(Disclosure: Some of the links below may be affiliate links) When you retire based on a safe withdrawal rate, you withdraw from your principal month after month. The main risk is that you run out of money before the end of your retirement. The main case when that would happen is if you retire just before a major stock market crash. A bad sequence of returns is a big risk for your retirement. One way to reduce the risk is to reduce the safe withdrawal rate you are using. But that means you will need to accumulate significantly more money. And you may also end up with a lot of money left at the end of your retirement. Another solution that many people wonder about is whether they should hold more cash to protect themselves against that risk. This is exactly what we are going to find out

Topics:

Mr. The Poor Swiss considers the following as important: Financial Independence

This could be interesting, too:

Baptiste Wicht writes A few ways to simplify our life

Baptiste Wicht writes Retire Early: The Simple Guide – I wrote a book

Mr. The Poor Swiss writes 9 Reasons to Aim for Financial Independence

Mr. The Poor Swiss writes How to Open an Interactive Brokers Account in 2021?

(Disclosure: Some of the links below may be affiliate links)

When you retire based on a safe withdrawal rate, you withdraw from your principal month after month. The main risk is that you run out of money before the end of your retirement.

The main case when that would happen is if you retire just before a major stock market crash. A bad sequence of returns is a big risk for your retirement. One way to reduce the risk is to reduce the safe withdrawal rate you are using. But that means you will need to accumulate significantly more money. And you may also end up with a lot of money left at the end of your retirement.

Another solution that many people wonder about is whether they should hold more cash to protect themselves against that risk. This is exactly what we are going to find out today!

I have simulated a few usages of so-called cash cushions in retirement. We will see whether that makes sense or not.

The problem

The main risk in retirement is a bad sequence of returns. If you start your retirement close to a major stock market crash, your portfolio will greatly suffer during the first years. This will make your effective withdrawal rate significantly higher than you planned for. And you risk running out of money much sooner than you wanted!

The main mitigation for this risk is to be more conservative with the withdrawal rate. Lowering your withdrawal rate can make a very significant difference. But lowering your withdrawal rate will also significantly increase the amount of money you need to accumulate before you can retire. In turn, this means you will need to work longer.

Many people believe that having a large cash cushion before you retire would help significantly with the success rate of your portfolio. And they also believe that they will be able to retire earlier with that.

So, let’s see how does a cash cushion performs in retirement.

Simulations

To find, I am going to run simulations of the Trinity Study. For this, I am going to use data from the S&P 500 index for the stocks. And I will use U.S. Treasury bonds for bonds.

I use my own tool to do these simulations. If you are interested in the tool and the data, look at my Updated Trinity Study article. I have added support for cash in my tool for more simulations.

The output of the simulation is the success rate. Success is defined as not running out of money before the end of the simulation. A simulation ending with 1 CHF is a success. And the success rate is the percentage of successful simulations in the set of simulations.

For this article, I have simulated more than 2 million scenarios!

Delay withdrawing from stocks

The simplest idea of a cash cushion is to delay withdrawing from stocks. It means that during the first M months, you are withdrawing from the cash instead of withdrawing from the portfolio.

For instance, if you spend 3000 USD per month, you could accumulate 18’000 USD (M=6) and only withdraw from this money during the first six months. That way, your portfolio would grow the first six months of retirement, which would give it a better chance of success in retirement.

This is a straightforward view of a cash cushion. But it is interesting to start with something small.

