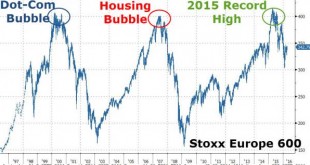

A year ago today, European equities hit their highest levels ever. But, as Bloomberg reports, the euphoria about Mario Draghi’s stimulus program didn’t last, and trader skepticism is now rampant. The Stoxx Europe 600 Index has lost 17% since its record, and investors who piled in last year are now unwinding bets at the fastest rate since 2013 as analysts predict an earnings contraction. The trading pattern looks familiar: a fast run to just over 400 on the gauge, then disaster... To...

Read More »SDR Does Not Stand for Secret Dollar Replacement

At the IMF/World Bank meetings this week, Chinese officials are again pushing for greater use of the IMF’s unit of account, Special Drawing Rights. It is China’s turn as the rotating host of the G20, which gives it greater influence over its agenda. For its part, the IMF is concerned about global financial stability and must be open-minded. It wants to strengthen the financial system. It is only prudent to examine all reform ideas. Last September, the IMF agreed to include the yuan...

Read More »Weekly Emerging Markets: What has Changed

Bank Indonesia will use the 7-day reverse repo rate as its new benchmark policy rate The ruling party in South Korea unexpectedly lost parliamentary elections The Monetary Authority of Singapore eased monetary policy to recession settings Turkey has nominated its next central bank chief The Brazilian special lower house committee voted 38-27 in favor of impeachment The first round of Peru’s presidential election was inconclusive In the EM equity space, Brazil (+5.4%), UAE (+4.9%), and...

Read More »Why All Central Planning Is Doomed to Fail

Positivist Delusions [ed. note: this article was originally published on March 5 2013 – Bill Bonner was on his way to his ranch in Argentina, so here is a classic from the archives] We’re still thinking about how so many smart people came to believe things that aren’t true. Krugman, Stiglitz, Friedman, Summers, Bernanke, Yellen – all seem to have a simpleton’s view of how the world works. A bunch of famous people with a simpleton view of how the world works…who not only seriously think...

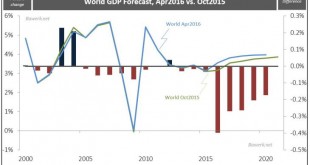

Read More »Circulus in probando

In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth. First, they promote debt-funded consumption because spending – money supply/credit and velocity – is equivalent to nominal GDP growth, and as long as you have nominal GDP growth you can always add more debt to the existing stock ad infinitum. That obviously came crashing down in 2008. At that...

Read More »FX Daily, 04/15: Better Chinese Data Fails to Deter Pre-Weekend Profit-Taking

China’s slew of economic data lends credence to ideas that the world’s second-largest economy may be stabilizing. However, the data failed to have a wider impact on the global capital markets, including supporting Chinese equities. In fact, the seven-day advance in the MSCI Asia-Pacific Index was snapped with a fractional loss today. European shares are also lower on profit-taking, breaking a five-day advance. Commodities, including oil, copper, nickel and zinc are also trading off....

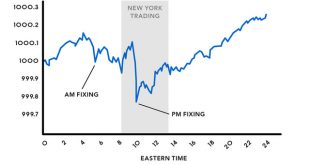

Read More »Every Single Bloody Market Is Manipulated … See For Yourself

Gold and Silver Are Manipulated Deutsche Bank admitted today that it participated with other big banks in manipulating gold and silver prices. In 2014, Switzerland’s financial regulator (FINMA) found “serious misconduct” and a “clear attempt to manipulate precious metals benchmarks” by UBS employees in precious metals trading, particularly with silver. Reuters reported: Swiss regulator FINMA said on Wednesday that it found a “clear attempt” to manipulate precious metals benchmarks during...

Read More »Guess Which Major Bank Loses The Most From Brexit?

Banks have been lobbying intensively against Brexit. Among those leading the charge is Goldman Sachs. For three years, the bank’s executives have publicly warned about the downsides of leaving the EU... and now we know why (hint - it's not concern for the common man). As The Wall Street Journal reports, about a decade ago, Goldman launched project “Armada,” a plan for a hulking European headquarters on the site of an old telephone exchange in London. Unbundling this kind of structure...

Read More »BOE and Brexit

No one can feign surprise that the Bank of England kept policy steady. Nor was the 9-0 vote truly surprising, though there had been some speculation of a couple of dovish dissents. Nevertheless, there are two important takeaways for investors. First, the BOE recognized what many in the market have already accepted; namely that the economy has lost some momentum. Growth for Q1 is estimated at 0.4%, which represents a some moderation. Over the past four quarters, the UK has averaged...

Read More »A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world’s savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published “Negative Rates: How One Swiss Bank Learned to Live in a Subzero World“: Alternative Bank Schweiz AG late last year became Switzerland’s first bank to comprehensively pass along negative rates to all of its customers. Violating an almost religious precept in the financial...

Read More » SNB & CHF

SNB & CHF