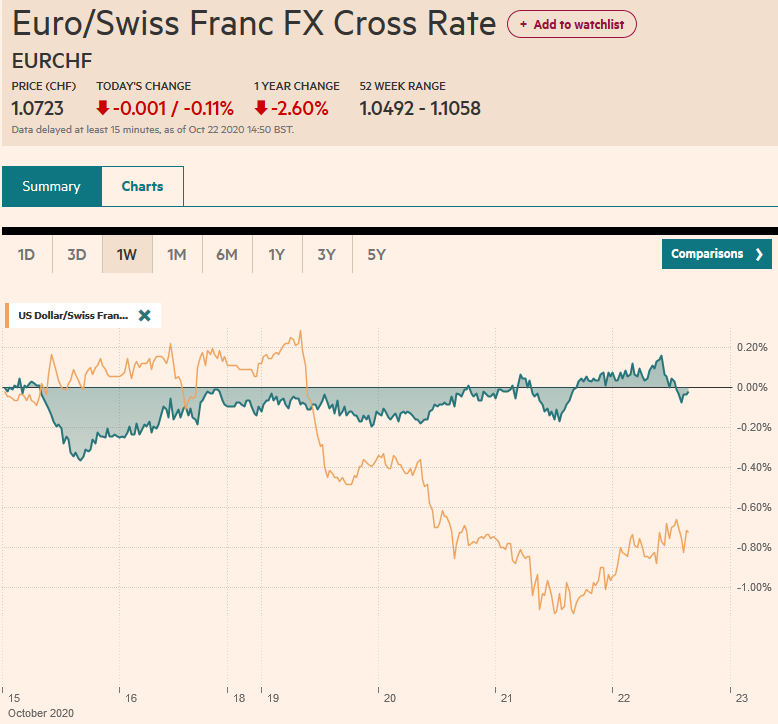

Swiss Franc The Euro has fallen by 0.11% to 1.0723 EUR/CHF and USD/CHF, October 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Two sets of talks have riveted attention, and both appeared to have made progress yesterday. After some words, the EC, recognizing the importance of UK sovereignty, UK Prime Minister Johnson signaled a resumption of trade talks. In the US, Pelosi and Mnuchin appear to be on the verge of a deal. The dollar is consolidating yesterday’s losses. Equities are lower, and benchmark yields are little changed. Sterling, which jumped 1.8%, the most in seven months, stalled near .3180, is softer today, as are most of the majors, but the New Zealand and Canadian dollars are slightly

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Brexit, Canada, China, Currency Movement, Featured, Fiscal, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.11% to 1.0723

|

EUR/CHF and USD/CHF, October 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

