Swiss Franc The Euro has fallen by 0.07% to 1.1787 CHF. EUR/CHF and USD/CHF, April 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Global equity markets are higher, following the stunning recovery in the US yesterday, where the S&P 500 rallied 76 points or 3% from its lows to it highs, near where it finished. The outside up day is seeing following through today. Without China and Hong Kong, which are on holiday, the MSCI Asia Pacific Index snapped a three-day down draft and closed 0.55% higher. The Nikkei led the region with a 1.5% gain, led by real estate, health care and financials. It posted its highest close since in two weeks. Gains in Europe have been

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, EUR, EUR/CHF, Eurozone Markit Composite PMI, Eurozone Services PMI, Featured, Germany Factory Orders, Germany Services PMI, JPY, newsletter, SPY, U.K. Services PMI, U.S. Initial Jobless Claims, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

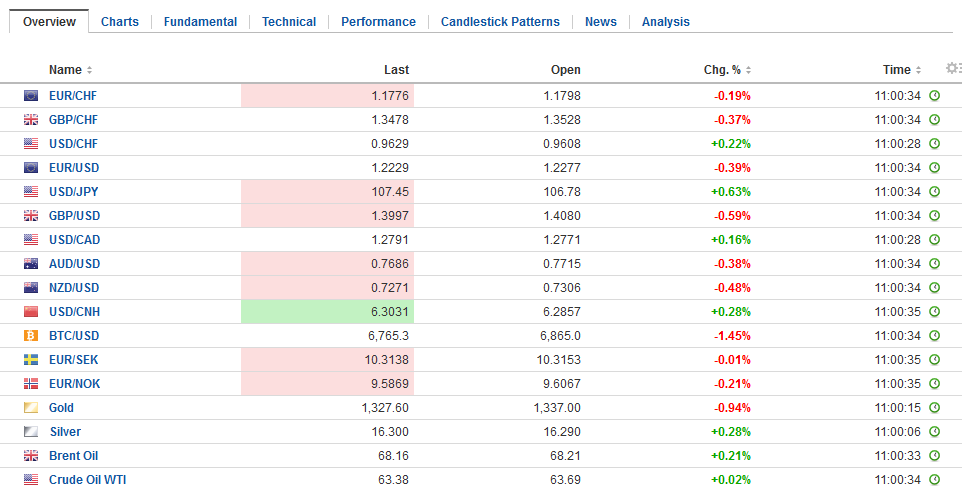

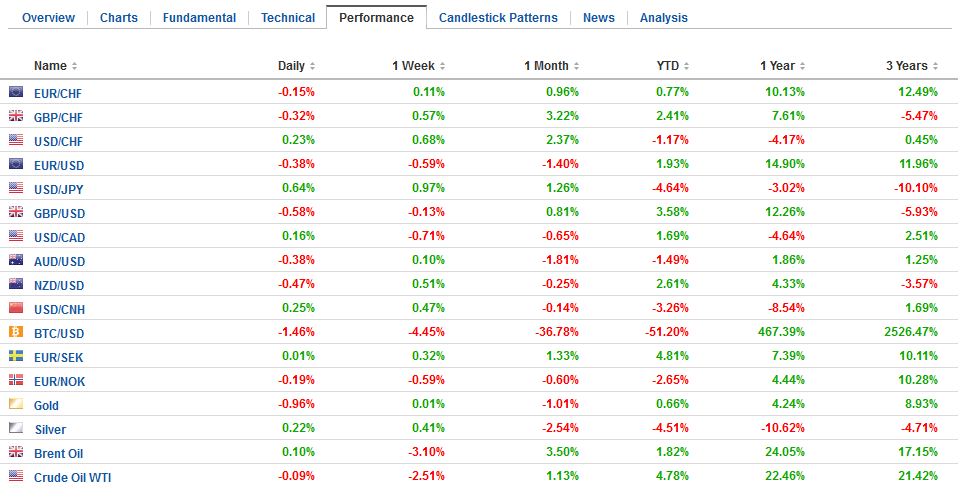

Swiss FrancThe Euro has fallen by 0.07% to 1.1787 CHF. |

EUR/CHF and USD/CHF, April 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesGlobal equity markets are higher, following the stunning recovery in the US yesterday, where the S&P 500 rallied 76 points or 3% from its lows to it highs, near where it finished. The outside up day is seeing following through today. Without China and Hong Kong, which are on holiday, the MSCI Asia Pacific Index snapped a three-day down draft and closed 0.55% higher. The Nikkei led the region with a 1.5% gain, led by real estate, health care and financials. It posted its highest close since in two weeks. Gains in Europe have been stronger. The Dow Jones Stoxx 600 is up 1.5% in late morning turnover. It is led by information technology and materials (both sectors are up more than 2%). Real estate is the laggard, up 0.65%. While the Asia Pacific Index is well below its 20-day moving average, the Stoxx 600 is straddling its. There is a 60-day period between the announcements and when the US tariffs will be implemented. China has not indicated when it will enforce its tariffs. This is understood to allow room to negotiate here in Q2. Also, this is seen as compatible with the Trump Administration’s bold rhetoric and climb down in practice. Consider the recent flip on NAFTA–from threatening to leave it to seek an agreement in principle next week. As part of the effort, the US appears to have softened its demands on the controversial domestic content requirement for autos (presently 62.5%, and the US had sought 85%). |

