (previously called the governor of the Federal Reserve Board) became the chairman [while] … [a]ll members of the Board (formerly just called members) received the title of governor.

The Board of Governors became increasingly independent from the executive branch of the federal government. The secretary of treasury, who had served as the chairman of the Federal Reserve Board, and the comptroller of the currency, who had served as a member of the Federal Reserve Board, ceased to serve with the Federal Reserve after 1936. The Federal Reserve moved its meetings from the Treasury Department to a new building constructed on Constitution Avenue and consolidated its staff at that location. …

In each Federal Reserve district, the chief executive officer, who had been labeled the governor, received the title of president. …

Changing the titles of the Federal Reserve’s leaders had symbolic and legal significance. Around the world, the final decision-maker in a central bank held the title of governor. … The Federal Reserve Act of 1913 labeled the chief executive officers at reserve banks as governors because the Fed’s founders viewed the system as a confederation of autonomous reserve banks, each operating independently under general oversight of the Federal Reserve Board in Washington, DC. Governors were active executive officers who directed the day-to-day operations of their organization.

The Banking Act of 1935 changed the titles of the System’s leaders to signify the centralization of authority at the Board of Governors and the reduction in the independence and stature of the twelve Federal Reserve District Banks. …

In this rewriting of the [Federal Reserve Act], the reserve banks lost certain legal powers and much policy independence. Originally, each bank directed open-market operations in its own district. Banks decided what securities to purchase at what price for their own accounts. …

The Banking Act of 1935 superseded [the previous interim] arrangement by creating the [Federal Open Market Committee’s] FOMC’s modern structure. … The FOMC directed open market operations for the system as a whole[,] implemented through the trading facilities at the Federal Reserve Bank of New York. Within this structure, the district banks participated in the creation of a coordinated, national monetary policy, rather than pursuing independent policies in their own districts.

Control of the most important tool of monetary policy, open market operations, was vested in the FOMC, where voting rules favored the Board of Governors. The Banking Act of 1935 [also] gave the Board of Governors control over other tools of monetary policy. The act authorized the Board to set reserve requirements and interest rates for deposits at member banks [endnotes removed, emphasis added].14

And thus, through the 1935 legislation, the United States created a truly “modern” central bank patterned after the European model. Setting aside the question of the merits of this consolidation of power in Washington, it is safe to say that this version of the Federal Reserve would not have been approved politically back in late 1913. Indeed, the very term federal had been picked in order to assure Americans that this would be a relatively decentralized network of autonomous banks.

The Federal Reserve Reform Act of 1977

The other major reform we will discuss is the aptly titled Federal Reserve Reform Act of 1977. If the legislation of 1935 gave the Fed more autonomy from the federal government, the 1977 act arguably tightened the leash.

The biggest takeaway from the 1977 legislation is its explicit assignment of what is commonly referred to as the Fed’s “dual mandate.” As Joy Zhu of the Federal Reserve Bank of Philadelphia explains:

When the Federal Reserve was first established in 1913, Congress directed it only to “furnish an elastic currency, to afford means of rediscounting commercial paper” and “to establish a more effective supervision of banking in the United States.” In effect, the Federal Reserve’s central founding purpose was to provide a more flexible supply of currency and bank reserves in order to stem banking panics. The original act assumed continued adherence to the gold standard regime, which tended to keep inflation under control automatically over the long run. …

By the 1970s, the gold standard had been abandoned and the worsening inflation and unemployment experience called into question the conduct of monetary policy. The 1977 Reform Act amended the original act by explicitly directing the Federal Reserve to ”maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote the goals of maximum employment, stable prices, and moderate long-term interest rates.”

Although the Reform Act directs the Federal Reserve to pursue three policy goals, the Federal Reserve focuses on employment and prices [emphasis added].15

Thus, Congress’s so-called dual mandate to the Fed is to promote maximum employment and stable prices. The debates over monetary policy among professional economists tend to focus on which policy tools and/or institutional frameworks are most conducive to achieving these two goals, which — according to those economists who subscribe to the “Phillips curve”16 — are in tension, at least in the short run.