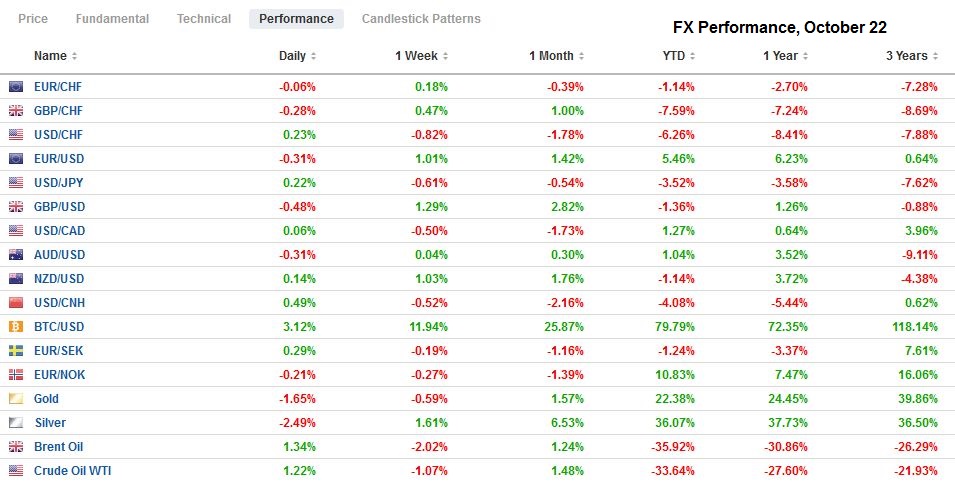

FX RatesOverview: Two sets of talks have riveted attention, and both appeared to have made progress yesterday. After some words, the EC, recognizing the importance of UK sovereignty, UK Prime Minister Johnson signaled a resumption of trade talks. In the US, Pelosi and Mnuchin appear to be on the verge of a deal. The dollar is consolidating yesterday’s losses. Equities are lower, and benchmark yields are little changed. Sterling, which jumped 1.8%, the most in seven months, stalled near $1.3180, is softer today, as are most of the majors, but the New Zealand and Canadian dollars are slightly firmer. Most bourses in the Asia Pacific region fell, though Hong Kong and Taiwan eked out small gains. Europe’s Dow Jones Stoxx 600 is off for the fourth consecutive day and set new lows for the month. Germany, Greece, and Italy are reporting record virus cases, and Spain and France have surpassed one million cases. The S&P 500 is trading a little lower following yesterday’s 0.2% decline. The US 10-year yield is a basis point or two lower and still holding above 0.80%. European bond yields edging higher. Core yields have risen by a couple of basis points over the past five sessions, while peripheral yields are 5-8 bp higher. Emerging market currencies are mostly lower, including the Chinese yuan. Turkey is being watched closely as the market expects the central bank to increase the one-week repo rate by 1.75%-2.0%, as it increases the funding costs for banks. Gold rose almost 1% yesterday, the most in a couple of weeks, on the back of the weaker dollar. Today is giving back about a third. WTI for December delivery slumped 4% yesterday and slipped below the $40-mark and straddled today. |

FX Performance, October 22 |

Asia Pacific

The US continues to press China. It added six more publications to the list of state-owned media that will be treated as an extension of the government (diplomatic missions) in the US. Two were named earlier this year. Meanwhile, a new $1.8 bln arm sale to Taiwan is being finalized. The media is fond of saying that China regards Taiwan as a breakaway province, but the often unspoken truth is that the US formally does too and for more than 40 years. It is part of an unorganized propaganda campaign that mentally and emotionally prepares the American psyche for sustained confrontation with China and allows for changing its position on Taiwan. Meanwhile, China appears to be retelling the Korean War to emphasize the US hostility. A new movie is coming out this week in China about how a small group of Chinese soldiers held larger US forces at bay at the end of the Korean War.

Following on the heels of its decision to reduce to zero the reserve requirement for currency forwards, Chinese officials have eased some capital outflow restrictions. Reports indicate that Beijing will lift the quota for foreign investment by Qualified Domestic Institutional Investors by $10 bln. It would appear to lift the quota to $117 bln. Like the reserve adjustment, many observers’ knee-jerk reaction is that China is trying to cap the yuan’s appreciation. It is also taking advantage of the strong yuan to take another step toward opening its markets carefully and deliberately. With a large current account surplus and foreign portfolio inflows, Chinese officials could face stronger upward pressure on the currency in the coming months, and softening the controls of portfolio outflows seems like an obvious move and consistent with Beijing’s modus operandi.

Japanese officials have confirmed that a third supplemental budget will be delivered. It is likely to be delivered around the middle of December. Since there are reportedly several trillion yen of unspent funds from the previous extra budgets, investors will want to keep an eye for the “freshwater” figures of new funds. The Bank of Japan meets next week. While it is unlikely to take new steps, it may lower its assessment of the economy.

The dollar was sold to about JPY104.35 yesterday and is consolidating today in about a quarter of a yen range, mostly above JPY104.50. A $2.6 bln option expires there today, and $1.5 bln in expiring options are struck between JPY104.90 and JPY105. The US dollar’s sell-off lifted the Australian dollar to almost $0.7140, roughly the halfway point of the decline since the month’s high of nearly $0.7245 was set on October 9. It has come back a bit softer today and is struggling to hold above $0.7100. The Chinese yuan is trading near two-year highs. The PBOC set the reference rate for the dollar at CNY6.6556, a little firmer than the models suggested. The combination of the QDII reports, the fix, and the greenback’s firmer tone, saw the yuan snap a four-day rally and essentially gave back yesterday’s gains.

Europe

The surging virus and new restrictions are adding to renewed economic pessimism in Europe. As we noted, it has dragged equities down to new lows for a month. It will be reflected in the ECB’s tone at next week’s meeting. There, risks are clearly and heavily on the downside. A McKinsey survey found that more than half of the small and medium-sized companies in Europe believe they are at risk of failure in the next years. The new restrictions mean new government support may be needed. This is the case in the UK, where Chancellor Sunak is talking about more measures to help those businesses hit.

