A shake-up in interest-rate policy in China promises to cut lending rates and should benefit the broad Chinese economy over time.Over the weekend, the People’s Bank of China (PBoC) announced a major change in its benchmark lending interest rate, establishing a closer linkage between banks’ funding costs and their lending rates.Given the notable decline in short-term market interest rates since last year due to the PBoC’s liquidity injections, this likely will lead to a decline in commercial banks’ effective lending rates, and therefore act as the equivalent to a rate cut.This move addresses one of the key problems in the transmission mechanism of China’s monetary policy and should benefit the real economy. The latest changes in interest rate policy is both part of a long-term structural

Read More »Articles by Dong Chen

BoJ stays put amid economic headwinds

August 7, 2019Japan’s central bank has little room for further easing despite a downbeat outlook.

At its monetary policy meeting on 30 July, the Bank of Japan (BoJ) decided to keep its monetary policy unchanged, as expected. The decision came as the Japanese economy faces strong external headwinds and a downbeat outlook for domestic demand.

However, we do not expect the BoJ to make any changes to its current monetary easing framework until H1 2020 as it has probably reached the limit of its easing capacity. Any possibly changes after that may involve just some minor tweaks in forward guidance and/or adjustment in certain parameters in its yield– curve control.

In our view, the BoJ’s dilemma can to a large extent be attributed to

BoJ stays put amid economic headwinds

August 6, 2019Japan’s central bank has little room for further easing despite a downbeat outlook.At its monetary policy meeting on 30 July, the Bank of Japan (BoJ) decided to keep its monetary policy unchanged, as expected. The decision came as the Japanese economy faces strong external headwinds and a downbeat outlook for domestic demand.However, we do not expect the BoJ to make any changes to its current monetary easing framework until H1 2020 as it has probably reached the limit of its easing capacity. Any possibly changes after that may involve just some minor tweaks in forward guidance and/or adjustment in certain parameters in its yield- curve control.In our view, the BoJ’s dilemma can to a large extent be attributed to the lack of coordination between monetary policies and fiscal policies. In

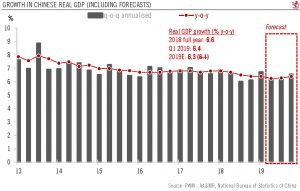

Read More »China: Q2 growth lowest in decades

July 17, 2019Downward pressure on growth persists amid ongoing trade tensions.Chinese real GDP growth came in at 6.2% year-over-year (y-o-y) in Q2, down from 6.4% in Q1, and the lowest quarterly growth in over two decades.The tertiary sector (mainly services) continued to lead growth, expanding by 7.0% y-o-y in Q2, the same as in Q1. In comparison, growth in the secondary sector (mainly manufacturing) declined to 5.6% y-o-y, from 6.1% in the previous quarter.From an expenditure perspective, consumption contributed 3.8% to the 6.2% headline growth in the first half of the year, while capital formation and net exports contributed 1.2% and 1.3% to headline growth, respectively. Lingering impact of deleveraging policies and the damages by the trade dispute will likely continue to create headwinds to

Read More »China: Q2 growth lowest in decades

July 17, 2019Downward pressure on growth persists amid ongoing trade tensions.

Chinese real GDP growth came in at 6.2% year-over-year (y-o-y) in Q2, down from 6.4% in Q1, and the lowest quarterly growth in over two decades.

The tertiary sector (mainly services) continued to lead growth, expanding by 7.0% y-o-y in Q2, the same as in Q1. In comparison, growth in the secondary sector (mainly manufacturing) declined to 5.6% y-o-y, from 6.1% in the previous quarter.

From an expenditure perspective, consumption contributed 3.8% to the 6.2% headline growth in the first half of the year, while capital formation and net exports contributed 1.2% and 1.3% to headline growth, respectively. Lingering impact of deleveraging policies and the

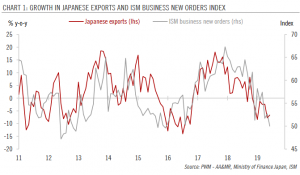

Asian manufacturing sector in contraction

July 11, 2019The latest Asian PMIs point to continued deceleration of growth momentum in the region, but domestic-driven economies are more resilient than export-dependent ones.The average of manufacturing purchasing manager indices (PMIs) for Asia (excluding Japan) came in at 49.6 in June, down from 49.9 in May. This was the second consecutive month in which this measure fell below the 50 threshold and indicates that manufacturing activity in Asia is contracting.China is the largest contributor to the slowdown, but some other export-driven economies, particularly Taiwan and South Korea, have also shown weakened momentum as global demand declines and trade tensions persist.PMIs in domestic-driven economies remain above 50, suggesting continued expansion in economic activity, although momentum also

Read More »Hong Kong unrest

July 11, 2019The extradition bill is ‘dead’ but political turmoil is not over yet.

