The Transition

“The chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or euros. The sooner the better.”

Ron Paul

The intricate relationship between energy markets and our global financial system, can be traced back to the emergence of the petrodollar system in the 1970s, which was mainly driven by the rise of the United States as an economic and political superpower.

For almost twenty years, the U.S. was the world’s only exporter of petroleum. Its relative energy independence helped support its economy and its currency. Until around 1970, the U.S. enjoyed a positive trade balance.

|

A new oil pipeline is built in the Saudi desert… this one is apparently destined for the Ghawar oil field, one of the oldest fields in Saudi Arabia and still the largest in the world Photo credit: Saudi Aramco |

| Oil expert and author of the book “The Trace of Oil”, Bertram Brökelmann, explains a dramatic change took place in the U.S. economy, as it experienced several transitions: First, it transitioned from being an oil exporter to an oil importer, then a goods importer and finally a money importer. This disastrous downward spiral began gradually, but it ultimately affected the global economy.

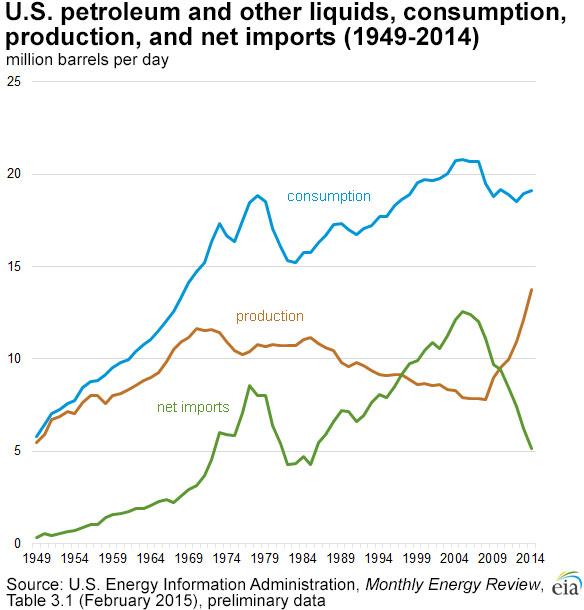

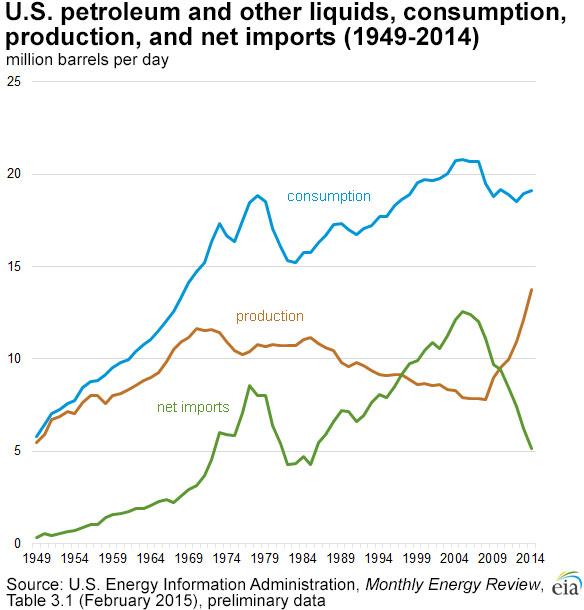

A petrodollar is defined as a US dollar that is received by an oil producing country in exchange for selling oil. As is shown in the chart below, the gap between US oil consumption and production began to expand in the late 1960s, making the U.S. dependent on oil imports.

|

Village in the desert: this compound in the Sahara houses people working at Saudi Arabia’s Shaybah oil field. Photo credit: lugh23s |

| And while it led to the U.S. Dollar being established as the world’s premier reserve currency, it also contributed to the country’s increase in debt. The oil embargo of 1973-74 was a major hit that exposed the vulnerability of the U.S. economy.

Nevertheless, under the banner of “national security” the future policy course was firmly set: in a 1973 National Security Council (NSC) paper, it was stated that “U.S. leverage in energy matters resulted from its economic and political influence with Saudi Arabia and Iran, the two leading oil exporters”.