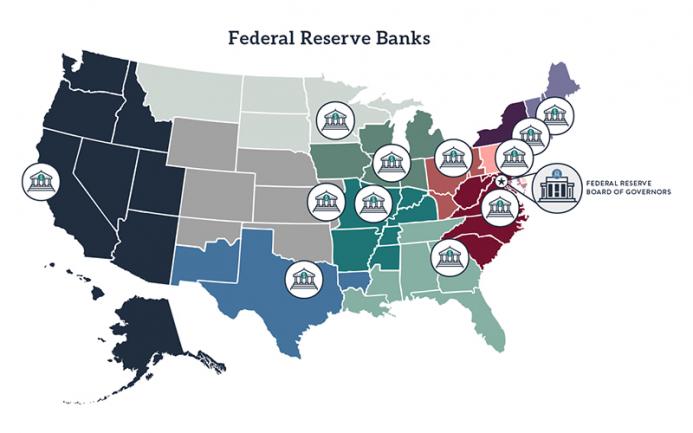

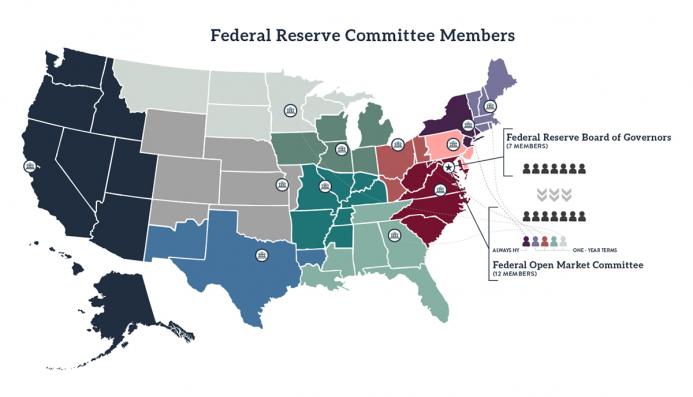

The Current Organization of the Federal Reserve SystemThere are twelve Federal Reserve Banks, one for each district, each located in its respective city. The Board of Governors is located in Washington D.C. In terms of personnel, the Board of Governors consists of seven members, each of whom has the title of governor (hence the Board of Governors). Each governor on the Board is appointed for a fourteen-year term, after being nominated by the president of the United States and confirmed by the Senate. The president must also nominate, and the Senate confirm, two members of the Board of Governors to be the chairman and vice chairman. These are only four-year-term positions, however.17 As the name suggests, the seven-member Board of Governors is the overarching authority over Federal Reserve actions. However, the specific component of monetary policy known as “open market operations” (analyzed in detail in Chapter 5) is handled by the twelve-member Federal Open Market Committee (FOMC). |

Federal Reserve Banks |

| The seven members of the Board of Governors are always on the FOMC, and the remaining five members are presidents of the reserve banks: one is always the president of the New York bank, while the remaining four are drawn from the other eleven districts, serving one-year terms on a rotating basis.18

To conclude, the following diagram should help illustrate the relationships: |

Federal Reserve Committee Members |

- 1. For a fascinating account of Andrew Jackson’s battle against Nicholas Biddle, head of the Second Bank of the United States, from an Austrian perspective, see Dan Sanchez, “The 19th-Century Bernanke,” Mises Wire, Sept. 1, 2009, https://mises.org/library/19th-century-bernanke-0. For a conventional historical discussion, see: https://www.history.com/this-day-in-history/andrew-jackson-shuts-down-second-bank-of-the-u-s.

- 2. For two essays on the so-called Free Banking era in the United States written by Federal Reserve-affiliated economists, see Daniel Sanches, “The Free-Banking Era: A Lesson for Today?,” Federal Reserve Bank of Philadelphia Research Department, Economic Insights (Third Quarter 2016): 9–14, https://www.philadelphiafed.org/-/media/research-and-data/publications/economic-insights/2016/q3/eiq316_free_banking_era.pdf; and Gerald P. Dwyer, Jr., “Wildcat Banking, Banking Panics, and Free Banking in the United States,” Federal Reserve Bank of Atlanta, Economic Review (December 1996): 1–20, https://www.frbatlanta.org/-/media/documents/research/publications/economic-review/1996/vol81nos3-6_dwyer.pdf. These two essays in turn cite several works by the two most prominent members of the Austrian “free banker” camp, namely George Selgin and Lawrence White.

- 3. On this point, see Sanches 2016, p. 9.

- 4. Paul Warburg, “Defects and Needs of Our Banking System,” New York Times, January 6, 1907, available (with subscription) at https://www.nytimes.com/1907/01/06/archives/defects-and-needs-of-our-banking-system-paul-warburg-of-kuhn-loeb.html.

- 5. For an example of the conventional treatment of the Panic of 1907 and its relation to the Federal Reserve, see Jon R. Moen and Ellis W. Tallman’s “The Panic of 1907,” Federal Reserve History, Dec. 4, 2015, https://www.federalreservehistory.org/essays/panic_of_1907. The essay was written for the Federal Reserve, and Tallman works at the Federal Reserve Bank of Cleveland.