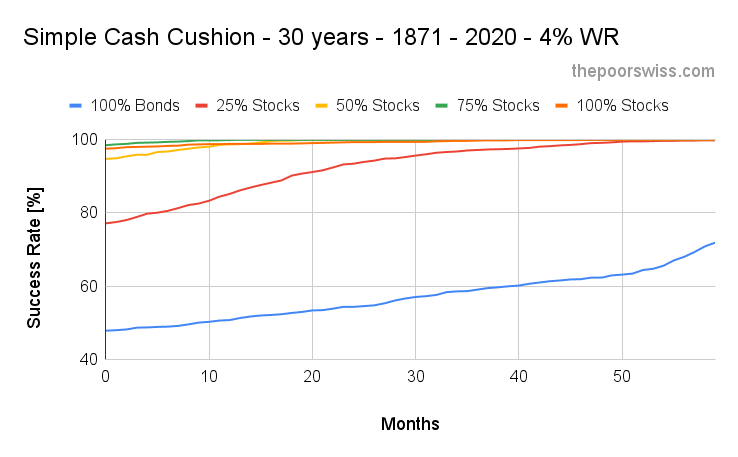

Let’s start with 30 years of retirement and a 4% withdrawal rate. I will simulate adding a cash cushion from 0 months (no cash cushion) to a cash cushion of 60 months.

We can see several things on this graph. First, using some cash first definitely helps the success rate of the different simulations. It can even bring a 25% stocks portfolio from less than 80% to 100% chance of success. However, you would have to accumulate more than 50 months of expenses. This makes a significant difference in how long it will take you to reach financial independence and retire.

Since the chances of retirement with a 100% bonds portfolio are very low, I will remove it from the graph to make it more readable.

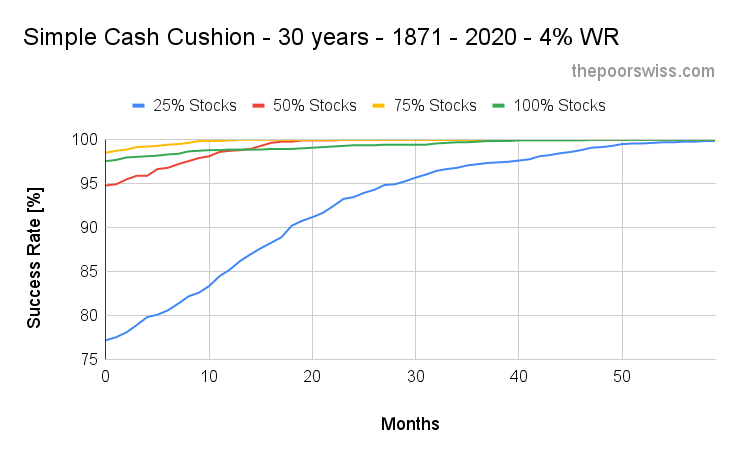

We can see that having a cash cushion helps the 4% withdrawal significantly. However, even a portfolio of 50% of stocks already has a more than 95% chance of success. To see if it makes a lot of difference, we need to see what happens with 40 years of retirement.

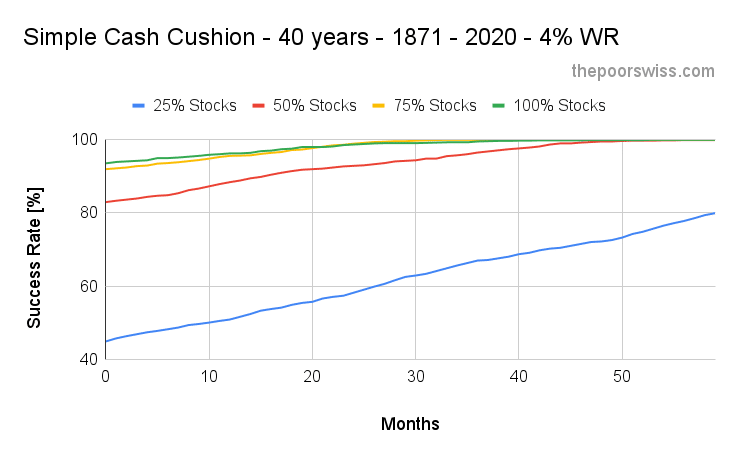

For a 40 year-long retirement, we will have to eliminate the 50% stocks portfolio.

