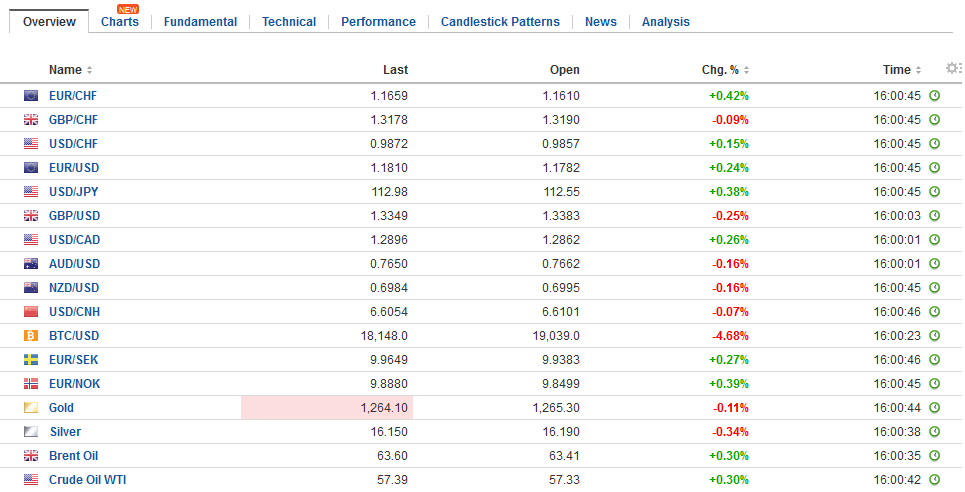

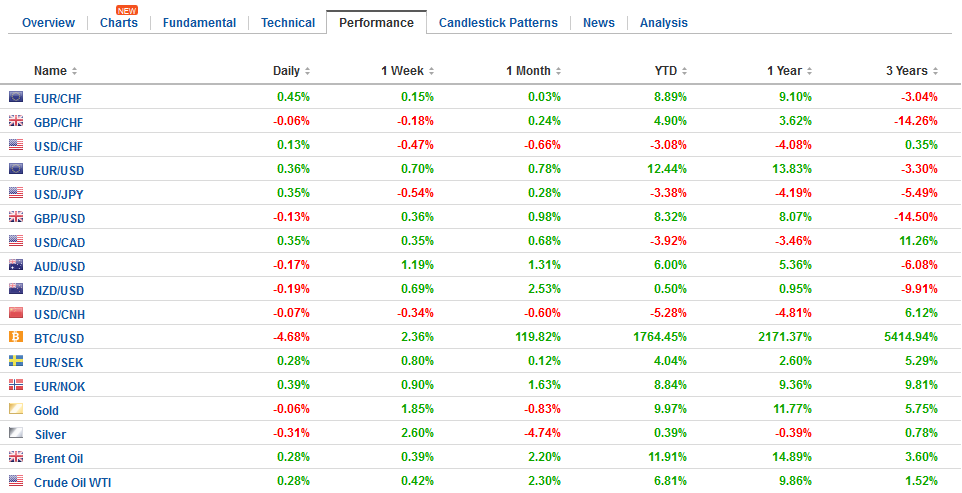

Swiss Franc The Euro has risen by 0.48% to 1.1666 CHF. EUR/CHF and USD/CHF, December 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge GBP/CHF The pound has risen against the Swiss Franc as we get closer to understanding just what Brexit means for the UK and global concerns ease, weakening the Franc. The pound is essentially a barometer of progress on Brexit whilst the Swissie is effectively a barometer of global attitudes to risk. At present, a weaker Franc and stronger pound is presenting a good opportunity for CHF buyers, will this last? The Franc looks likely to remain on the weaker side and it would not be wholly surprising to see the Franc weaken further as global

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Featured, FX Trends, GBP, Germany Business Expectations, Germany Current Assessment, Germany IFO Business Climate Index, JPY, newslettersent, U.S. Current Account, U.S. Housing Starts, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.48% to 1.1666 CHF. |

