Force cannot restore legitimacy, trust or confidence, nor can it magically erase the consequences of a still-unfolding national trauma. The Chinese authorities threatening to punish workers who refuse to return to work are getting a lesson in the limits of force in an unprecedented national trauma: a bayonet in the back will not restore the legitimacy and confidence that have been lost. There are two enormous blind spots in conventional media coverage of the...

Read More »Mises: To Adopt Keynesian Terminology Is to Legitimize It

Some years ago, there was published a book in the German language with the title L.T.I. These three letters stood for three Latin words, lingua Tertii Imperii, the language of the Third Reich. And the author, a former professor of Romance languages at one of the German universities, described in this book his adventures during the Nazi regime. And his thesis was that all people, without any exception, in Germany of course, were Nazis—not because they had accepted...

Read More »Transport operators told to pay back millions in state subsidies

BLS must pay back CHF43.6 million is wrongly claimed state subsidies. (© Keystone / Christian Beutler) Two more Swiss state-owned transport companies have been ordered to pay back more than CHF50 million ($51 million) in wrongly claimed subsidies. The authorities are also looking into the possibility of criminal prosecutions in connection with the worsening subsidies scandal. Government auditors have targeted Swiss Federal Railways and a transport operator in canton...

Read More »Could the Covid-19 Pandemic Collapse the U.S. Healthcare System?

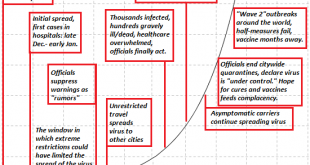

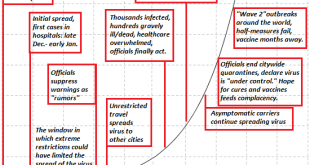

Disregard these second-order effects at your own peril. A great many systems that are assumed to be robust are actually fragile. Exhibit #1 is the global financial system, of course, but Exhibit #2 may well be the healthcare system globally and in the U.S. Observers have noted that the number of available beds in U.S. hospitals is modest compared to the potential demands of a pandemic, and others have wondered who will pay the astronomical bills that will be...

Read More »The US’s “Free Trade” Isn’t Very Free

The false notion that the US has eliminated virtually all of its barriers to foreign imports has been repeated more and more in recent years. The claim is made both by advocates for free trade and by critics of free trade. For instance, Patrick Buchanan has claimed only American elites “are beneficiaries to free trade” while implying the US either has free trade, or something close to it. Rather than insulate US companies from global competition, Buchanan insists,...

Read More »Jeff Snider Part 2/2 (Repo Mkt/Eurodollar Expert) Rebel Capitalist Show Ep. 19

Jeff Snider reveals insights ?YOU CAN'T AFFORD TO MISS! ?This interview with Jeff Snider is so packed with knowledge bombs we had to turn it into 2 parts! This is PART 2 of 2, and trust me, it will blow your mind! As always, The Rebel Capitalist show helps YOU learn more about Macro, Investing, Entrepreneurship AND Personal Freedom. Jeff and I discuss how money is actually created and how US dollars (Eurodollars) have been created, outside the US, for decades! We had some technical...

Read More »Close to one fifth of households in Switzerland behind on debt payments

© Kawee Srital On | Dreamstime.com In 2017, 18.9% of Switzerland’s population lived in a household with outstanding debt repayments, a percentage that has rose from 17.7% over the proceeding 4 years. The most common forms of outstanding debts were taxes, health insurance premiums and phone bills. 9.9% of households had outstanding tax payments, 7.3% owed health insurance money and 5.2% had an outstanding telecommunications bill. The most common reason for going into...

Read More »Swiss business takes on global waste

A worker at the conveyor belt in Nairobi. (zVg) Mr. Green, a recycling subscription service with a social mission, has been a big hit with busy families and businesses in cities in Switzerland. But can it work in Africa? Swiss entrepreneur Keiran Smith had no connection with Kenya before starting Mr. Green Africa. It all started more than a decade ago when four business school students in a shared house in Zurich tried to find a solution for their recycling woes:...

Read More »Swiss parliament assumes control of Crypto probe

Crypto AG’s encryption machines, sold worldwide, were reportedly bugged to enable spying by the CIA and West Germany. (Keystone / Alexandra Wey) The Swiss parliament has insisted that it will take control of and merge the ongoing investigations into the Crypto spying affair that has rocked the Alpine nation. On Wednesday, members of the parliamentary control delegation decided to immediately take over the direction of investigation launched by the Federal Council...

Read More »Goldman: 3 Key Reasons Why We Are Bullish On Gold

On “Bloomberg Commodities Edge”, Bloomberg’s Alix Steel and Naureen Malik talk with Jeff Currie, global head of commodities research at Goldman Sachs. They discuss Goldman’s bullish stance on gold. Gold is gaining on mounting speculation China and other central banks will unleash stimulus to counter the economic pain from the coronavirus outbreak, boosting liquidity in the market and devaluing currencies. UBS are also bullish on gold as a hedge on dollar and...

Read More » SNB & CHF

SNB & CHF