Since early June, a series of large-scale demonstrations took place in Hong Kong in protest of proposed legislation that would allow extradition of criminal suspects to certain jurisdictions, including mainland China. The proposed bill was triggered by the case of a Hong Kong man who allegedly murdered his girlfriend in Taiwan but could not be sent back for trial in absence of such a legal framework.

The proposed bill met with strong opposition from the public on concerns that it would potentially remove the legal ‘firewall’ between Hong Kong and mainland China, and, by extension, lead to erosion of the rule of law in Hong Kong. Facing strong

China looks to new policies to boost infrastructure spending

June 19, 2019To stabilise growth, the Chinese government will likely put more focus on infrastructure investment. A new policy announced recently could give a further boost to this sector.

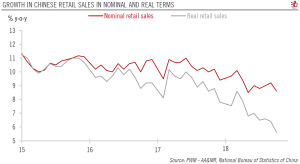

Activity data in May point to continued weakness in Chinese economic momentum, with growth in both fixed-asset investment and industrial production slowing last month. The only positive news came from retail sales, where growth picked up after the slump in April—but this rebound was probably due to seasonal effects. After taking into account special seasonality, growth in retail sales slowed in the first two months of Q2.

In our view, to stabilise growth, the Chinese government will likely put more focus on infrastructure investment going

China looks to new policies to boost infrastructure spending

June 19, 2019To stabilise growth, the Chinese government will likely put more focus on infrastructure investment. A new policy announced recently could give a further boost to this sector.Activity data in May point to continued weakness in Chinese economic momentum, with growth in both fixed-asset investment and industrial production slowing last month. The only positive news came from retail sales, where growth picked up after the slump in April—but this rebound was probably due to seasonal effects. After taking into account special seasonality, growth in retail sales slowed in the first two months of Q2.In our view, to stabilise growth, the Chinese government will likely put more focus on infrastructure investment going forward, given that the collapse in infrastructure investment was one of the

Read More »Weakening Japanese momentum behind strong GDP figures

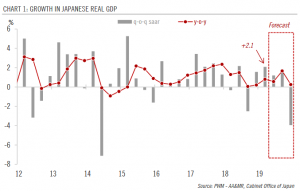

May 23, 2019Japan’s latest GDP report reveals some notable weakness in the economy despite the strong headline figures.

The preliminary reading of Japanese GDP for Q1 shows that the economy grew by 2.1% q-o-q annualised, beating the consensus forecast of -0.2%.

However, behind the strong headline figures, details of the GDP report reveal some broad-based weakening in momentum.

Declining corporate capex and sluggish household consumption both drag on domestic demand.

The seemingly strong net exports in Q1 were the result of a sharp decline in imports, which is unsustainable and points to further downside in exports ahead.

The upcoming consumption tax hike will add more headwinds to growth in Q4.

At this point, our 2019 Japanese

Weakening Japanese momentum behind strong GDP figures

May 21, 2019Japan’s latest GDP report reveals some notable weakness in the economy despite the strong headline figures.The preliminary reading of Japanese GDP for Q1 shows that the economy grew by 2.1% q-o-q annualised, beating the consensus forecast of -0.2%.However, behind the strong headline figures, details of the GDP report reveal some broad-based weakening in momentum.Declining corporate capex and sluggish household consumption both drag on domestic demand.The seemingly strong net exports in Q1 were the result of a sharp decline in imports, which is unsustainable and points to further downside in exports ahead.The upcoming consumption tax hike will add more headwinds to growth in Q4.At this point, our 2019 Japanese GDP forecast remains at 0.8%. Given the elevated trade tensions between the US

Read More »China growth moderates in April

May 17, 2019After a strong first quarter for Chinese growth, signs point to a weaker Q2.Latest hard data indicate that China’s growth momentum moderated in April, after a strong Q1. Industrial activity, fixed investment and consumption all weakened in April.In the context of escalating trade tensions with the US, we expect the Chinese government to step up stimulus measures to support growth in the coming months, especially in the area of infrastructure investment and household consumption.Given the potential increase in policy support, we maintain our 2019 Chinese GDP growth forecast at 6.3% for now.Read full report here

Read More »China: Q1 growth beats expectations

April 21, 2019The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in.