EUR/CHF and USD/CHF, December 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

GBP/CHFThe pound has risen against the Swiss Franc as we get closer to understanding just what Brexit means for the UK and global concerns ease, weakening the Franc. The pound is essentially a barometer of progress on Brexit whilst the Swissie is effectively a barometer of global attitudes to risk. At present, a weaker Franc and stronger pound is presenting a good opportunity for CHF buyers, will this last? The Franc looks likely to remain on the weaker side and it would not be wholly surprising to see the Franc weaken further as global attitudes to risk subside further as investor concerns over problems in the global economy subside. The UK is not coming out of Brexit too badly, the political concerns in Europe we worried about 12 months ago have not materialised and Donald Trump and North Korean have not launched a nuclear war on each other just yet. The fact these concerns have failed to materialise means the CHF is a little weaker, 2018 could easily see them resurface. The Spanish election in the Catalonian region on Thursday and the Italian election in March 2018 could also present uncertainty that would make the Franc attractive to safe-haven investors. Sterling looks like it will, on the whole, perform slightly better as markets expect the UK will now find agreement with the EU on a trade deal. Whilst no one knows exactly how this will look now and more than likely sentiments will shift, there are now more reasons to be confident in a deal. The progress made with this latest EU Summit is a good reason to be confident for the future. |

GBP/CHF - British Pound Swiss Franc, Dec 19 |

FX RatesUS tax changes appear to be providing fuel for the year-end advance that has carried the major indices to new record highs. The coattails are a bit short, and while global equity markets are firm, they are unable to match the strength of US. Despite a heavier tone in Japan, Taiwan, and Korea, the MSCI Asia Pacific Index edged higher for the second session but remains around one percent below the record highs set in late November. The Dow Jones Stoxx 600 is flat near midday in London. It is about two percent below the high for the two-year set in early November and about five percent below 2015 high. This European benchmark is up an 8.65% year-to-date. For dollar-based investors, the index is up 22% on an unhedged basis. The S&P 500 is up 20% coming into today’s session, and the Dow Jones Industrials is up 25%. Apparently, at the last minute, a provision was added that gives about a quarter of the Republican Senators a new tax cut through their real estate shell companies. It was not in the original bill that was passed by the Senate on December 1. Reports suggest that the Chair of the Senate Finance Committee that drafted the bill included it in the final measure. It appears that the measure will ensure passage. |

FX Daily Rates, December 19 |

| Sterling is the weakest of the major currencies today. Brexit is the driver. Specifically, UK still seems to be in collective denial. It hopes to draw the benefits of being in a single market without actually being in it. Specifically, the EU’s chief negotiator ruled out a carve-out for UK financial services post-Brexit. When the UK leaves the EU, its financial services will not enjoy a passport arrangement that will allow it to provide financial services to other EU members on the same terms it currently enjoys.

That said, the EU has not given negotiating instructions to Barnier and his team yet that covers the second stage of talk, the post-Brexit trade relationship. That is earmarked for March 2018. The next couple of months will be spent discussing the transition period the UK seeks. However, Barnier is unlikely to be straying far from the sentiment and intentions of the EU with this interview in the Guardian. |