US petroleum production, consumption and net imports – after surging dramatically from 1950 to the early 21st century, US energy imports have declined dramatically since the mid 2000ds as a result of the fracking boom. This is inter alia beginning to affect global dollar liquidity. |

|

From a Gold-Based Monetary System to the Petrodollar System

Former U.S. Senator Ron Paul explains that “understanding the Petrodollar system and the forces affecting it, is the best way to predict when the U.S. Dollar will collapse.” The origins of the petrodollar system go back to the Bretton Woods system, the 1944 post-war agreement, which made the U.S. Dollar the sole reserve currency.

From then on, only the U.S. Dollar would be convertible into gold at a fixed rate of USD 35 per ounce. This also meant that only the U.S. was able to change the price of gold and, in turn, it committed to maintaining the value of the Dollar by buying and selling unlimited quantities of gold, at the agreed upon rate of USD 35 per ounce.

In 1945, the U.S. Treasury held 17,848 metric tons of fine gold, which at the time represented around 63% of official global gold reserves. The gold-backed Dollar offered the world a reliable and stable reserve currency. However, cracks in the Bretton Woods system began to emerge, as US export surpluses began to drop after 1960. |

Bretton Woods monetary conference at the Mt. Washington Hotel in July 1944 Photo via beforeitsnews.com |

| The Kennedy and Johnson administrations were rather big on money printing, be it to finance the space race, or to spend on domestic social programs. A significant burden on the U.S. budget were also the wars fought in Korea and Vietnam, which had to be paid for by resorting to the usual war funding mechanisms, i.e. by borrowing money.

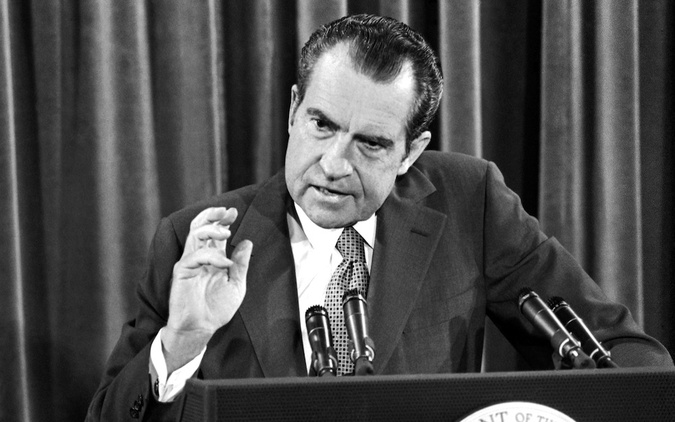

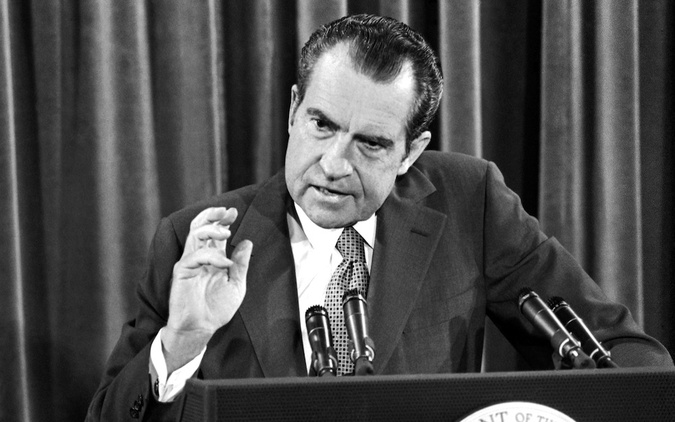

Thus, the country began to live on credit and banks worldwide were flooded with US dollars. These dollars represented gold claims on the United States though. In 1971, the US “temporarily” suspended convertibility of the Dollar into gold, and announced that the dollar would be devalued to USD 38.00 per ounce. |

Richard Milhouse Nixon. Here is a link to a video of his announcement of the US gold default in 1971. It is a classical example of how governments are routinely telling bald-faced lies when imposing steps to combat “economic emergencies” they themselves have caused. These steps invariably mean that someone’s wealth is stolen or diminished in favor of the State. Photo via epictimes.com |

A run on gold ensued, as European states, particularly France and Germany, were skeptical and wary of another devaluation. As a result, US gold reserves eventually shrunk to about 286 million ounces. Richard Nixon then “closed the gold window” in August 1971 and the dollar was devalued for a second time by 10%.

