The world we come from had lots of death. Every society we know of before the mid-1800s or so saw more than one in four children die during their first year of life. Of those who made it through this first difficult year—through disease, malnutrition, famines, or natural disasters—another quarter or so died before they reached fifteen. Into the 1900s, you had to get into your sixties before your per year risk of death again was as high as it was in your first year of...

Read More »You Don’t Have To Take My Word For It About Eliminating QE

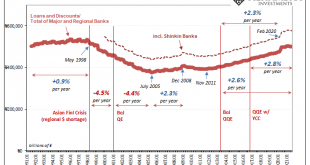

You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s. If none handy, then just read what officials and central bankers write about their own programs (or those of their close and affectionate counterparts). After nearly a decade of Abenomics in Japan, the latest Japanese Prime Minister Fumio Kishida...

Read More »Switzerland remains top place for expats in 2021

© minnystock | Dreamstime.com Switzerland is the highest rated country in the latest HSBC expat ranking published this week, a position held for the last three years. 91% of the expats surveyed living in Switzerland said their living environment was better than it was before moving. The average on this measure across all expats questioned was 67%. After moving, 86% said they felt safer, another of Switzerland’s strong points among expats. In addition, nearly 9 out of...

Read More »Why Do Central Banks Want Higher Inflation?

Why do Central Banks want higher inflation? The debt ceiling debate in U.S. Congress and related political nonsense brings even more to light the exponential growth in US federal government debt. US government debt has doubled in the 10 years since the last major debacle Congress created over raising the debt ceiling back 2011. The debate and Congress’s unwillingness to increase the limit back in August 2011 resulted in declining equity markets. It also resulted in...

Read More »Rothbard: With Interest Rates, “There Are Two, Opposite Causal Chains at Work.”

Editor’s Note: Interest rates and inflation are certainly connected to efforts on the parts of central banks to loosen and tighten the money supply. These relationships, however, are much more complex than many people suppose. As we’ve seen in recent weeks, with constant talk about what the Fed will do next, expectations are an important factor in how markets respond to central bank actions. In his article “Ten Great Economic Myths,” Murray Rothbard addresses some of...

Read More »America Is Now a Kleptocrapocracy

I hope everyone here is hungry because the banquet of consequences is being served.I’ve coined a new portmanteau word to describe America’s descent: kleptocrapocracy, a union of kleptocracy (a nation ruled by kleptocrats) and crapocracy, a nation drowning in a moral sewer of rampant self-interest in which the focus is cloaking all the skims, scams, rackets and bezzles in some virtuous-sounding garb, a nation choking on low-quality junk ceaselessly hawked by...

Read More »Paul Krugman’s One-Man War on Science

When David Card was recently awarded the Nobel Memorial Price in Economic Science (along with two other economists), I figured Paul Krugman would weight in, since Card, along with the late Alan Krueger, authored an economic study almost thirty years ago that allegedly debunked standard economic theory on the effects of a binding minimum wage. Krugman did not disappoint. As is his M.O., Krugman cherry-picked his information and then went on to claim that the...

Read More »Ask Bob – What Do I Do If I Choose The Wrong Medicare Plan?

Alhambra’s Bob Williams answers the question, “What do I do if I choose the wrong Medicare Plan?”. [embedded content] [embedded content] You Might Also Like Weekly Market Pulse: Perception vs Reality 2021-10-18 It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too...

Read More »Can Interest on Gold Outpace Inflation?

Yield. It’s on the tip of every investor’s tongue, but it’s much harder to find than it used to be. A long time ago, in a galaxy far, far away (like the early 1980’s) one could simply open a savings account, purchase a CD or US 10-year notes, and earn between 7% to 14%. The idea of earning 14% on treasurys seems the stuff dreams are made of. And you must be dreaming if you think you can find that kind of yield today. Interest rates are at zero, near zero, or negative...

Read More »What’s the real problem in our supply chains?

Containers are piling up at ports, ships are waiting to offload cargo and store shelves are sitting empty. Are all the quick fixes enough to fix the real problems in our supply chains? Headlines over the past few weeks about our global supply chain woes are enough to make anyone start stocking up on toilet paper and other essentials (again!). Goods from steel and lumber to toys, bicycles, and semiconductors are all facing delivery delays and higher prices, causing...

Read More » SNB & CHF

SNB & CHF