Share: USD/CHF finds support at 0.9010, with buyers lifting pair to 0.9057 in late North American session. ‘Golden cross’ formation of 50-day moving average crossing above 200-day moving average opens door for bullish resumption. Sellers must push prices below 0.9000 mark and reclaim latest cycle low at 0.8887 to maintain control. The USD/CHF finds some support at around the 0.9010 area, though it failed to print a green day on Thursday after market participants...

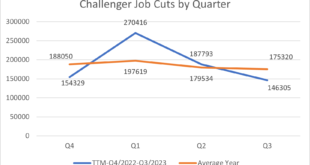

Read More »Macro: Challenger Job Cuts — Improvement throughout the year

We had a bad 1st quarter relative to historic averages for job cuts. But the situation has gotten better throughout the year. In the 3rd quarter of 2023 less people are losing their job relative to the average 3rd quarter going back to 1989. . Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the information herein constitutes an...

Read More »Coauthor of War College Journal Article Tries to Backtrack on Call for “Partial Conscription”

At the end of September, I reported how a recent article in the Army War College academic journal examined lessons learned from the war in Ukraine and that one of the most concerning was the claim that the military might need to reinstate the draft in order to wage a high-intensity war. I argued at length that this was an example of the military laying the groundwork to resume the draft and laid out the reasons why it might be necessary from the regime’s...

Read More »Back to the Future Morphs into Dystopia

Thanks to the exponential growth of government and regulation, the optimistic society of Back to the Future is fast becoming the dystopian world of Escape from New York or Death Wish. Original Article: Back to the Future Morphs into Dystopia [embedded content] Tags: Featured,newsletter

Read More »Macro: Factory Orders — revision

This was a slight downward revision. Nothing to cheer and really nothing to write home about. September Durable Goods were revised down .1% MoM in Sept and .05% MoM in Aug. Here’s a picture of Factory Orders. Looking at this time series, it’s almost as if the recession that has been 2 years in the waiting was merely coming off a covid fever sugar high. Orders briefly went negative, but now climbing. Let’s see if we can maintain the positive momentum from Q3, stay...

Read More »The Current US Economic Situation from an Austrian Viewpoint

This article is a brief analysis of the US economic situation from the point of view of the Austrian School of Economics. It is strictly macroeconomic: a deductive hypothesis of what is happening in the aggregates. Let us place ourselves in the months immediately after the arrival of covid-19, the first quarter of 2020. As an economic policy measure, the US government decided to increase the money supply. Through different mechanisms, they put an unprecedented amount...

Read More »The Spirit of the Establishment Will Thrive under a “Populist Opposition” Government

Is a true populist US government on the horizon? Probably not. Original Article: The Spirit of the Establishment Will Thrive under a “Populist Opposition” Government [embedded content] Tags: Featured,newsletter

Read More »Gold Hits New All Time Highs

The big news in gold is two-fold right now; gold hit new all-time highs in several currencies and central bank demand for physical gold remains strong hitting a year-to date record in Q3 this year. Gold at $2,000? So whilst the headlines were all about dollar-denominated gold showing us that it’s still destined for levels north of $2,000 the real news is about other currencies and gold. Ahead of yesterday’s FOMC announcement the price of the yellow metal hit...

Read More »A Fed-Induced “Neutral” Interest Rate Is a Contradiction in Terms

The New York Federal Reserve said on Tuesday, September 5, 2023, that the estimate for the neutral rate for Q2 has eased to 0.57 percent from 0.68 percent in Q1. Analysts typically translate that rate into a real-world setting by adding the neutral rate to the Fed’s 2 percent inflation target. The current reading suggests that a federal funds rate of around 2.5 percent would represent a neutral setting. Given that the Fed’s current target rate range is between 5.25...

Read More »Dollar Extends Losses Post-FOMC

Overview: We suspect that if Martians read the FOMC statement, which was nearly identical to the September statement and listened to Chair Powell, they would conclude there was nothing new. Yet, the market habitually hears Powell as dovish and this has weighed on rates and the dollar, while lifting risk appetites. Follow-through selling of the greenback has dragged it lower against all the major currencies, with the Antipodean leading the way, and nearly all the...

Read More » SNB & CHF

SNB & CHF