The long view: The current war:

Read More »Dollar Jumps, while Surge in Covid Cases Raise Questions about China’s Pivot

Overview: Surging Covid cases in China and Hong Kong are undermining hopes of a Covid-pivot and the US dollar is broadly higher. Equities are under pressure to start the week. Most of the large bourses in the Asia Pacific but Japan, fell earlier today. Europe’s Stoxx 600 is paring last week’s minor gain, which was the fifth consecutive weekly rise. US stock futures are lower, while the 10-year US Treasury yield is flat near 3.83%. European yields are mostly around...

Read More »FX Daily, January 19: Even When She Speaks Softly, She’s Yellen

Swiss Franc The Euro has fallen by 0.07% to 1.0754 EUR/CHF and USD/CHF, January 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The animal spirits are on the march today. Equities are mostly higher, peripheral European bonds are firm, and the dollar is mostly softer. After posting the first back-to-back decline this year, the MSCI Asia Pacific Index bounced back today, led by a 2.7% gain in Hong Kong...

Read More »EM Preview for the Week Ahead

EM benefited greatly from the improvement in US-China trade relations and quite possibly Brexit. The dollar is likely to remain under some pressure near-term as a result. Yet we must caution investors against getting too optimistic. The details of the partial trade deal still need to be worked out, while existing tariffs will still remain in place if the deal is signed next month as most expect. Brexit negotiations have accelerated but we note that any deal must...

Read More »FX Daily, September 17: Markets Calm(er)

Swiss Franc The Euro has risen by 0.60% to 1.0984 EUR/CHF and USD/CHF, September 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Oil prices have stabilized after yesterday’s surge. Both Brent and WTI are holding on to around $7-$8 a barrel gain. Equity markets are mixed. Some are attributing the losses in Asia Pacific outside of Japan (Nikkei rose its highest level since late April), Korea and Australia to...

Read More »Emerging Markets: Preview of the Week Ahead

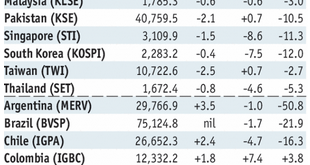

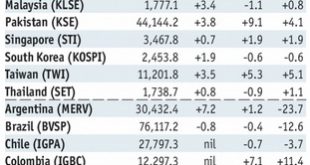

Stock Markets EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned. With US rates pushing higher, we think the...

Read More »Emerging Markets: Week Ahead Preview

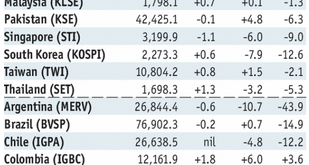

Stock Markets EM FX was whipsawed last week but ended on a firm note. We look past the noise and believe that the true signals for EM remain higher US interest rates and continued trade tensions, both of which are negative. Turkish markets reopen after a week off. Nothing fundamentally has changed there, and so it still poses some spillover risk to wider EM. Stock Markets Emerging Markets, August 22 - Click to...

Read More »Emerging Markets: Preview of the Week Ahead

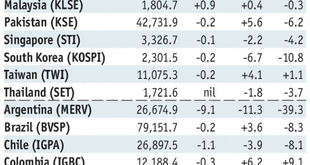

Stock Markets EM FX came under greater pressure last week as the situation in Turkey deteriorated. With no weekend developments as of this writing, we expect Turkish assets to remain under pressure this week. Five worst EM currencies YTD are TRY (-41%), ARS (-36%), RUB (-15%), BRL (-14.5%), and ZAR (-12%). All five have serious baggage that warrants continued underperformance.Yet it’s worth noting that the five best...

Read More »Emerging Markets: What Changed

Summary Nor Shamsiah Mohd Yunus was named the new Governor of Malaysia’s central bank. Moody’s cut the outlook on Pakistan’s B3 rating to negative from stable. National Bank of Hungary tiled more hawkish. Israeli Prime Minister Benjamin Netanyahu’s wife was charged with misusing public funds. MSCI added Saudi Arabia and Argentina to its Emerging Markets index Brazil’s government its split on the inflation target for...

Read More »Emerging Markets: Preview of the Week Ahead

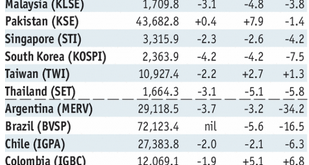

Stock Markets EM FX ended Friday on a mixed note, capping off a roller coaster week for some of the more vulnerable currencies. We expect continued efforts by EM policymakers to inject some stability into the markets. However, we believe the underlying dollar rally remains intact. Central bank meetings in the US, eurozone, and Japan this week are likely to drive home that point. Stock Markets Emerging Markets, June 6...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org