FX Daily Rates, April 05 |

| From camps that have been critical of China, about its holdings of US Treasuries, large debt accumulated since 2008, currency practices, etc., bellicose language is still fanning the flames. This war camp worries that one-way China could retaliate is to allow its currency to depreciate. Sure, it could, but over the last few months there is only one major country that stood accused of talking its currency down. In fact, it was so disturbing that it raised addressed at ECB press conference, and was subsequently, walked back by the US President and the Treasury Secretary.

The war camp that is playing up the possibility that China sells its Treasuries in displeasure also complains when China buys US Treasuries. We can also test the hypothesis of what happens when China has sold US Treasuries in the recent past. From June 2016 through November 2016, China’s Treasury holdings, according to US data fell by $200 bln, which was 15% of their holdings. What happened to the US 10-year yield (as a rough and ready metric of the impact), you ask? It was virtually unchanged. The Chinese yuan has appreciated 3.2% against the US dollar this year. As we have noted, the US Treasury’s report on the international economy and foreign exchange is expected this month. China’s behavior in the foreign exchange market has not changed. It is slowly rebuilding its reserves that were previously run down by 25%. Capital controls appear to have arrested some of the outflows. China is expected to report March reserves figures in the coming days. They are expected to have risen by about $14 bln. |

FX Performance, April 05 |

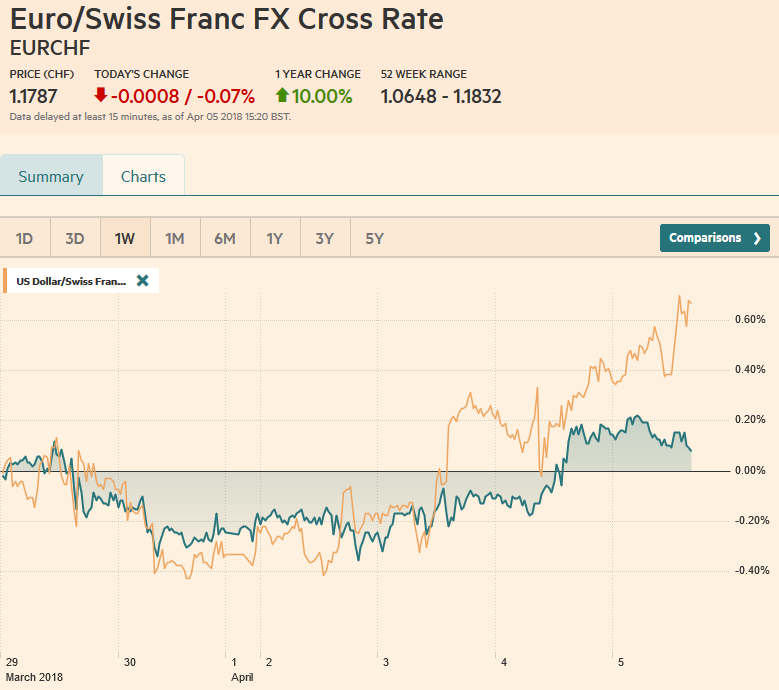

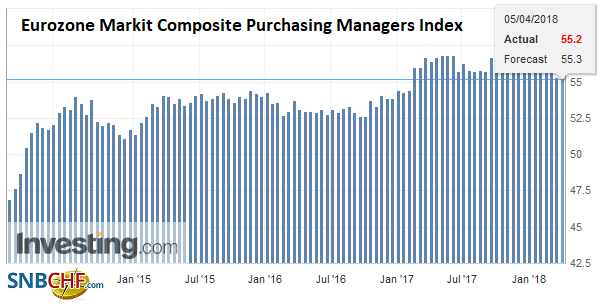

EurozoneOutside of the focus on the trade and the bounce in global equities, Europe’s service and composite PMIs were the data highlight. The eurozone service PMI was revised to 54.9 from the 55.0 flash reading, which itself was down from 56.2 in February and 58.0 in January. |

Eurozone Services Purchasing Managers Index (PMI), Apr 2013 - 2018(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

| The composite was also revised lower, to 55.2 from 55.3. It peaked in January at 58.8 and fell to 57.1 in February. While the loss of momentum is significant, the impact on GDP may be more measured. Consider that the Q4 17 average was 56.4 and the Q1 18 average is 56.7. We think that the if the loss of momentum spills over in the start of Q2, for which some data will be available in the coming weeks, then investors may be more sensitive to it. It could help determine in which direction the euro breaks out of its range. |

