High street shops have been closed and some production facilities have been ordered to shut down. (© Keystone / Gaetan Bally) A third of a CHF20 billion ($21 billion) fund offering state guaranteed loans to small and medium sized Swiss companies has been used up just four days after being introduced. The loan facility has already promised CHF6.6 billion in funding of up to CHF500,000 to nearly 32,000 firms – an average of CHF207,000 per company. The speed at which...

Read More »(No) Dollars And (No) Sense: Eighty Argentinas

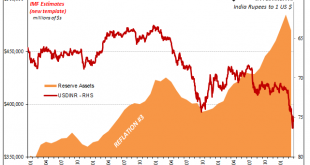

India like many emerging market countries around the world holds an enormous stockpile of foreign exchange reserves. According to the latest weekly calculation published by the Reserve Bank of India (RBI), the country’s central bank, that total was a bit less than half a trillion. While it sounds impressive, when the month began the balance was much closer to that mark. Over the last several crisis-filled weeks, officials in India have been fighting against a...

Read More »Oren Cass and the Conservative Critique of Pure Laissez-Faire

Oren Cass is the executive director of American Compass (AmericanCompass.org), a conservative think tank that stresses the importance of family and domestic industry, in opposition to a singleminded devotion to economic efficiency. Cass was previously a senior fellow at the Manhattan Institute for Policy Research, and was the domestic policy director for Mitt Romney’s 2012 presidential campaign. Bob and Oren have a friendly discussion about their disagreements on...

Read More »The End of Globalization & Financialization Leads To A New Monetary System – Charles Hugh Smith

Thanks for watching this RTD Q&A ft. Charles Hugh Smith. Share your thoughts in the comment section below. Subscribe & click the ? icon to be notified of the next livestream. Consider becoming a supporter of the RTD Channel. All gifts add up to make a difference. Thanks RTD Patreon (Monthly Support): https://www.patreon.com/rtd RTD Donation (One Time Gift): https://www.rethinkingthedollar.com/donate/ ================================= Like the livestream software I use???...

Read More »The End of Globalization & Financialization Leads To A New Monetary System – Charles Hugh Smith

Thanks for watching this RTD Q&A ft. Charles Hugh Smith. Share your thoughts in the comment section below. Subscribe & click the ? icon to be notified of the next livestream. Consider becoming a supporter of the RTD Channel. All gifts add up to make a difference. Thanks RTD Patreon (Monthly Support): https://www.patreon.com/rtd RTD Donation (One Time Gift): https://www.rethinkingthedollar.com/donate/ ================================= Like the livestream software I use??? Sign up...

Read More »Making Sense Eurodollar University Episode 2

Jeff Snider, Head of Global Investment Research at Alhambra Investments, and Emil Kalinowski make sense of today's global monetary system.

Read More »FX Daily, March 30: Monday Blues

Swiss Franc The Euro has fallen by 0.36% to 1.0553 EUR/CHF and USD/CHF, March 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk appetites remain in check as the spread of the coronavirus is leading to more and longer shutdowns. Asia Pacific equities fell with Australia, the notable exception. Its benchmark rallied a record 7%, encouraged by additional stimulus measures. Led by financials, following new...

Read More »Record exports drive up Swiss chocolate sales

Swiss consumers also appear to be rediscovering their love of chocolate. (© Keystone / Gaetan Bally) The value of Swiss chocolate exports topped CHF1 billion ($1.05 billion) for the first time last year, led by increased demand from Canada, the United States, China, the Middle East and Singapore. Domestic consumption of the delicacy also grew slightly following declining demand in previous years. Sales for Swiss chocolate makers rose 2.2% in 2019 to reach almost...

Read More »USD/CHF hits ten-day lows near 0.9550 as the greenback remains under pressure

US Dollar Index tumbles to fresh weekly lows at 98.73, down 4% from the top. US data: Consumer Sentiment Index suffers second-largest monthly decline in March. The USD/CHF pair is falling for the fourth consecutive day amid an ongoing sell-off of the US dollar. The DXY approached earlier on Friday the 100.00 area and recently bottomed at 98.73, the lowest level since March 17. The US dollar remains under pressure, affected by lower US yields. After a short-lived...

Read More »France drops blocks on face mask exports to Switzerland

Doing it properly: instructions for wearing a FFP2 face mask. (Keystone / Christian Beutler) After Germany, France has lifted restrictions on the delivery of hygienic face masks to Switzerland. Some two million masks are needed each day, according to the Federal Office for Public Health. The French embassy to Switzerland made the announcementexternal link on Saturday, paving the way for two shipments of FFP2 hygienic masks to go ahead from France to Switzerland....

Read More » SNB & CHF

SNB & CHF