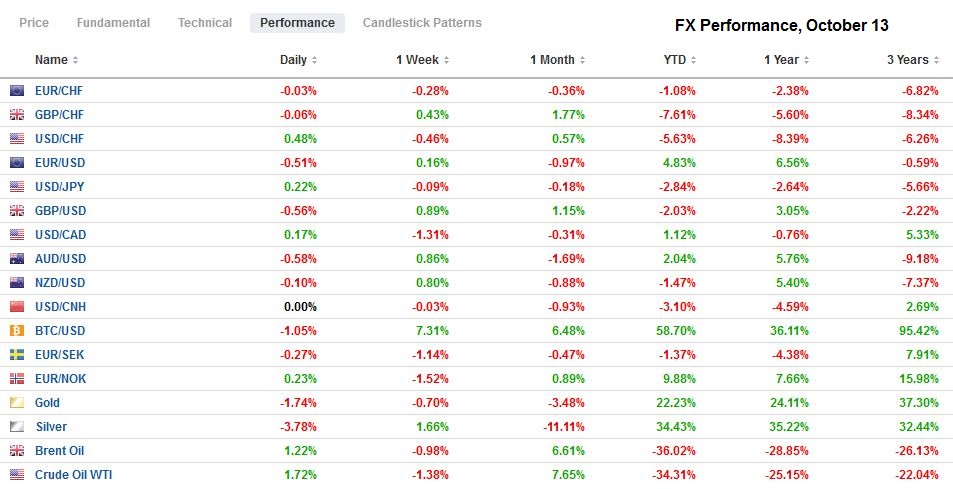

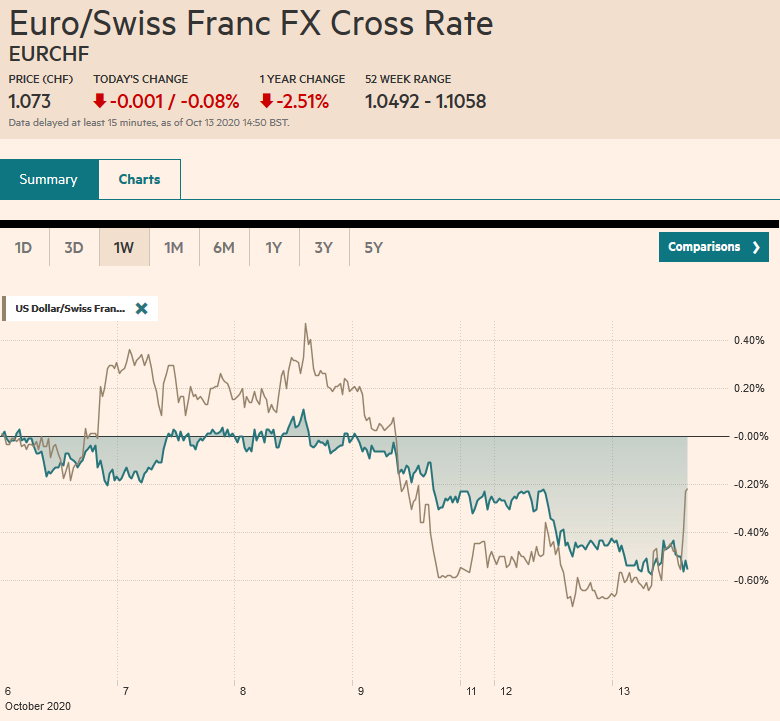

Swiss Franc The Euro has fallen by 0.08% to 1.073 EUR/CHF and USD/CHF, October 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 and NASDAQ gapped higher for the third consecutive session and continued to advance. The benchmarks reached their best level since early September. Hong Kong markets were closed due to a storm, but the MSCI Asia Pacific gained for the seventh consecutive session. Most markets were higher, though Taiwan and South Korea were exceptions. European stocks are struggling a bit, and the consolidative tone is threatening to end the three-day advance. European yields are softer, and the peripheral yields are slipping to new record lows, and premiums over German continue to

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Brexit, Currency Movement, Featured, newsletter, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.08% to 1.073 |