Interestingly, even for 40 years, a simple cash cushion can significantly affect your chances of success. For instance, adding 30 months of a cash cushion to a 75% or 100% stocks portfolio would bring the chances almost up 100%. This could definitely help some people that want to be more conservative.

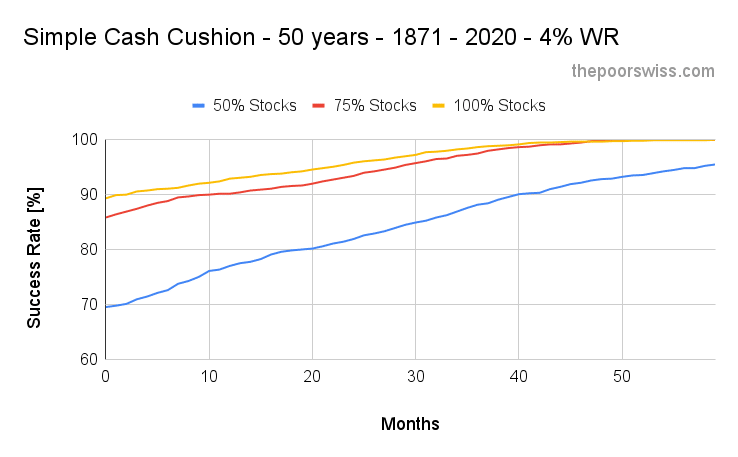

Finally, let’s look at 50 years of retirement.

This time, we can see that it would take at least 40 months of a cash cushion to reach a 100% chance of success with a 4% withdrawal rate and a 75% or 100% stocks portfolio.

Nevertheless, adding a 12 months cash cushion to an aggressive portfolio would give you a few more percent chance of a successful retirement. During that time, the portfolio would grow enough to increase your chances of success.

A smart cash cushion

Before doing these simulations and writing this article, I thought we could have a smarter cash cushion strategy. I was thinking that using the cash cushion during the first M months was not optimal.

My idea was to use the cash cushion based on the current effective withdrawal rate. If this rate was higher than the expected withdrawal rate, we would withdraw from cash, otherwise from the portfolio. However, it turns out that this does not work significantly better than always withdrawing from cash when possible.

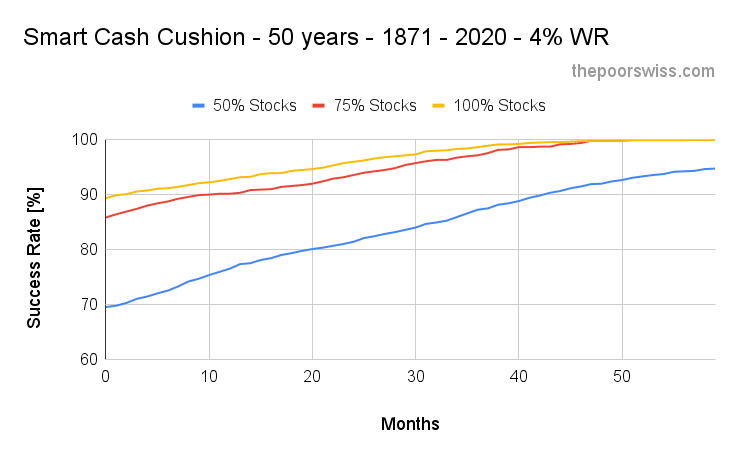

Here are the results for 50 years with the smart cash cushion:

It does not look very different from the previous results. To get a better look, I have put both on the same graph:

