Please visit our website https://www.macrovoices.com to register your free account to gain access to supporting materials.

Read More »Is Now a Good Time to Buy Gold? Market Report 16 March

We got hate mail after publishing Silver Backwardation Returns. It seems that someone thought backwardation means silver is a backward idea, or a bad bet. “You are a *&%#! idiot,” cursed he. “Silver is the most underpriced asset on the planet,” he offered as his sole supporting evidence. He doesn’t know that backwardation means scarcity, not that a commodity’s price is too high. Since we wrote that on March 2 (our Reports are always based on the prior Friday’s...

Read More »FX Daily, March 16: Monday Blues: Fed Moves Bigly and Stocks Slump

Swiss Franc The Euro has fallen by 0.01% to 1.0541 EUR/CHF and USD/CHF, March 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve and central banks in the Asia Pacific region acted forcefully, but were unable to ease the consternation of investors. The Reserve Bank of New Zealand cut key rates by 75 bp. The Bank of Japan appears to have doubled its ETF purchase target to JPY12 trillion, and...

Read More »Geldpolitik – Coronavirus-Krise: Zentralbanken starten Notaktion gegen Liquiditätsengpass

Die EZB, die US-Notenbank, die kanadische Notenbank, die Bank von England, Japans Notenbank und die Schweizerische Nationalbank wollen dazu bestehende US-Dollar-Devisentauschabkommen nutzen, wie auch die SNB am späten Sonntagabend ankündigte. Die sechs Notenbanken vereinbarten, zusätzlich zu bereits angebotenen Kreditgeschäften mit einwöchiger Laufzeit nun auch wöchentlich die Weltleitwährung mit einer Laufzeit von 84 Tagen in ihrem jeweiligen Zuständigkeitsbereich...

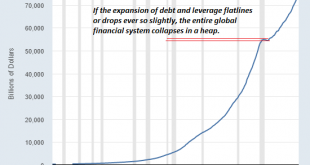

Read More »The Covid-19 Dominoes Fall: The World Is Insolvent

Subtract their immense debts and they have negative net worth, and therefore the market value of their stock is zero. To understand why the financial dominoes toppled by the Covid-19 pandemic lead to global insolvency, let’s start with a household example. The point of this exercise is to distinguish between the market value of assets and net worth, which is what’s left after debts are subtracted from the market value of assets. Let’s say the household has done very...

Read More »Swiss industry fears consequences of US travel ban

SWISS International Air Lines has been forced to reduce flights to the US and other parts of the world. (© Keystone / Gaetan Bally) A United States ban on travellers from Europe has been condemned as “incomprehensible” by leading Swiss manufacturing association, Swissmem. The Swiss-American Chamber of Commerce has also weighed in, saying firms would seriously suffer if borders remain closed for longer than a month. The US is Switzerland’s second-largest trade...

Read More »Coronavirus: Swiss hospitals have around 750 breathing ventilators

© Ryzhov Sergey | Dreamstime.com One of the biggest challenges during the coronavirus outbreak will be ensuring there are enough qualified staff and equipment to keep the worst affected patients alive. Thierry Fumeaux, head of the Swiss Society of Intensive Medicine, told RTS there are 82 intensive care units (ICU) across Switzerland. These have a combined 850 places, of which 750 are equipped with breathing equipment. It is not clear how many of these places are...

Read More »EM Preview for the Week Ahead

Market sentiment is likely to open this week on an upswing after the Fed’s emergency rate cut and expanded QE were announced Sunday afternoon local time. Yet as we have seen time and again this past couple of weeks, added stimulus has had little lasting impact on markets as the virus numbers continue to worsen. Europe is now reporting more daily cases than China did at its peak. We remain negative on EM until the global growth outlook becomes clearer. AMERICAS...

Read More »Coronavirus: an estimate of the real number of infections in Switzerland

Today, according to the Federal Office of Public Health (FOPH), there were 815 confirmed cases in Switzerland. There are obvious challenges to this figure. Possibly the most important is the time lag between infection and a confirmed case. On average, there are 5.1 days between catching the virus and the onset of symptoms. If you look at the chart above from a WHO report on COVID-19 in China, which shows new coronavirus cases from 8 December until 20 February for...

Read More »Swiss lawyers seek to keep special ‘advisor’ status in the shadow economy

The Panama Papers leaked by Panamanian law firm Mossack Fonseca revealed that 1,339 Swiss lawyers, financial advisers and other middlemen had set up more than 38,000 offshore entities over the last 40 years. (Keystone / Alejandro Bolivar) The Swiss government faces resistance to efforts to tighten anti-money laundering rules that close loopholes for lawyers who act as “advisors” in setting up offshore financial structures. Anti-corruption expert Mark Pieth writes...

Read More » SNB & CHF

SNB & CHF