FX Performance, December 19 |

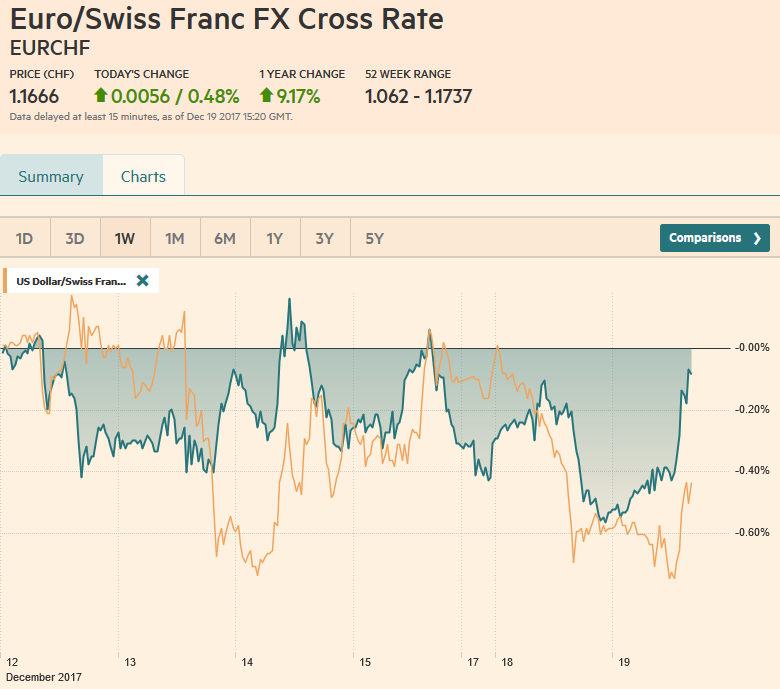

United StatesThe US dollar is trading within yesterday’s ranges amid light news. The focus in the US is on the tax changes which the House will likely vote this afternoon. |

U.S. Current Account, Q3 2017(see more posts on U.S. Current Account, ) Source: Investing.com - Click to enlarge |

| The Senate vote could come later today or early tomorrow. Toward the end of last week, we had suggested the risks that the bill is defeated were greater than many investors seemed to appreciate. |

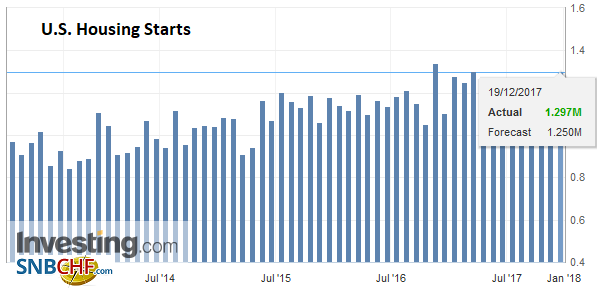

U.S. Housing Starts, Nov 2017(see more posts on U.S. Housing Starts, ) Source: Investing.com - Click to enlarge |