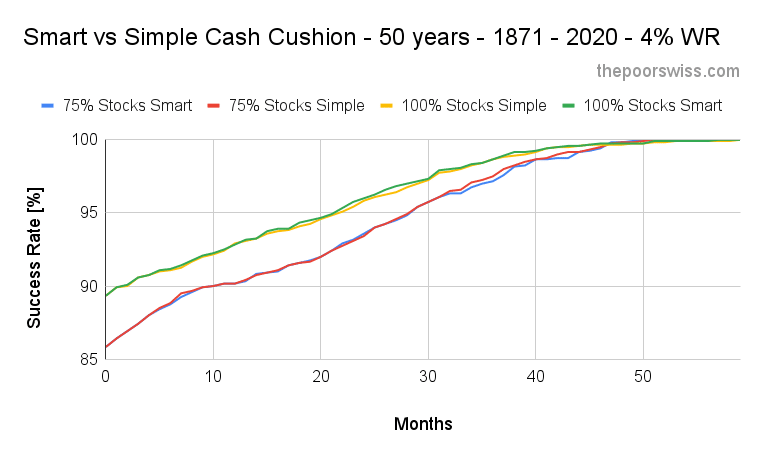

As you can see, the differences between both strategies are minimal. For a small number of months, the small strategy is slightly better. For a large number of months, the simple strategy is slightly better. But given these differences, the simple strategy is definitely better because it is so much simpler and works as well!

Another solution that I have not implemented but should yield similar results is to withdraw only from cash when we are in a sustained drawdown period (a bear market). This should be fairly similar since, in a drawdown, your effective withdrawal rate is significantly higher. The difference would be that we would run through the entire cash cushion during a bear market instead of at the beginning of the retirement. But I do not expect this strategy to work much better.

So, overall, it seems like the strategy of delaying withdrawing the first M months with a cash cushion works best. There is no need for a smarter strategy.

Comparison with a lower withdrawal rate

Accumulating some money in cash next to the portfolio means you have a total net worth higher. And it also that your effective withdrawal based on your total net worth will be lower than your planned withdrawal rate on your portfolio.

In fact, adding some months in cash can be mapped to a different withdrawal rate. For instance, with a 4% withdrawal rate:

- 12 months of cash cushion is about a 3.84% withdrawal rate

- 24 months of cash cushion is about a 3.70% withdrawal rate

- 36 months of cash cushion is about a 3.57% withdrawal rate

- 48 months of cash cushion is about a 3.44% withdrawal rate

- 60 months of cash cushion is about a 3.33% withdrawal rate

So, how does a cash cushion differ from lowering your withdrawal rate? Let’s find out!

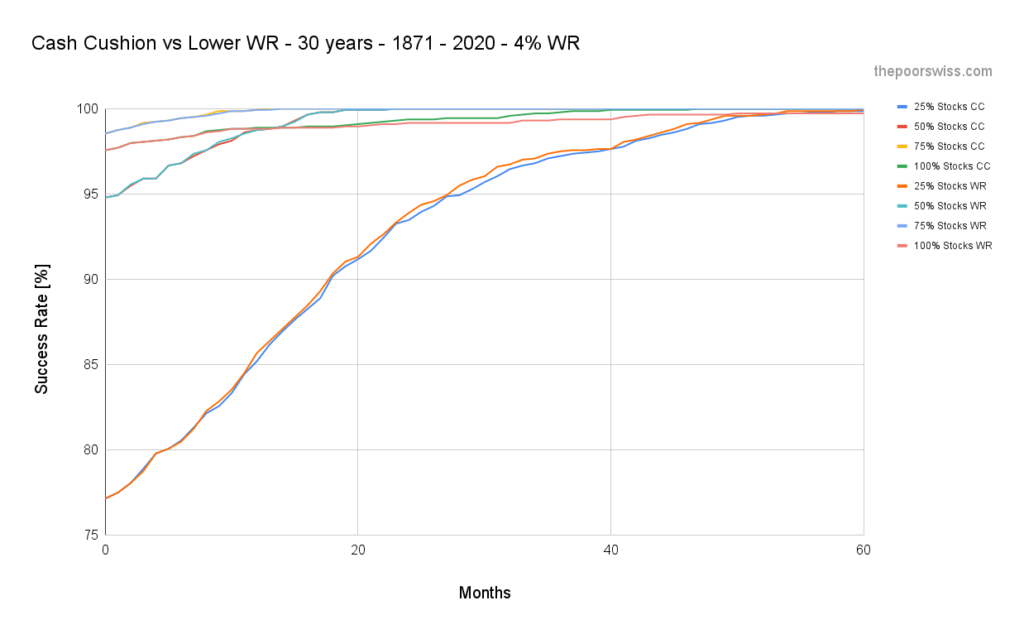

Let’s start once again with 30 years of retirement. We will compare building a cash cushion (CC) of several months against increasing your portfolio by the same amount (WR). Increasing the portfolio has the effect of lowering the WR.