The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest data releases still surprised to the upside. In light of the strong Q1 results and the likely trade agreement between the US and China, we have decided to revise up our Chinese GDP forecast for 2019 to 6.3%, from 6.1% previously.

The better-than-expected Q1 results suggest that the effect of the

China: Q1 growth beats expectations

April 18, 2019The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in.The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest data releases still surprised to the upside. In light of the strong Q1 results and the likely trade agreement between the US and China, we have decided to revise up our Chinese GDP forecast for 2019 to 6.3%, from 6.1% previously.The better-than-expected Q1 results suggest that the effect of the government’s stimulus may have materialised earlier than we had expected (at least

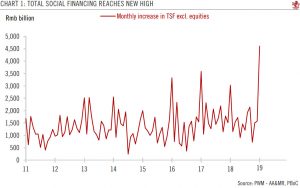

Read More »China: strong credit growth in March again

April 16, 2019Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February, but stimulus to the real economy may not be as strong.Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February. Monthly total social financing (TSF) came in at Rmb2.86 trillion, much stronger than the market consensus forecast of Rmb1.85 trillion. New bank loans also surprised on the upside at Rmb1.69 trillion, compared with the consensus forecast of Rmb1.25 trillion. In year-over-year (y-o-y) terms, the outstanding balance of TSF expanded by 10.6%, up from 10.0% in February.The latest data indicate that the slump in the shadow banking sector may have reached a trough, with growth in the main shadow banking sectors starting

Read More »India: RBI cuts interest rate again

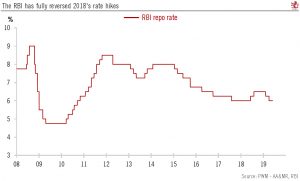

April 8, 2019As widely expected, the Reserve Bank of India announced a cut to its policy interest rate last week. We expect that monetary policy will likely stay accommodative in order to support growth going forward.The Reserve Bank of India (RBI) cut its policy interest rate (RBI repo rate) by 25 basis points (bps) last week, bringing it down to 6.0%. This was the RBI’s second interest rate cut this year under its new governor Shaktikanta Das. With this move, the RBI has fully reversed last year’s rate hikes. Since the change of RBI governor in December 2018, there has been a U-turn in the Indian central bank’s monetary policy to “neutral” from “calibrated tightening”.The latest cut is confirmation of this change, following a previous rate cut in February. The move was widely expected given the

Read More »China PMIs jump in March

April 8, 2019Industrial gauges rebound on seansonality as well as policy easing.

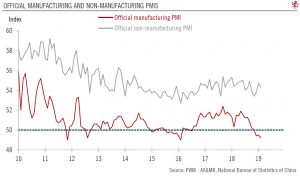

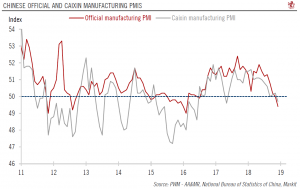

Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0. Details of the PMI survey report generally point to improvement in growth momentum, both on the domestic and external fronts.

While historical data suggest that the March jump in PMI figures could be partly due to seasonality related to the Lunar New Year holidays, the rebound is still encouraging and could suggest a reduced likelihood

China PMIs jump in March

April 2, 2019Industrial gauges rebound on seasonality as well as policy easing.Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0. Details of the PMI survey report generally point to improvement in growth momentum, both on the domestic and external fronts.While historical data suggest that the March jump in PMI figures could be partly due to seasonality related to the Lunar New Year holidays, the rebound is still encouraging and could suggest a reduced likelihood of a further sharp deceleration of the Chinese economy. Since H2 2018, the

Read More »Data remains soft in China

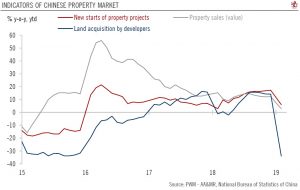

March 20, 2019China’s growth momentum is likely to continue to decelerate before staging a modest rebound in the second half of this year.The latest economic indicators show that Chinese growth momentum remained soft in January and February, consistent with our expectations.Industrial activity was especially weak, weighed down by the mining and utility sectors. Growth in fixed asset investment improved slightly, mainly driven by the acceleration in property investment, but investment in the manufacturing sector declined. However, the strength in property investment is unlikely to be sustained. A broad range of leading indicators suggest that property construction may slow down in the coming months (see chart). At the same time, retail sales growth remains sluggish, indicating soft momentum in the

