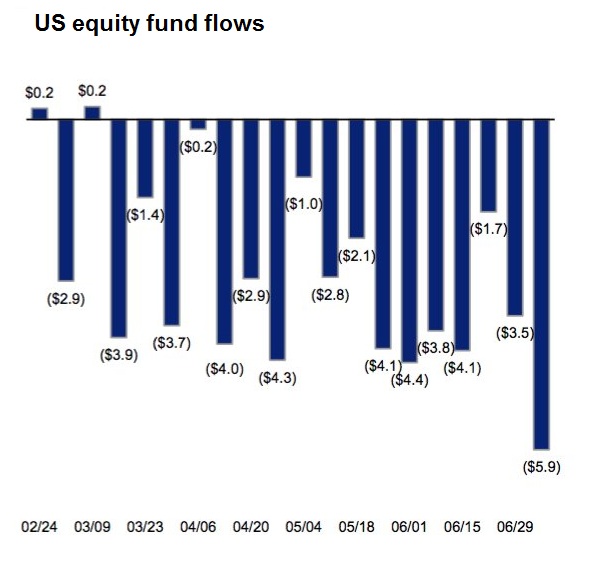

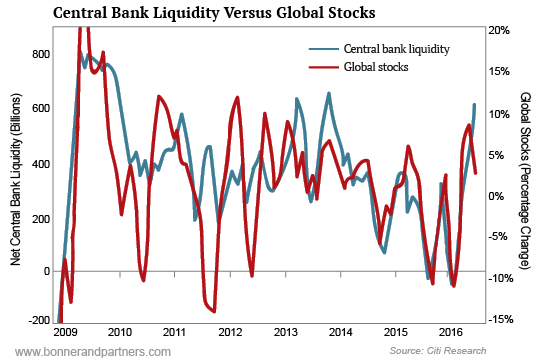

Speculator’s Market LOS ANGELES – Stocks were up again… Whoa! Hold on just a cotton-picking minute. Honest investors are getting out of the stock market. There have been net withdrawals of billion from U.S. equity funds so far this year. Who’s buying? This is a speculator’s market. And the No. 1 gambler is playing with an infinite amount of chips. We’re talking about central banks – who create money on demand. Weekly US equity fund flows, via AMG Now, alarmed by Brexit and the worldwide slowdown, they’re buying assets at the fastest pace since 2013. Just look at the chart below from Citi Research. As you can see, central bank-issued liquidity tracks the stock market almost perfectly. We have our answer: Central bank stimulus, more than any other factor, is responsible for pushing up stock prices. So, let’s get this straight. Central banks are using counterfeit “money” that no one ever earned or saved, to buy stocks at record high prices – while real investors head for the exits. Does this sound like a winning program, or what? We’ll have to go with the “or what” on that one. But exactly how or when it comes to an end, we don’t know. Theoretically, central banks can continue indefinitely buying stocks and bonds with fake money.

Topics:

Bill Bonner considers the following as important: Debt and the Fallacies of Paper Money, Featured, G.K. Chesterton, Hillary Rodham Clinton, John Mackey, Mark Skousen, newslettersent, On Economy, On Politics, Steve Forbes

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Speculator’s MarketLOS ANGELES – Stocks were up again… Whoa! Hold on just a cotton-picking minute. Honest investors are getting out of the stock market. There have been net withdrawals of $80 billion from U.S. equity funds so far this year. Who’s buying? This is a speculator’s market. And the No. 1 gambler is playing with an infinite amount of chips. We’re talking about central banks – who create money on demand. |

|

| Now, alarmed by Brexit and the worldwide slowdown, they’re buying assets at the fastest pace since 2013. Just look at the chart below from Citi Research. As you can see, central bank-issued liquidity tracks the stock market almost perfectly.

We have our answer: Central bank stimulus, more than any other factor, is responsible for pushing up stock prices. So, let’s get this straight. Central banks are using counterfeit “money” that no one ever earned or saved, to buy stocks at record high prices – while real investors head for the exits. Does this sound like a winning program, or what? We’ll have to go with the “or what” on that one. But exactly how or when it comes to an end, we don’t know. Theoretically, central banks can continue indefinitely buying stocks and bonds with fake money. And stocks and bonds can continue to go up in price even as the economy goes down. |

|

Delusions, Demons, and DementiaWe’ve come out to the West Coast to see our daughter in Los Angeles. Then we will drive to Las Vegas to join Mark Skousen’s Freedom Fest, where we will be participating in a couple of panel discussions. We explained to Mark that we were not really fans of “freedom.” We are all prisoners of our own myths, delusions, demons, and dementia. Without them, we’d be lost… with nothing more than our brains to guide us. As G.K. Chesterton said of a crazy man, he had “nothing left but his sense of reason.” We trudge happily in our own chains; we just don’t want to submit to someone else’s. Nevertheless, Mark asked us to take part in a panel of “libertarian CEOs,” along with Steve Forbes and John Mackey of Whole Foods. We haven’t confessed this to Mark yet, but we join the panel as an imposter… As a libertarian we are a complete counterfeit. We don’t really believe in the creed; we merely practice it when it suits us. And as a CEO, we are an even bigger fraud. We are not, nor have we ever been, a real businessman. That would take far more organizational skill and force of personality than we have at hand. Instead, we might more accurately be described as a “clumsy entrepreneur who was lucky enough to find real business people to help build a company.” But the libertarian CEO stretches the truth even further. Steve Forbes, John Mackey, and Charles Koch are the real McCoys. They apply the principles of libertarianism to business management in a serious and organized way. We do not. We realized long ago that we were far too incompetent to try to tell anyone what to do, let alone undertake any serious central planning. Laissez-faire is what you get when you shirk your responsibilities and fail at management. But we left off yesterday with a promise. We said we would explore that den of foxes in Lower Manhattan: Wall Street. |

|

Three-Ring CircusWe were describing how cronies and zombies – Republicans and Democrats – work together and use government for their own purposes. They are the insiders… the elite… the Establishment – represented by Hillary Rodham Clinton in this upcoming election. To bring new readers more fully into the picture, public policy is not directed by our elected representatives, who wisely and prudently debate the issues as they arise. Congress is more like a three-ring circus than a real legislative institution. You will find freaks and grotesqueries aplenty (many members of Congress have hidden tails; we’re sure of it). You also see stunts, legerdemain, and bombast – all gaudy and solemnly fraudulent. |

|

| The tourists who come to visit are impressed by the marble, the smoke, and the mirrors. But they have no more idea of what is really going on than members of Congress do.

They’re too busy raising money from cronies, or glad-handing their constituents to seriously consider the bills they vote on; they rely on staff (more or less permanent inside-the-Beltway apparatchiks) to tell them how to vote and what to say. And don’t bother to get into a deep discussion of the Fed’s zero-interest-rate policy or central bank asset buying (QE) with your congressman. More often than not, he will have only the slimmest, most superficial, and self-serving grasp of the details and no idea whatsoever of the theories. He will understand – barely – only the myths of modern central banking, based on a few “talking points” provided to him by his aides. More to come… |

Charts by AMG, Citigroup

Chart and image captions by PT

The above article originally appeared as “The Trouble With Freedom…” at the Diary of a Rogue Economist, written for Bonner & Partners.