As expected, the difference is not very significant between these two strategies. Nevertheless, we can still see two interesting things:

- For low allocation to stocks, a lower WR is almost always better than having a cash cushion.

- For a high allocation to stocks, a cash cushion is very slightly better than a lower withdrawal rate.

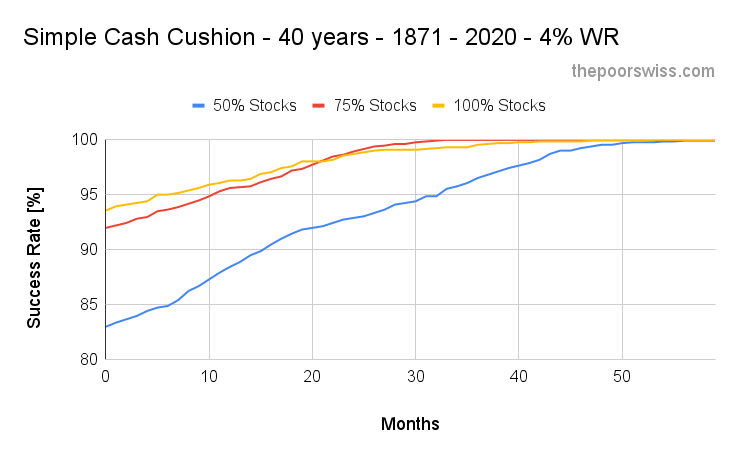

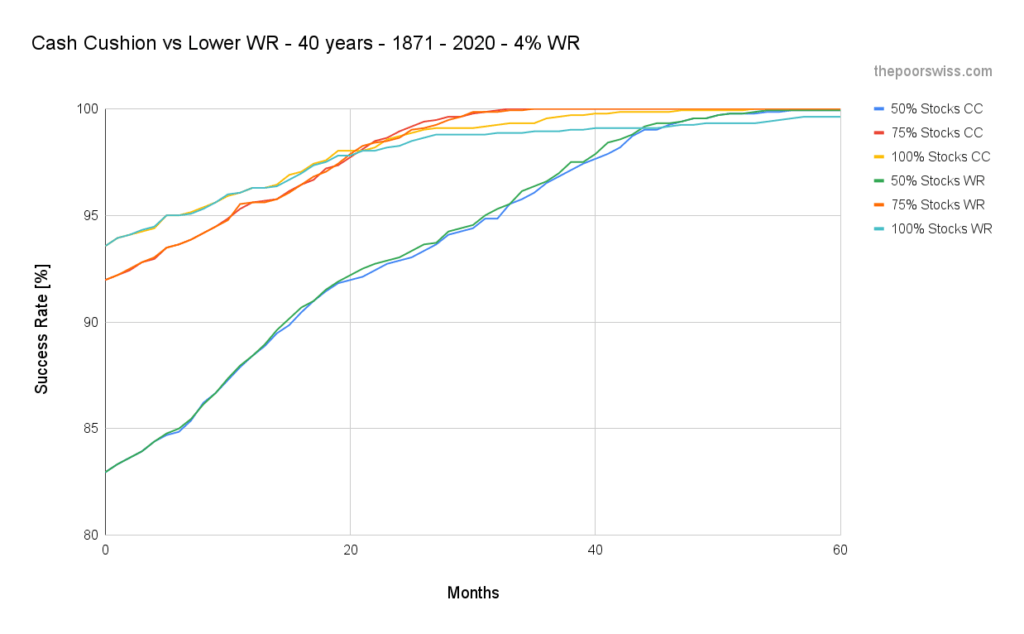

Let’s see if these findings hold true for a 40 years retirement.