Eurozone Markit Composite Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

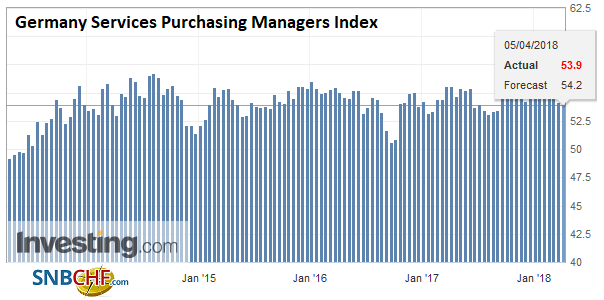

GermanyThe loss of momentum is especially evident in Germany. It service PMI was revised down from the flash reading as was the composite (55.1 from 55.4 flash and 57.6 in February). |

Germany Services Purchasing Managers Index (PMI), Apr 2013 - 2018(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

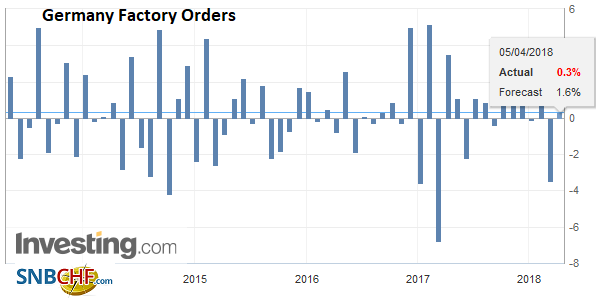

| It also reported disappointing factory orders. Some recovery was expected after the 3.9% drop in January. The bounce was not even halfhearted. Rather than rise 1.5%, as the median forecast from the Bloomberg survey, Germany reported a 0.3% increase. And this was only marginally less disappointing because the January decline was revised to a 3.5% decline. |

Germany Factory Orders, May 2013 - Apr 2018(see more posts on Germany Factory Orders, ) Source: Investing.com - Click to enlarge |

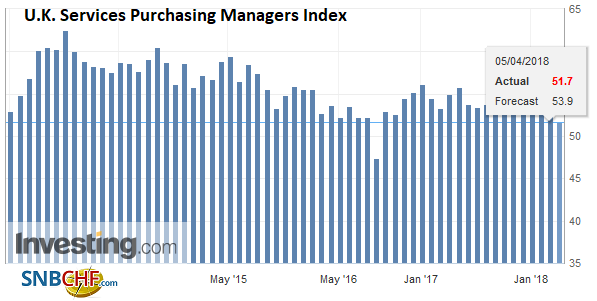

United KingdomThe UK also disappointed. Start with new car registrations. They fell 15.7% in March, and have not grown on a year over year basis since last March. The average pace last year was a 7% decline. It services PMI fell to 51.7 from 54.5, well below expectations. The composite similarly fell to 52.5 from 54.5. Unlike the EMU, the UK’s composite average in Q1 18 (53.5) is below the composite average for Q4 17 (55.2). |

U.K. Services Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on U.K. Services PMI, ) Source: Investing.com - Click to enlarge |

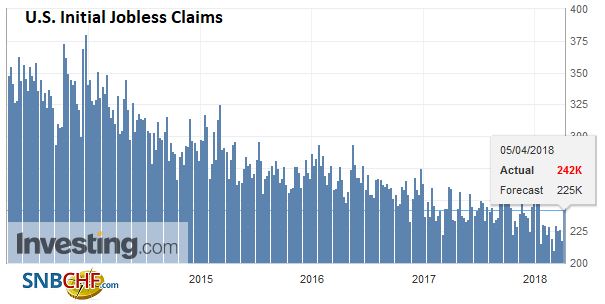

United StatesCanada and the US report February trade figures. Both countries will report deficits, and are expected to be larger sequentially. The US Challenger Job Cuts and the weekly initial jobless claims are the last reports ahead of tomorrow’s non-farm payroll report. The strength of the ADP report underscores our focus on the other details of the employment report, especially hourly earnings and the participation rate. |

U.S. Initial Jobless Claims, Apr 2013 - 2018(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

There are several maturing options that may be in play. One is a 755 mln euro options struck at $1.2300 and another 518 mln euros struck at $1.2325. Between JPY106.90 and JPY1017.15 there are nearly $1.7 bln in option that will be cut today.

The dollar has been largely confined to yesterday’s ranges against the euro and sterling and both are little changed. The dollar has firmed against the yen and reached JPY107.15, a four-week high. In addition, the option expirations, the intraday technical indicators warn of the risk that the dollar may pullback in early North American turnover. That said, a move above JPY107.30 could signal a break of a head and shoulders bottom that would project toward JPY110. The Australian dollar is the weakest of the majors, though, down twice what the yen is (0.40% vs 0.20%), and that is after it made new seven-session highs near $0.7730. Yesterday’s lows seem to be the proximate target and it was found near $0.7665.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: $AUD,$CNY,$EUR,$JPY,EUR/CHF,Eurozone Markit Composite PMI,Eurozone Services PMI,Featured,Germany Factory Orders,Germany Services PMI,newsletter,SPY,U.K. Services PMI,U.S. Initial Jobless Claims,USD/CHF