Read More »More fiscal support as expected but no massive stimulus for China

March 6, 2019The Chinese government set new economic targets and policy announcements for 2019, broadly in line with what we had been expecting.The new economic targets for 2019 and policy announcements are broadly in line with our expectations. They generally reflect Chinese policymakers’ intention to support growth in the face of economic headwinds but to avoid massive stimulus.The target for real GDP growth for 2019 was lowered to a range between 6.0% and 6.5%, from “around 6.5%” in 2018 and 2017, suggesting Beijing is fully aware of the headwinds the economy is facing in the near term.M2 and total social financing (TSF) are expected to grow in line with nominal GDP growth, while monetary policy should remain prudent.Additional tax cuts were announced, as expected. The total reduction in taxes and

Read More »After a slight rebound, Chinese business sentiment falls again

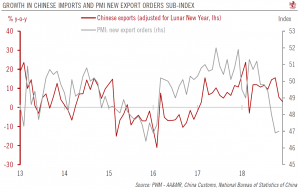

February 28, 2019Latest data point toward continued deceleration in China in February, especially in the external sector.Chinese official manufacturing and non-manufacturing purchasing manager indexes (PMI) fell again in February, following a pause in January. The manufacturing PMI came in at 49.2, down from 49.5 in the previous month. The non-manufacturing PMI, while continuing to signal expansion, also fell in February—to 54.3, from 54.7 the previous month.The data show a divergence between the performances of large enterprises and small- and medium-sized enterprises (SMEs), suggesting that the government’s stimulus so far has mainly benefited the former.After a rebound in January, trade activity remained weak, with the new export and imports orders sub-indexes falling again in February.On the domestic

Read More »China: Credit surges in January

February 19, 2019The PBoC’s policy easing is gaining traction but growth deceleration may continue in H1.China’s credit numbers for January surprised on the upside. The figures show strong credit creation in the first month of the year, especially in corporate bonds and bank bill financing. The contraction in the shadow banking sector has also moderated. This suggests that the PBoC’s monetary easing measures, which started in Q2 2018, are gaining traction.Although this is an encouraging development, we recognise that a significant part of the surge in new credit was due to an increase in short-term credit, while growth in long-term corporate credit is not as strong as the aggregate numbers suggest. In our view, long-term corporate credit is more directly related to real economic activity, especially

Read More »Japan: Q4 GDP disappoints

February 15, 2019Japanese economy expands below expectations, while external uncertainties weigh on outlook.Japanese GDP rebounded by 0.3% quarter-on-quarter (q-o-q) in Q4 (1.4% annualised) after contracting by 0.7% q-o-q in Q3 (-2.6% annualised) due to a series of natural disasters over the summer. In year-over-year (y-o-y) terms, output remained virtually unchanged.Domestic demand was the main driving force for the rebound in Q4, while external demand continued to be a drag.A fairly strong domestic capex cycle is underway in Japan, likely due to the tight capacity constraints. However, if the deterioration in external demand gets much worse, this could derail this positive trend.We have decided to downgrade our Japanese GDP growth forecast for 2019 to 0.8% from 1.0% previously due to softer momentum and

Read More »People’s Bank cuts banks’ reserve requirements, more policy easing ahead

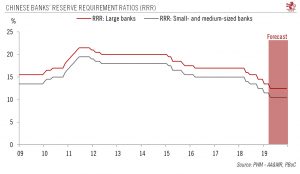

January 8, 2019While the latest move will inject liquidity into the Chinese banking system, more direct stimulus can be expected in a bid to lift China’s slowing economy.The People’s Bank of China (PBoC) announced a further reduction in banks’ required reserve ratios (RRR) on Friday by 1 percentage point. According to the central bank, this round of RRR cuts will inject roughly Rmb800 billion of net liquidity into the banking sector.In our view, this move was partly motivated by the economy’s seasonal liquidity needs before the Lunar New Year (which will occur in early February in 2019). The RRR cuts were also likely motivated by the rapid deceleration in the Chinese economy in the past few months.However, the RRR cuts alone will not be able to halt the economic slowdown in China right away. The

