The American Dream increasingly involves a lease, not a mortgage.

[embedded content]

Sam Zell Sees Surge in Supply of NYC Real Estate

Detroit was once known as a city where a working-class family could afford to own a home. Now it’s a city of renters.

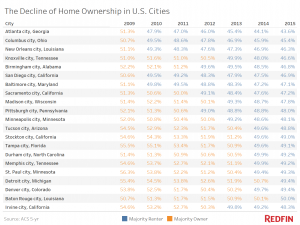

Just 49 percent of Motor City households were homeowners in 2015, down from 55 percent in 2009 and the lowest percentage in more than 50 years. Detroit isn’t alone, of course: The rate of U.S. home ownership fell steadily for a decade as the foreclosure crisis turned millions of owners into renters and tight housing markets made it hard for renters to buy homes. Demographic shifts—millennials (finally) moving out of their parents basements, for instance, or a rising Hispanic population—further fed the renter pool.

Fifty-two of the 100 largest U.S. cities were majority-renter in 2015, according to U.S. Census Bureau data compiled for Bloomberg by real estate brokerage Redfin. Twenty-one of those cities have shifted to renter-domination since 2009. These include such hot housing markets as Denver and San Diego and lukewarm locales, such as Detroit and Baltimore, better known for vacant homes than residential development.

While U.S. home ownership ticked up in the second half of 2016, there are reasons to think the trend toward renting will continue.

Read More »