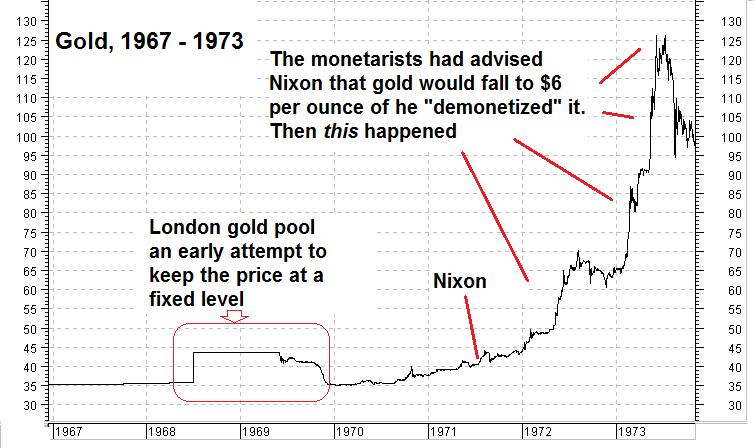

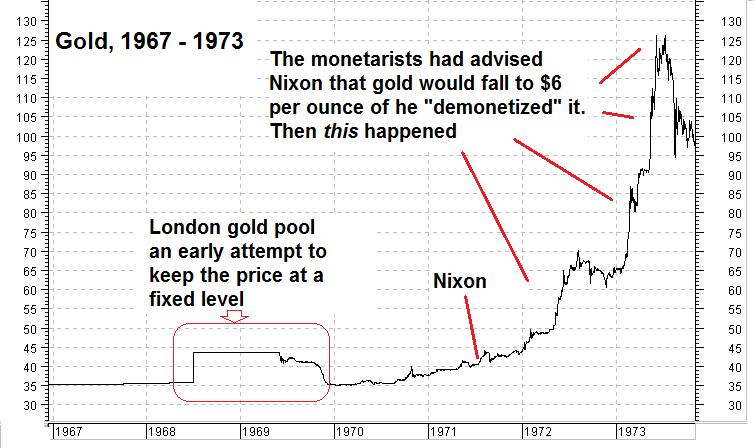

Gold price from 1967 to 1973

The gold price shot up to USD 42.22 in one go. This essentially meant that the U.S. Treasury defaulted on its promise to back the dollar with gold and thus, the financial system as it was constituted at the time was no longer sustainable.

1973 was an important year for oil: the oil embargo was imposed as a reaction to the Yom Kippur war, but it also related to the closure of the gold window. The Dollar became nothing more than a fiat currency and the Fed was free to pursue monetary expansion completely unhindered. The main problem the US faced was how to motivate other countries to hold and use US dollars. Saudi Arabia became the lynchpin of this effort. |

Gold price from 1967 to 1973. In the late 1960s there was an attempt by governments to keep the gold price under control through the “London Gold Pool” – they lost gold so fast in this market manipulation effort that they soon gave up again. It foreshadowed the eventual default. Monetarist economists like Milton Friedman told Nixon that the gold price would fall to $6 if the US were to “demonetize” gold – once again proving that the forecasts of most economists aren’t worth much – click to enlarge. |

| According to leaked documents, there were other interested parties that helped to “orchestrate” these developments in 1973-74. Henry Kissinger held a meeting in Bilderberg in the Netherlands with an influential group of men: Lord Greenhill of BP, David Rockefeller of Chase Manhattan Bank, George Ball of Lehman Brothers and Zbigniew Brzezinski.

