A History of Money and Banking in the United States:

The Colonial Era to World War II

by Murray N. Rothbard

Edited with an Introduction by Joseph T. Salerno

(Auburn, Alabama: Ludwig von Mises Institute, 2002; 510 pages)

A History of Money and Banking in the United States comprises a collection of essays written by Murray N. Rothbard and compiled and edited by Joseph T. Salerno. It is the most comprehensive and enlightening treatise on the history of money and banking (not only in the United States, but also, to a large extent, in the rest of the world) written to date. In short, this work constitutes the most illuminating historical interpretation, from the perspective of the Austrian school, of the evolution of money and banking over nearly the last 250 years.

Articles by Jesús Huerta de Soto

Who Pays Wealth Tax: The Rich or the Poor?

November 30, 2022The Spanish government’s announcement that it plans to introduce a new “solidarity tax” on the wealth of those who possess over €3 million has again brought to the fore the debate about taxes levied on wealth and capital. The issue is not merely that the announcement is highly politicized in what is already, de facto, a preelection period, nor that it could disrupt the fiscal autonomy of Madrid, Andalusia, and Galicia. (Let us recall that these regions comprise eighteen million Spanish people; that is, almost 38 percent of Spain’s total population.)

Neither must we focus on the possible illegality or even unconstitutionality of the tax due to its potentially confiscatory nature. Nor is the main question the fact that people have already paid taxes (for instance,

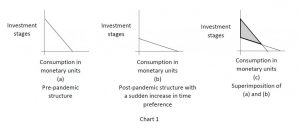

The Economic Effects of Pandemics: An Austrian Analysis

April 3, 2021Traditionally, Austrian theorists have focused with particular interest on the recurrent cycles of boom and recession that affect our economies and on studying the relationship between these cycles and certain characteristic modifications to the structure of capital-goods stages. Without a doubt, the Austrian theory of economic cycles is one of the most significant and sophisticated analytical contributions of the Austrian School. Its members have managed to explain how credit-expansion processes lead to systematic investment errors that result in an unsustainable productive structure. Such processes are advanced and orchestrated by central banks and implemented by the private-banking sector, which operates with a fractional reserve and creates money from nothing

Read More »