The UK voted to leave the EU. The German and Japanese yield curve is negative out through 15 years. The entire Swiss curve have negative yields. There is little doubt that the US economy was recovering from a soft six-month stretch even before the recent string of data. And even then speculators in the futures market mostly added to foreign currency exposures. In five of the eight currency futures, we track,...

Read More »FX Daily, July 08: US Jobs Data, Little Policy Significance, Swiss Unemployment falls

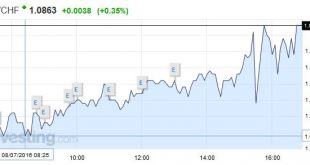

Swiss Franc The Non-Farm Payrolls for June were very positive, even if Marc Chandler is not totally convinced. Good job data in the United States are typically positive for both USD and EUR, because the odds of a rate hike are increasing. Consequently the EUR/CHF rose. In the last two days SNB interventions should have been smaller. The Swiss (seasonally adjusted) unemployment rate fell from 3.5% to 3.3%. Click to...

Read More »Emerging Markets: What has Changed

Political tensions on the Korean peninsula are rising The IMF cut its growth forecasts for South Africa Brazil announced its 2017 budget target In the EM equity space as measured by MSCI, Hungary (+3.0%), UAE (+2.0%), and Qatar (+0.7%) have outperformed this week, while Mexico (-3.4%), South Africa (-2.1%), and Colombia (-1.7%) have underperformed. To put this in better context, MSCI EM fell -1.2% this week while...

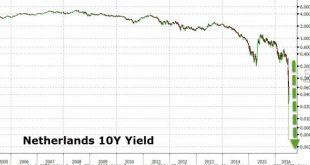

Read More »Going Dutch? Netherlands Joins The 10Y NIRP Club

Netherlands 10Y Yield For the first time in Dutch history, 10Y government bond yields have turned negative (-0.001% intraday) closing at 0.00%… Click to enlarge. Joining Switzerland, Japan, Germany, and Denmark… Pushing Global NIRP bonds over the $13 trillion! Click to enlarge. Chart: Bloomberg

Read More »Swiss Franc Trade-Weighted Index, Performance Far Worse than Dollar Index

The Swiss Franc index is the trade-weighted currency performance 2016: Update On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. Contrary to popular believe, the CHF index gained only 1.73% in 2015. It lost 9.52% in 2014, when the dollar strongly improved. Swiss Franc Index 2009-2012 The CHF Trade-Weighted Index (click link on Unciatrends) shows how the Swissie...

Read More »North American Jobs Report and Implications

There is something for everyone in today’s US jobs report, and at the end of the day, it is unlikely to sway opinion about the direction and timing of the next Fed move. The greenback itself may remain range bound after the initial flurry. On the other hand, the disappointing but noisy Canadian data underscores the risk of a more dovish slant to the central bank’s neutral stance next week. United States Nonfarm...

Read More »Seeking a second medical opinion online

Health insurance premiums are on the rise and reflect soaring healthcare costs. The number of operations performed is among the root causes. Seeking a second opinion online can help cut down on the need for operations. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or...

Read More »Fearing Confiscation, Japanese Savers Rush To Buy Gold And Store It In Switzerland

Japan has pushed further away from being the nation that embraces “Krugman Era” economics and deeper into the new “Bernanke Era” economics of helicopter money. As a result Japan’s citizens have been on a blitz to save what little purchasing power they still possess, before hyperinflation finally arrives. The gold price is up double digits in the past month and as we said last night, something big is coming as Japan...

Read More »Shaking up the chocolate industry

The Swiss chocolate industry is increasingly supporting fair trade practices, which give cocoa farmers in West Africa and South America the chance of a decent wage. A Swiss start-up leads the way. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube...

Read More »Milking robots improve cows’ lives

A farmer in canton Aargau extolls the virtues of his new milking robot, which also feeds his cows and cleans up after them. (RTS/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More » SNB & CHF

SNB & CHF