The came to the conclusion that OPEC “could completely disorganize and undermine the world monetary system” and so they decided to target the commodity it controlled. Oil was to save their banks and financial interests from the collapse of the dollar. |

Kissinger meets with King Faisal of Saudi Arabia. At this point, the latter seemed not quite convinced yet. In the end, the Saudi royals realized what a great deal this would be for them. Photo credit:Bettmann / Getty Images |

| Shortly thereafter, Kissinger negotiated with the Saudi monarchy, and helped steer events in the direction that would eventually lead to an agreement between Saudi Arabia and the United States. It has only recently been disclosed that there was another covert meeting between the Saudis and newly appointed U.S. Treasury secretary, William Simon.

The objective was to find a way to convert the then hostile Saudis to US allies and by doing so create the petrodollar so as to reanimate the ailing US economy. Nixon would not take no for an answer – not only was it a matter of economic security, but he also wanted to block the Soviet Union from getting a toehold in the region. |

Former US treasury secretary William Simon – it has only recently emerged that he actually went on a secret mission to Saudi Arabia to persuade the Saudis to take dollars for oil and recycle them into treasury debt Photo credit: Ira Schwartz / AP |

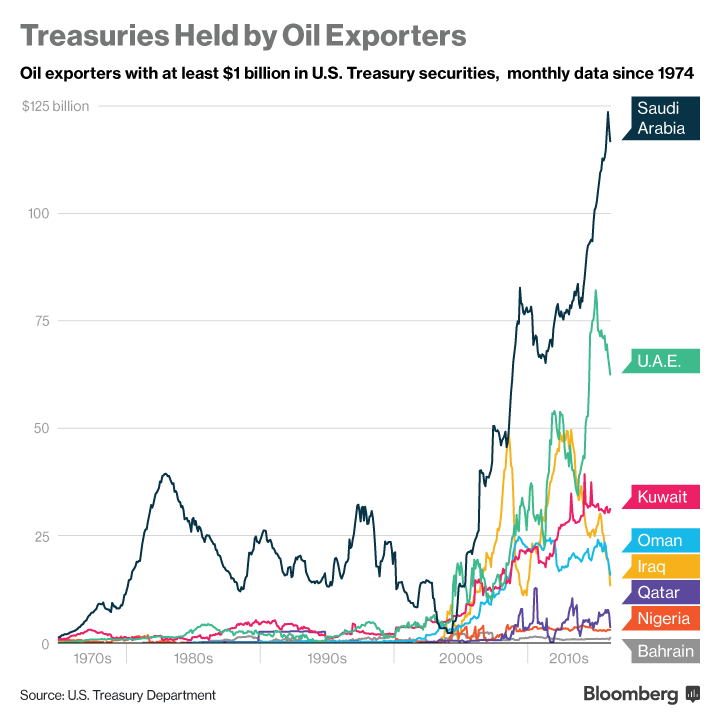

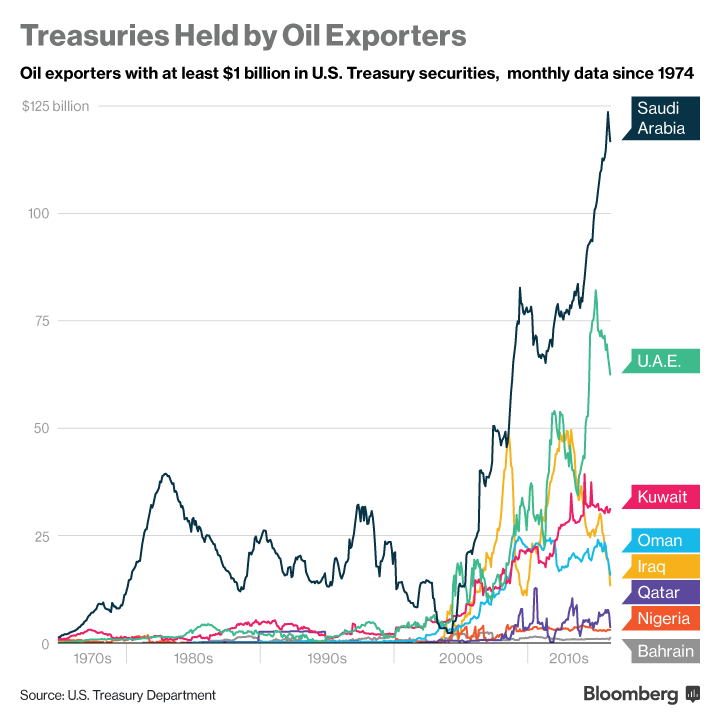

| Simon knew how to sell the idea: America was the safest place for the Saudis to invest their petrodollars and no one would know about it (Saudi investments were not disclosed separately, instead they were grouped with other oil exporting countries). As shown in the chart below, today Saudi Arabia is the largest US creditor among oil exporting countries, holding about USD117 billion in treasury securities.

And so, a partnership and a strategic alliance were formed: The US agreed it would guarantee the survival of the House of Saud, provide military security for the Saudi oil fields, as well as sell arms weapons to the Saudi government.

In return, Saudi Arabia would use its leverage in OPEC to ensure all oil transactions would be in USD, invest its own Dollars generated from oil sales in US investment vehicles, maintain influence over price levels and prevent another oil embargo.

This alliance marked a paradigm shift, the transition to the “petrodollar system”. It enabled the US to fill the vacuum that was left by the closure of the gold window. The oil conglomerates and financial oligarchs secured the flow of funds by creating a new wave of demand for US dollars.