Read More »China manufacturing PMIs enter contraction territory

January 3, 2019Further economic deceleration is expected ahead.The official Chinese manufacturing purchasing manager indices (PMIs) came in at 49.4 in December, down from 50 in November and below the recent trough in early 2016. This brings PMI survey results below the crucial level of 50, entering contraction territory.The sharp deceleration was evident for both large enterprises and small- and medium-sized enterprises (SMEs), with the latter showing more weakness. The official PMI figure for large enterprises came in at 50 in December, compared to 50.6 in November, while it was at 48.4 for SMEs in December, down from 49.1 in the previous month.The decline in headline PMIs was driven by weak demand from both domestic and overseas markets. On the domestic front, the production, new orders and imports

Read More »Chinese export growth slumps

December 12, 2018Net exports likely to be a drag on GDP growth in 2019.Chinese exports decelerated significantly in November, rising by 5.4% year-over-year (y-o-y), down from 15.5% the previous month. The slowdown in Chinese exports was likely a result of the deceleration in both global growth and the tapering of front-loading of exports to the US.Looking forward, we expect Chinese exports to decelerate further, especially in early 2019, just as China honours its commitment to increase purchases from the US, leading to a rebound in US imports. All in all, net exports will likely be a drag on Chinese growth in 2018 and 2019.In the first 10 months of 2018, Chinese held up remarkably well in the light of elevated trade tensions with the US, growing at an average rate of 12.6% y-o-y, compared to 7.9% in

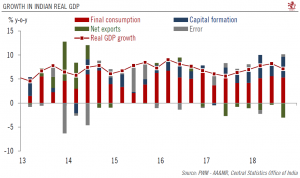

Read More »Indian Q3 growth numbers disappoint

December 5, 2018But leading indicators point to Q4 rebound.Indian GDP in Q3 2018 rose 7.1% year-over-year (y-o-y) in real terms, down from 8.2% in Q2 and significantly below the consensus and our own forecasts of 7.5%. As a result, we have revise down our fiscal year (FY) 2018-2019 GDP forecast for India to 7.2% from 7.6% previously. Our forecast for FY 2019-2020 remains the same, however.In our view, external headwinds, specially surging oil prices, were the main reasons for the downturn in Q3, but domestic activity also posted weak results. In more detail, while growth picked up slightly to 12.4% year-on-year in Q3 from 12.7% the previous quarter, it was dwarfed by the surge in imports, which rose by 25.6% in Q3 from 12.5% in Q2. The dramatic increase in imports was largely driven by the significant

Read More »China hard data for October reveals mixed picture

November 18, 2018Disappointing consumption numbers point to growth deceleration in early 2019, but government measures beginning to be felt.

Hard data out of China for October was mixed. On the positive side, growth in infrastructure picked up, suggesting the government’s fiscal policy easing is taking effect in the real economy. Industrial production numbers stopped declining, and the mining sector has a particularly strong performance.

Growth in fixed asset investment rebounded strongly in October, to 8.1% year-over-year from 6.1% in September. Investment in manufacturing continued to rise, coming in at 9.1% y-o-y in October from 8.7% the previous month.

Consumption continued to disappoint, with retail sales growth declining

China hard data for October reveals mixed picture

November 15, 2018Disappointing consumption numbers point to growth deceleration in early 2019, but government measures beginning to be felt.Hard data out of China for October was mixed. On the positive side, growth in infrastructure picked up, suggesting the government’s fiscal policy easing is taking effect in the real economy. Industrial production numbers stopped declining, and the mining sector has a particularly strong performance.Growth in fixed asset investment rebounded strongly in October, to 8.1% year-over-year from 6.1% in September. Investment in manufacturing continued to rise, coming in at 9.1% y-o-y in October from 8.7% the previous month.Consumption continued to disappoint, with retail sales growth declining further. This is in line with our expectation of a rebound in growth momentum in

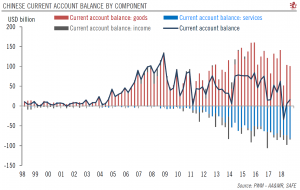

Read More »China’s days of current account surplus may be behind it

November 9, 2018Structural changes may lead to the first current account deficit in over two decades this year.Over the first three quarters of this year, China ran a current account deficit of USD12.8 billion. It looks likely that China will see its first full-year current account deficit in over two decades in 2018.We believe that China’s current account position is going through structural change, driven by two trends. The first is the decline in China’s merchandise trade surplus. Indeed, since reaching a peak in late 2016 at nearly 38% of GDP, exports as a share of GDP has been falling, to below 20% in Q3 2018. The second change is China’s growing trade deficit in services, particularly as a result of outbound tourism and education abroad. There is little sign of either trend abating any time soon.

Read More »