EUR/CHF and USD/CHF, October 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The S&P 500 and NASDAQ gapped higher for the third consecutive session and continued to advance. The benchmarks reached their best level since early September. Hong Kong markets were closed due to a storm, but the MSCI Asia Pacific gained for the seventh consecutive session. Most markets were higher, though Taiwan and South Korea were exceptions. European stocks are struggling a bit, and the consolidative tone is threatening to end the three-day advance. European yields are softer, and the peripheral yields are slipping to new record lows, and premiums over German continue to narrow. The US 10-year yield is off a couple of basis points, after not trading yesterday to about 0.75%. The dollar is mostly firmer, though the New Zealand and the Swedish krona are a little better. The Australian dollar and euro are off about 0.2%, the most among the majors. Eastern and central European currencies, with the exception of the Turkish lira and Russian rouble, are weighing on the complex of emerging market currencies. After yesterday’s pullback, the Chinese yuan firmed slightly today. Gold is little changed around $1922 an ounce, and oil has steadied, and the November WTI contract is up about 2% to reclaim the $40-a-barrel mark. |

FX Performance, October 13 |

Asia Pacific

China’s trade figures have become among the most high-frequency reports. The September surplus fell to $37 bln from almost $59 bln. The median forecast in the Bloomberg survey was for a $60 bln surplus. The miss was due primarily to imports, which surged by 13.2% (-2.1% in August). Economists had expected less than a 0.5% increase. The imports may have been flattered by inventory building ahead of US sanctions. Imports of integrated circuits rose by more than 28% (~11% in August). Overall, the imports of high-tech products rose by over 20%. Imports from Taiwan rose by 35.8%, South Korea17.2%, and Japan 13.4%. Oil imports were off 14.1% year-over-year, after a nearly 25% drop in August. Exports to the US rose by 20.5% (9.5% in August) while imports from the US rose by a quarter. The bilateral surplus stood at $30.8 bln. More broadly, exports rose 9.9% year-over-year, which just missed the median forecast. Of note, exports of medical instruments rose by nearly 31%, and the category that includes protective masks surged by almost 35%, both of which were less than August.

Japanese bank lending, excluding trusts, slowed last month to 6.2% from 6.6% in August. Deposits rose by 9%, and bankruptcies fell to a 30-year low. These figures likely reflect the winding down of the distribution of government assistance. The percentage of loans guaranteed by private credit companies is estimated to be near 70% (JPY35 trillion) in August. Separately, Prime Minister Suga’s honeymoon proved short, as support for the cabinet slipped 7 percentage points to 55%.

The US dollar is in about a quarter of a yen range below JPY105.50 as it consolidates yesterday’s fall to a six-day low (~JPY105.25). For nearly three weeks, the dollar has been trading on the JPY105 handle with a brief exception on October 2 when it traded a little lower. Yesterday’s high was around JPY105.85. The Australian dollar slipped to $0.7165 before turning better bid in the European morning. It is straddling the $0.7200 area, where an option for A$690 mln expires today. Above there resistance is seen in the $0.7220-$0.7230 area. The PBOC set the dollar’s reference rate at CNY6.7296, which was in line with the bank models. This is seen as a sign, as we suggested, that officials are seeking to slow but not reverse recent yuan gains,

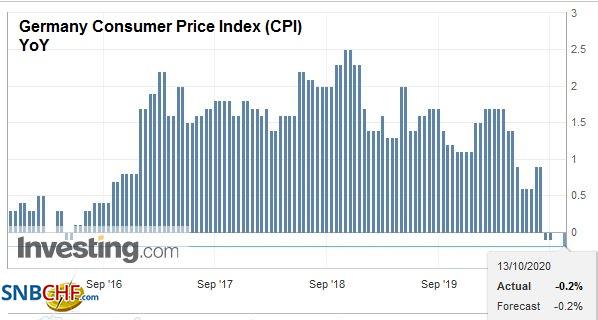

EuropeThe October German ZEW investor survey was a bit disappointing. The expectations component fell more than expected to 56.1 from 77.4. It was the first decline since July and is the lowest since May. The assessment of the current situation improved to -59.5 from -66.2 in September. It is the least negative since March. The survey is important because it is the first inkling into the new month. While BRC sales jumped in September (6.1% vs. 4.7% in August), news of a sharp deterioration in the labor market is more important. The three-month jobless rate jumped to 4.5% from 4.1%, and job cuts rose to 114k in the June-August period, the most since 1995. Employment fell by 153k over the period, five-times more than the median forecast in the Bloomberg survey. |

Germany Consumer Price Index (CPI) YoY, September 2020(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

Access to UK fishing waters has become a larger issue than the direct economics would suggest is necessary. It is one of the few areas the UK has an advantage and is pressing it hard. It has offered a re-negotiated agreement that as a clear sunset provision. Three-quarters of EU fishing catch comes from the UK waters (~650 mln euros), and the UK sends about three-quarters of its catch to the EU. The EU Parliament must approve the agreement, and while French President Macron may be pressing a particularly hardline, the UK has alienated many potential allies.