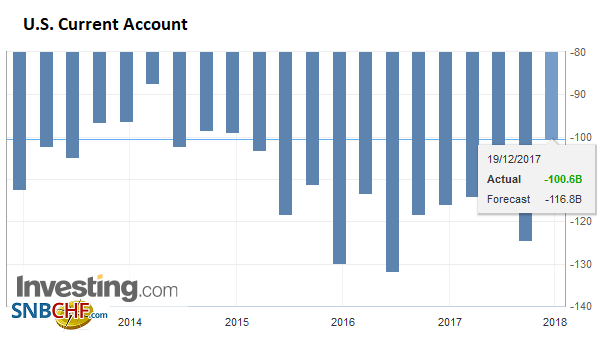

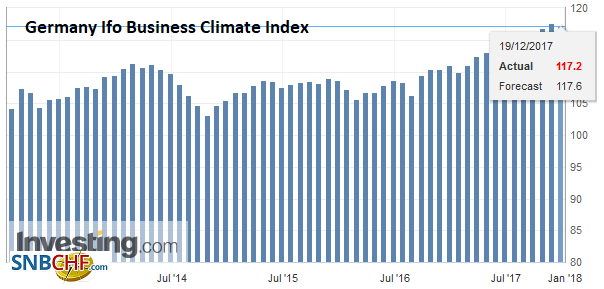

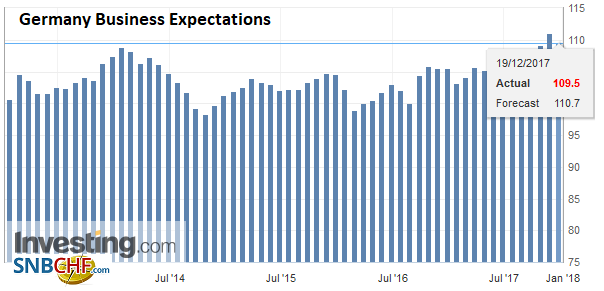

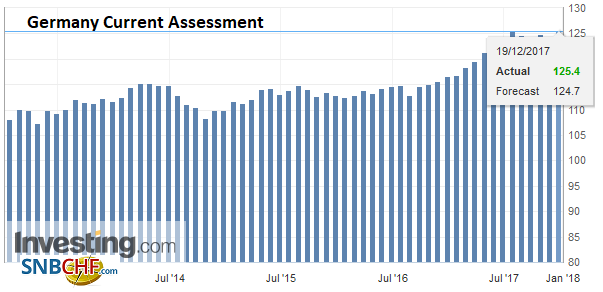

GermanyThe German IFO saw a decline in the expectations component of the December survey, but the current assessment rose to approach the record high set in July. |

Germany Ifo Business Climate Index, Dec 2017(see more posts on Germany IFO Business Climate Index, ) Source: Investing.com - Click to enlarge |

| However, more importantly, wage growth in the euro-area disappointed. In the three months through September, wages rose 1.6% year-over-year. |

Germany Business Expectations, Dec 2017(see more posts on Germany Business Expectations, ) Source: Investing.com - Click to enlarge |

| This is down from 2.1% in the previous three-month period. The report supports the cautiousness expressed by Draghi at the press conference last week. |

Germany Current Assessment, Dec 2017(see more posts on Germany Current Assessment, ) Source: Investing.com - Click to enlarge |

Note that the UK cabinet took up the “end state” or the post-Brexit relationship for the first time in a formal discussion. Reports suggest a meeting of the minds that the starting point is that there are identical rules and regulations and that deliberately and selectively it will move away. This is hardly reassuring to the EU, and below the surface, the predicament posed by the unresolved Irish border is festering.

The EU appears determined that the UK cannot adhere to the red lines that May has articulated–controlling immigration and free of the European Court of Justice–and have access to the single market, including for financial services. The immovable object meets an irresistible force, and this will continue to dominate the discussions next year.

The euro retreated in the North American session yesterday from about $1.1835 to roughly $1.1775. This range has held in Asia and the European morning. The cross-currency basis swap has continued to correct from the spike seen at the end of last week, which we suggest is primarily a function of intense year-end scramble. There is a large option (~785 mln euros) struck at $1.1775 that expires today.

The dollar has traded in less than a 20 pip ranges against the yen today. The JPY112.50-JPY112.65 has caught the bulk of the price action. The US 10-year yield is flat just below 2.40%. There is an $866 mln option struck at JPY112.50 that will be cut today.

Sterling recorded its lows (~$1.3350) early in the European morning and quickly snapped back. It can challenge the $1.3400 high seen in late Asian turnover. It is the third session of lower highs and higher lows as if a spring is coiling.

The Canadian dollar also appears to be coiling in tighter ranges. Despite Bank of Canada Governor Poloz signaling the likelihood of a rate hike next year, the Canadian dollar remains pinned to the lower end of two-month trading range against the US dollar. The greenback seems capped in the CAD1.2910 area. It has closed below CAD1.28 once in the past nine sessions.

For its part, the Australian dollar is stuck in the range seen before the weekend–roughly $0.7640 to $0.7700. The minutes from the RBA’s recent meeting showed greater confidence in the labor market, underscored by the recent strong November report, but, as other central banks, is not sure when the tightening of labor conditions translates into higher wages and inflation. We see the RBA steadfastly on hold for the next couple of quarters at least.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Featured,Germany Business Expectations,Germany Current Assessment,Germany IFO Business Climate Index,newslettersent,U.S. Current Account,U.S. Housing Starts,USD/CHF