The UK and EU talks will resume, and the EC negotiator Barnier said a deal was within reach. It is difficult to know what rhetorical signals are being sent to allow a face-saving way for Johnson to allow negotiations to resume and reflect an actual closing of the gap between the two sides. It is a common meme in much of the coverage that it is primarily ego and posturing keeping that has prevented a deal. Yet this does not do justice to the real conflict between the UK’s sovereignty and the EU’s rules on access to the common market. A country outside the EU cannot be given the same privileges as those inside, and those privileges require adherence to some rules.

The euro reached $1.1880 yesterday, its highest level since visiting $1.19 on September 15. The single currency has been in a four-cent range ($1.16-$1.20) for nearly three months. A breakout still does not appear at hand. The euro can drift lower, and initial support is seen near $1.1820 but stronger support is in the $1.1785-$1.1800 area. A quiet even if choppy North American session seems likely. Sterling is paring yesterday’s gains and is nearly a cent off yesterday’s high (~$1.3175). Initial support is seen around $1.3040-$1.3050. On the cross, the euro held support near GBP0.9000 yesterday and is consolidating to almost GBP0.9050 today.

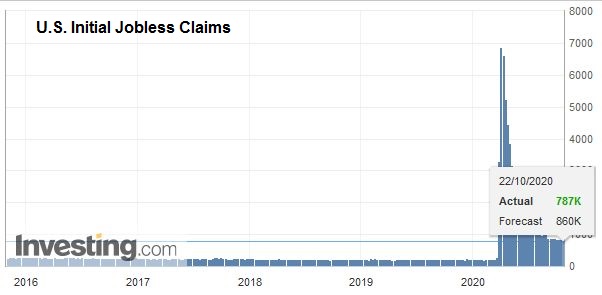

AmericaBudget talks between the White House and House Democrats have progressed though deadlines have been punched through like paper. The market may respond positively to news of an agreement, but the rub remains the Senate. The second-highest Republican in the Senate said that the 13 GOP votes needed to join all the Democrats to pass the bill are not there. The drafting of the bill itself will also take time, and the tactical consideration is whether there is a better chance of its passing before or after the election. According to reports, some 43 million Americans have already voted, which is a little more than 31% of the number of votes in 2016. The ECB and the Federal Reserve appear to be characterizing their respective economies in similar ways. The recovery, they say, is uneven, uncertain, and incomplete. The Beige Book, compiled with data through October 9, found most districts growing slightly to modestly. The Federal Reserve seems to be in no hurry to take fresh supportive measures. Weekly jobless claims expected to fall this week after an unexpected increase last week. The data is too distorted (e.g., the biggest state’s system is still not up to date, many are exhausting their insurance and shifting to the federal emergency program that is not picked up in the headline claims) to give a particularly clean read. Also on tap today, September Leading Economic Indicators (expected to rise 0.6% after a 1.2% gain in August) and existing home sales, a bright spot for the economy (~13-year highs). |

U.S. Initial Jobless Claims, October 22, 2020(see more posts on U.S. Initial Jobless Claims, ) Source: investing.com - Click to enlarge |

Canada’s retail sales missed yesterday, rising 0.4% instead of 1.1% economists had anticipated, while September CPI was in line with expectations. However, the focus was on politics, where Trudeau turned a Conservative attempt to investigate the spending of emergency funds to uncover conflict of interests with the Liberal minority government. The New Democrats again support the Prime Minister, as it did on the budget. No one seems to favor an election yet, but the maneuvering and jockeying will continue.

After falling to about CAD1.3080 yesterday, the greenback reversed and closed near session high’s around CAD1.3150. Some follow-through action lifted it almost CAD1.3180 in Asia before it came off and found bids near CAD1.3140. There appears to be scope toward CAD1.3200 in the firmer US-dollar and softer equity environment. Similarly, the US dollar slipped briefly below MXN21.00 yesterday for the first time in a month and reversed higher to close near MXN21.11. The greenback traded to MXN21.2260 today, and here too, the session high may be recorded in North America.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Brexit,Canada,China,Currency Movement,Featured,Fiscal,newsletter