The UK-EU negotiations are only one of three key challenges facing 10 Downing Street. The surge in the virus has brought new restrictions–the closing of bars and pubs from tomorrow in areas in which Covid is spreading rapidly. The Prime Minister said that the number of cases has quadrupled in the last three weeks. The other issue that is looming is monetary policy. The Bank of England is widely expected to increase its Gilt purchases at next month’s MPC meeting. A rate cut to zero is also possible and would allow the BOE to enrich its forward guidance, which in part has been, “we are not ready yet, but we do not rule out negative interest rates.” The derivatives market suggests the negative rates could come in H2 21. The UK’s T-bills and Gilt tenors out five-years have negative yields, though the current target rate is 10 bp. As of last Tuesday, the weekly Commitment of Traders report showed speculative accounts were next short sterling futures (~11.3k contracts). The gross longs peaked in late August at five-month highs (~54.3k contracts). The report has them at almost 41k contracts. The bears are holding a gross short position of about 52k contracts. They had been almost halved from the summer highs in late July to less than 34k contracts in early September.

The euro is in about a 20-tick range on either side of $1.18, where a 2.7 bln euro option expires today. As was the case yesterday, the single currency continues to trade within the pre-weekend range (~$1.1755-$1.1830). While an extension of today’s range looks likely, it may remain range-bound. More broadly, it has been in a $1.16-$1.20 range since late July. Sterling poked above $1.3080 yesterday, its best level in a little more than a month. The $1.3080 area corresponds to a (50%) retracement of the decline from the September 1 high near $1.3480. It remains within yesterday’s ranges today, holding above $1.30. There are around GBP550 mln in expiring options struck in the $1.2990-$1.3000 area today.

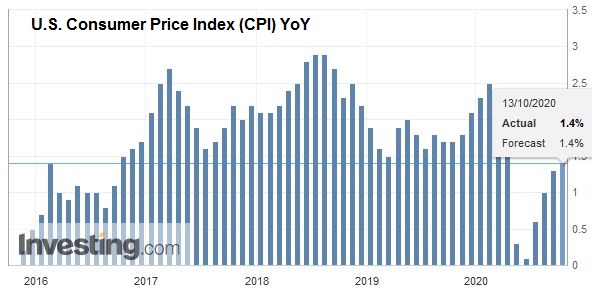

AmericaThe US reports September CPI. The headline rate is expected to tick up to 1.4% from 1.3% in August. It would be the highest since March. Recall that is was at 2.3% at the end of last year. Due to the base effect, the same 0.2% monthly rise would keep the core rate unchanged at 1.7%, which was also the highest since March. The core rate at 2.3% at the end of 2019 and 2.2% at the end of 2018. Before the equity market opens today, JP Morgan and Citi report earnings, and much interest is seen on their loan loss provisions. Note too that Apple makes a product announcement, and Prime Day kicks off. |

U.S. Consumer Price Index (CPI) YoY, September 2020(see more posts on U.S. Consumer Price Index, ) Source: investing.com - Click to enlarge |

Mexico’s August industrial output figures looked stronger than expected, rising 3.3% instead of the 2.4% median forecast in the Bloomberg survey. However, manufacturing was weak. It increased by less than 1%, and the year-over-year fell to -9.2% from -8.9% in July. Mining (drilling) also rose less than 1%. Pemex 10-year yields are over 500 bp premium to the sovereign, which is 8-9-times higher than other leading national oil companies. Construction, encouraged by low-interest rates, picked up some of the slack, rising over 11% in August.

The US dollar slipped to nearly CAD1.3100 yesterday, its lowest level in a little more than a month. It is little changed so far today. Nearby resistance is seen near CAD1.3160. While there is support just around CAD1.3090, but support is seen by CAD1.3040, and then the September 1 low just below CAD1.30. As we have noted, the exchange rate seems more sensitive to risk appetites (S&P 500 proxy) than other market favorites, including the Norwegian krone, the Japanese yen, and the Aussie-yen cross. The greenback is finding support around MXN21.12. It tested resistance seen near MXN21.35 in Europe. A move above there in North American trade could see MXN21.43-MXN21.50. Consolidation is the main feature.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Brexit,Currency Movement,Featured,newsletter,U.K.