Die Sichtguthaben bei der SNB steigen gegenüber der Vorwoche um 3,4 Milliarden Franken. Die Einlagen von Bund und Banken lagen am 23. Februar bei 480,5 Milliarden Franken nach 477,1 Milliarden in der Woche davor, wie die SNB am Montag mitteilte. Das ist ein Anstieg um 3,4 Milliarden Franken. Auf die Giroguthaben inländischer Banken entfielen Ende letzter Woche 471,4 Milliarden Franken. Das Total der Sichtguthaben bei der Nationalbank umfasst als grössten Posten die...

Read More »Behind the scenes of our trip to discover the pharma industry in Slovenia | Part one ?

We recently visited Slovenia to find out why the country is emerging as a global player in generic drug production. ??? Our reporter, Jessica Davis Plüss, shares how her investigation began and how she, along with our video journalist, Céline Stegmüller, explored chemistry labs, drug factories, and warehouses in Slovenia. Stay tuned for part two to see what Jessica Davis Plüss, found surprising about the country! ?Curious to discover why Swiss drug companies...

Read More »Switzerland’s marriage tax penalty back in the spotlight

Married couples in Switzerland are taxed together, unlike unmarried couples who are taxed individually. This often acts as a tax disincentive for one spouse to work, disproportionately affecting women. For many years, certain political parties have been pushing to remove what is essentially discrimination on the basis of marital status. The issue came back into the limelight this week in the run up to a 27 March 2024 deadline for the government to respond to an...

Read More »Is peace achievable in Ukraine? | Inside Geneva #podcast on the second anniversary of the war

Today marks the second anniversary of Russia’s full-scale invasion of Ukraine. On our Inside Geneva podcast we discuss the latest military developments in Ukraine, the chances of peace and where the war will go from here. Listen here ? ?Apple podcasts: https://podcasts.apple.com/ch/podcast/the-war-in-ukraine-whats-next/id1506227169?i=1000645968866 ?Spotify: https://open.spotify.com/episode/6veyHSIE8RTH3kFFBvXTfo --- swissinfo.ch is the international branch of the Swiss...

Read More »Javier Milei Ended a DC-Sized Deficit in…Nine Weeks

Argentina’s Javier Milei is racking up some solid wins, with the fiscal basket case seeing its first monthly budget surplus in 12 years. Apparently, it took Milei just nine and a half weeks to balance a budget that was projected at 5% of GDP under the previous government. In US terms, he turned a 1.2 trillion-dollar annual deficit into a 400 billion surplus. In 9 and a half weeks. How did he do it? Easy: he cut a host of central government agency budgets by 50% while...

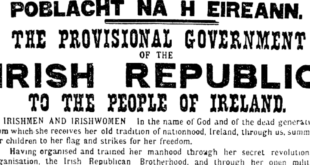

Read More »No, the Civil War Did Not Forever Settle the Matter of Secession

There are many arguments against secession. Some of them are quite prudent, such as those that simply contend that national separation may not be a good idea at this time. Many others are premised on the refusal to acknowledge the human right known as self-determination. This argument is wrong and immoral, and is nothing more than the traditional imperialist-colonialist argument repackaged for modern audiences. Perhaps the worst "argument" against secession is the...

Read More »Anti-Wild Cards

In this week's episode, Mark looks at the type information that investors need, but do not have. These anti-wild cards are going to appear in the economy, but no one really knows what, where, or when. Mark looks back at some historical examples. See also Surprised Again! The Covid Crisis and the New Market Bubble by Alex Pollock and Howard Adler: Mises.org/MI_59A Be sure to follow Minor Issues at Mises.org/MinorIssues. Get your free copy of Dr. Guido...

Read More »Week Ahead: With the Markets Converging (Again) with Fed’s Dots, Is the Interest Rate Adjustment Over?

The US dollar and interest rates appear to be at an inflection point. Much of the past several weeks have been about correcting the overshoot that took place in Q4 23, when the derivatives markets were pricing in nearly seven quarter-point rate cuts by the Federal Reserve this year. US two- and 10-year interest rates set new three-month highs last week. With the help of economic data and comments by Fed officials, the market, as it did a few times last year, has...

Read More »Biblical Critical Theory Is Not Biblical. It’s Watered-Down Marxism

Christianity Today magazine, founded by Billy Graham, chose Christopher Watkin’s book, Biblical Critical Theory: How the Bible’s Unfolding Story Makes Sense of Modern Life and Culture, as one of its 2024 Book Awards and the book most likely “to shape evangelical life, thought, and culture.” Other Christian organizations promote the book too. Nonreligious readers won’t care, but they need to keep in mind that most people won’t take a class or read a book on economics....

Read More »The Tyranny of the 1964 Civil Rights Act

In Freedom and the Law, Bruno Leoni argues that the main threat to liberty comes not from overweening officials but from the law that empowers them. As Murray Rothbard puts it, “The real and underlying menace to individual freedom is not the administrator but the legislative statute that makes the administrative ruling possible.” In that light, we can see that woke tyranny does not come from the self-important diversity, equity, and inclusion (DEI) officers who claim...

Read More » SNB & CHF

SNB & CHF