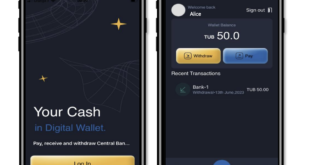

Project Tourbillon, an initiative led by the Bank for International Settlements (BIS) Innovation Hub Swiss Centre and supported by the Swiss National Bank (SNB), explored the feasibility of a retail central bank digital currency (CBDC), finding that it is possible to implement a CBDC design that provides anonymity to the payer and which is scalable and secure. In a new report released in November 2023, BIS shares details of the project, outlining findings of their...

Read More »Virtual Mises University 2024

Join 2024's Virtual Mises University for only $45—or join free for Mises Institute Members (use your promo code on the back of your Membership card). For almost thirty years, Mises Institute scholars have presented at Mises University, a world-class, week-long, intensive event in Austrian Economics. Virtual Mises University is the online component of this seminar for students, professionals, business people, and absolutely anyone, anywhere, who is interested in the...

Read More »Rothbard and Mises vs. Calhoun on the Natural Right to Secede

There are many reasons to support the breaking up states into smaller pieces. This is done via secession, and acts of secession produce smaller states. All else being equal, smaller states tend to be richer and they tend to have lower taxes. They tend to exercise less power over the resident population—because it's easier for people to escape smaller states than larger ones. Moreover, setting these tangible and practical considerations aside, secession may also be...

Read More »Our Friend the State

Economics in America: An Immigrant Economist Explores the Land of Inequalityby Angus DeatonPrinceton University Press, 2023; xiii + 273 pp. Economics in America disappointed me, but I have only myself to blame. As you would expect from a Nobel laureate, Angus Deaton is very smart and erudite, but what you might not expect is that he is funny as well. The book contains much good sense, but it is quite unsympathetic to the free market. And this is what disappointed me....

Read More »What, Me Normative?

Visions of Inequality: From the French Revolution to the End of the Cold Warby Branko MilanovicHarvard Univerity Press, 2023; 359 pp. Branko Milanovic’s Visions of Inequality contains one of the most misleading statements I have ever encountered by an author about the contents of his own book. Milanovic, an eminent economist who teaches at the City University of New York and was formerly the lead economist at the World Bank, addresses in this book what a number of...

Read More »Friedman versus Rothbard

Murray Rothbard and Milton Friedman didn’t only disagree on the subject of economics. They also sharply disagreed on the direction American conservatism needed to go. Original Article: Friedman versus Rothbard [embedded content] Tags: Featured,newsletter

Read More »Selections from The End of the Dollar Era

Government-Managed Digital Currency: A Further Threat to Our Freedom by Paul Gottfried Whatever the modern self-described liberal democratic administrative state claims to be doing in the name of disadvantaged people is intended primarily and perhaps exclusively to increase government control. Further, whenever the same regime purports to be making our lives more comfortable, more agreeable, we may assume that our freedom and property rights are under assault....

Read More »The Wrong Way and the Right Way to Fix the Fed

Monetary Policy as Inflationism Today all governments and central banks operate under the ideology of inflationism. The underlying principle of inflationism is that the quantity and purchasing power of money determined by the free market leads to deflation, recession, and unemployment in the economy. The inflationist ideology is therefore embedded in the very concept of monetary policy, which can be defined as an increase in the supply of money aimed at lowering the...

Read More »From the Editor—November/December 2023

The Mises Institute is different. We don’t change our positions or our ideology to match the current zeitgeist. Rather, we’re in it for the long haul. Our business is to change the minds of both scholars and the general public. Victory in the battle of ideas doesn’t begin in legislative committee rooms. It begins in classrooms and living rooms. To achieve this goal, it’s important to not sacrifice consistency to score some short-term and fleeting victories. This is...

Read More »Does Debt Make Capitalism Financially Unstable?

According to the post-Keynesian School of Economics economist Hyman Minsky, the capitalist economy has an inherent tendency to develop instability that culminates in a severe economic crisis. The key mechanism that pushes the economy toward a crisis is the accumulation of debt. According to Minsky, during “good” times businesses in profitable sectors of the economy are rewarded for increasing their debt levels. The more one borrows, the more profit one seems to make....

Read More » SNB & CHF

SNB & CHF