- 6. See, for example, the work of Murray N. Rothbard, The Origins of the Federal Reserve (Auburn, AL: Ludwig von Mises Institute, 2009), https://cdn.mises.org/The%20Origins%20of%20the%20Federal%20Reserve_2.pdf (excerpted from Rothbard’s A History of Money and Banking in the United States: the Colonial Era to World War II).

- 7. Some libertarian authors state that Vanderlip was vice president of the National City Bank. It’s true that when he originally joined the bank, Vanderlip held the position of vice president, but by the time of the Jekyll Island meeting, he had been elected president. See C. E. Booth, “Biography of Frank A. Vanderlip: A Brief Biography of Rockefeller protege [sic] Frank Vanderlip,” 1914, Modern History Project, accessed Jan. 1, 2020, https://modernhistoryproject.org/mhp?Article=VanderlipBio.

- 8. Gary Richardson and Jessie Romero, Federal Reserve Bank of Richmond, “The Meeting at Jekyll Island,” Federal Reserve History, Dec. 4, 2015, https://www.federalreservehistory.org/essays/jekyll_island_conference.

- 9. Roger Lowenstein, quoted in Kai Ryssdal and Bridget Bodnar, “How a Secret Meeting on Jekyll Island Led to the Fed,” Marketplace, Oct. 20, 2015, https://www.marketplace.org/2015/10/20/how-secret-meeting-jekyll-island-led-fed/.

- 10. “Federal Reserve Act,” Board of Governors of the Federal Reserve, accessed Jan. 8, 2020, https://www.federalreserve.gov/aboutthefed/fract.htm.

- 11. Voting record for Federal Reserve Act taken from “The Federal Reserve Act of 1913 – A Legislative History,” Law Librarians’ Society of Washington, D.C.,” last modified August 2009, https://web.archive.org/web/20100324115751/http://www.llsdc.org/FRA-LH/.

- 12. Sandra Kollen Ghizoni, Federal Reserve Bank of Atlanta, “Reserve Bank Organization Committee Announces Selection of Reserve Bank Cities and District Boundaries,” Federal Reserve History, Nov. 22, 2013, https://www.federalreservehistory.org/essays/reserve_bank_organization_committee.

- 13. The author (Murphy) encountered this dichotomy when writing his book on the Great Depression. In order to rebut the (now standard) allegation that the Fed’s “tight money” policy caused the economic calamity of the 1930s, Murphy wanted to contrast “the Fed’s” interest rate targets back in the early 1920s with those of the early 1930s. But in fact there was no such target, as the Federal Reserve Banks didn’t have a unified policy until the 1935 legislation was enacted. (Incidentally, Murphy made his point using the New York Fed’s discount rates, which were at then record highs in 1920–21, and what were then record lows from 1929–31, making it difficult to reconcile the history of the Roaring ’20s and the Great Depression with standard claims of “tight money” after the stock market crash of 1929.) See Robert P. Murphy, The Politically Incorrect Guide to the Great Depression and the New Deal (Washington, DC: Regnery 2009), pp. 76–80.

- 14. Gary Richardson, Alejandro Komai, and Michael Gou, “Banking Act of 1935,” Federal Reserve History, Nov. 22, 2013, https://www.federalreservehistory.org/essays/banking_act_of_1935.

- 15. Joy Zhu, Federal Reserve Bank of Philadelphia, “Federal Reserve Reform Act of 1977,” Nov. 22, 2013, https://www.federalreservehistory.org/essays/fed_reform_act_of_1977.

- 16. The Phillips curve describes an alleged tradeoff between the rate of unemployment and price inflation. See Kevin D. Hoover, “Phillips Curve,” Library of Economics and Liberty (Econlib), Liberty Fund, Inc., accessed Jan. 8, 2020, https://www.econlib.org/library/Enc/PhillipsCurve.html.

- 17. See “About the Federal Reserve System,” and “Federal Reserve Board,” Structure of the Federal Reserve System, Board of Governors of the Federal Reserve, accessed Jan. 8, 2020, https://www.federalreserve.gov/aboutthefed/structure-federal-reserve-system.htm and https://www.federalreserve.gov/aboutthefed/structure-federal-reserve-board.htm.

- 18. See “About the FOMC,” Federal Open Market Committee, Board of Governors of the Federal Reserve, accessed Jan. 8, 2020, https://www.federalreserve.gov/monetarypolicy/fomc.htm.

Tags: Featured,newsletter