Summary Russia’s Finance Ministry announced plans to increase its dollar. purchases in November Bahrain has reportedly asked its Gulf allies for financial assistance. S&P upgraded Argentina a notch to B+ with stable outlook. Brazil raised BRL6.15 bln (.9 bln) by auctioning off the rights to explore 6 of the 8 deep-water oil blocks. Venezuela bowed to the inevitable, announcing that it would have to restructure its debt. Stock Markets In the EM equity space as measured by MSCI, Korea (+5.6%), Turkey (+3.7%), and Egypt (+2.7%) have outperformed this week, while Brazil (-4.6%), Colombia (-4.5%), and Mexico (-2.9%) have underperformed. To put this in better context, MSCI EM rose 1.3% this week while MSCI DM rose

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

Stock MarketsIn the EM equity space as measured by MSCI, Korea (+5.6%), Turkey (+3.7%), and Egypt (+2.7%) have outperformed this week, while Brazil (-4.6%), Colombia (-4.5%), and Mexico (-2.9%) have underperformed. To put this in better context, MSCI EM rose 1.3% this week while MSCI DM rose 0.3%. In the EM local currency bond space, Indonesia (10-year yield -18 bp), Hungary (-7 bp), and Czech Republic (-5 bp) have outperformed this week, while Turkey (10-year yield +38 bp), Brazil (+37 bp), and South Africa (+18 bp) have underperformed. To put this in better context, the 10-year UST yield fell 5 bp to 2.36%. In the EM FX space, KRW (+1.5% vs. USD), PHP (+1.1% vs. USD), and IDR (+0.8% vs. USD) have outperformed this week, while BRL (-2.5% vs. USD), COP (-2.2% vs. USD), and TRY (-2.1% vs. USD) have underperformed. |

Stock Markets Emerging Markets, November 04 Source: economist.com - Click to enlarge |

RussiaRussia’s Finance Ministry announced plans to increase its dollar purchases in November. It plans to spend RUB5.8 bln ($99 mln) a day buying dollars, up sharply from RUB3.5 bln per day in October. The ruble was already weakening in recent weeks, so the announcement suggests that officials would like an even weaker currency. BahrainBahrain has reportedly asked its Gulf allies for financial assistance. Press reports suggest Saudi Arabia, Kuwait, and the UAE were approached. Those countries apparently responded with requests for Bahrain to get its finances under control in return for aid. ArgentinaS&P upgraded Argentina a notch to B+ with stable outlook. The agency noted that “The rating action reflects greater confidence about the government’s political capacity to continue pursuing its economic agenda, resulting in more predictable economic policy and governance.” We agree, as the upgrade brings it into line with our own sovereign ratings model. BrazilBrazil raised BRL6.15 bln ($1.9 bln) by auctioning off the rights to explore 6 of the 8 deep-water oil blocks in the so-called pre-salt area. Ten foreign oil companies submitted winning bids. The government forecasts $36 bln of investment to extract the oil, and expects to receive $130 bln in taxes and royalties during the life of the projects. VenezuelaVenezuela bowed to the inevitable, announcing that it would have to restructure its debt. This is the first major EM sovereign debt restructuring since Argentina back in the early 2000s, yet it has felt like watching a slow-motion train wreck. While we see limited contagion for the rest of EM, the news does underscore the fact that bad governance has consequences. |

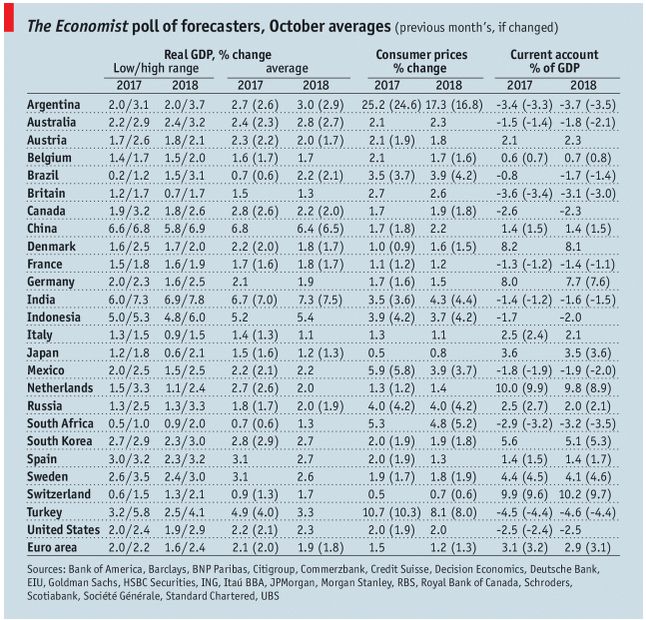

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, October 2017 Source: economist.com - Click to enlarge |

Tags: Featured,newsletter,win-thin