Interestingly, we can observe the same threads starting from 20 months of cash accumulated. Before that, the difference is minimal. After 20 months, a lower withdrawal rate is slightly better for a portfolio with 50% in stocks. On the other hand, the cash cushion is slightly better for the portfolio with 100% stocks. The portfolio with 75% stocks works similarly with both strategies.

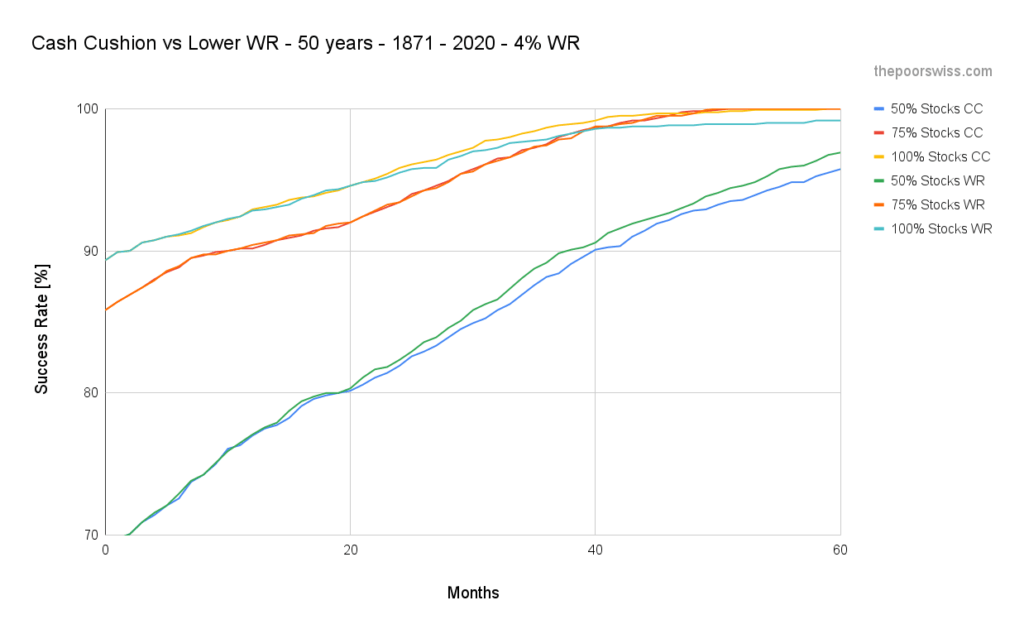

Finally, let’s take a look at what happens with 50 years in retirement.

The difference between the different strategies is not very significant. But we can observe the same trend:

- On the portfolio with 50% stocks, a lower WR has a better chance of success

- On the portfolio with 75% stocks, there is almost no difference

- On the portfolio with 100% stocks, a cash cushion is slightly better than a lower WR but only for more than 20 months in a cash cushion

So overall, both strategies have merit. However, it is generally easier to accumulate money in a portfolio than in cash. Indeed, the money you add to your portfolio will compound, while the money you accumulate in cash will not.

Conclusion

Overall, there is no very significant advantage in having a cash cushion in retirement. Having a simple cash cushion to delay withdrawing will help your chances of success. But overall, it performs about the same as adding the same amount of money to your portfolio instead.

Indeed, having some extra cash is very similar to having extra money in your portfolio. This will result in a lower withdrawal rate and a higher chance of success.

So, if you want to increase your chances of success, I would rather recommend delaying your retirement or lowering your withdrawal rate. This makes more sense.

If you are worried about your chances of success, you can read about the different ways to add some margin of safety to your retirement plan.

Do you plan on having