Though artificial and baseless, it was backed by the increasing demand for oil worldwide. And this, also artificial, demand has successfully supported the continuation of expansionary US monetary policy for decades – at least until the beginning of the global financial crisis and the point where we find ourselves now. |

US treasuries held by oil-exporting countries. In this group, Saudi Arabia is the largest creditor of the US – click to enlarge. |

Is Another Paradigm Shift Underway?

Similar to the paradigm shift that followed with the collapse of the Bretton Woods system, there is another major shift underway today. According to Ron Paul, we will know its consequences in full, the day oil-producing countries demand gold for their oil rather than dollars.

We have already seen changes in oil sale agreements made in recent years. In 2013, Russia’s Rosneft agreed to supply China with oil worth USD 270 billion, the largest agreement to date. Additionally several OPEC nations are allowing oil transactions to be carried out in a currencies other than the dollar. |

Rosneft facility in Siberia Photo credit:Efim Krelish / Kommersant |

| In January 2016, India and Iran agreed to settle their oil sales in Indian rupees. In 2014, Qatar agreed with China to be the first hub for clearing transactions in the Chinese yuan. In December 2015, the United Arab Emirates (UAE) and China created a new currency swap agreement for the yuan. Both steps strongly indicate that the Gulf states are taking measures to reduce their dependence and exposure to the US dollar.

It is therefore clear why all eyes are set on the geopolitical turmoil in the Middle East. Concerns have intensified after a failed military intervention by the US, the slowly weakening strategic position of Saudi Arabia in the region and the increasing strength of Iran after the removal of economic sanctions.

In addition, U.S.-Saudi relations are currently on shaky ground. In April Saudi Arabia warned it could proceed to sell off billions worth of US treasury bonds if Congress passed a bill that would allow the kingdom to be held liable in U.S. courts for the Sept. 11 terrorist attacks.

That bill indeed passed the Senate in May and is now in the hands of the House of Representatives, but a vote is yet to be scheduled. The Saudi threat has not yet materialized, but if it did, it would pull billions of dollars out of the US treasury bond market – it would be a move of great moment, symbolically ending more than 40 years of cooperation in the petrodollar system. |

President Obama and Saudi Arabia’s new King Salman find something to laugh about. In reality, relations between the US and Saudi Arabia have steadily deteriorated in recent years, official proclamations to the contrary notwithstanding. Photo credit:Jim Bourg / Reuters |