– Buy gold for long term as fiat money is doomed warns Frisby– Gold’s “winning streak” will continue in long term– September is traditionally a good month for gold, as we head into the Indian wedding season– “It’s just a matter of time before gold comes good again…”by Dominic Frisby, Money Week Today folks, by popular demand, we’re talking gold. It’s had a nice summer run. What now? Gold Daily, Jul 2010 - Oct 2017(see more posts on Gold, ) - Click to enlarge Gold has been buoyed by the North Korea scareLet’s start with an update. Back in July I suggested a flip trade: buy then in anticipation of a rally, sell in the autumn. But I also ventured that a proper, multi-year bull market in gold, such as the one we

Topics:

Mark O'Byrne considers the following as important: Daily Market Update, Featured, Gold, GoldCore, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| – Buy gold for long term as fiat money is doomed warns Frisby– Gold’s “winning streak” will continue in long term – September is traditionally a good month for gold, as we head into the Indian wedding season – “It’s just a matter of time before gold comes good again…”by Dominic Frisby, Money Week Today folks, by popular demand, we’re talking gold. |

Gold Daily, Jul 2010 - Oct 2017(see more posts on Gold, ) |

| Gold has been buoyed by the North Korea scareLet’s start with an update. Back in July I suggested a flip trade: buy then in anticipation of a rally, sell in the autumn. But I also ventured that a proper, multi-year bull market in gold, such as the one we saw in the 2000s, was a way off.

The price then was $1,230 an ounce. As I write, we’re a couple of dollars shy of $1,340. We’ve had a $110 rally. Aren’t I a genius? So what do we do now? Buy more? Sell? Hold? Let’s have a lively debate. The first observation I’d make is that a good $30 to $40 of today’s price is war premium. A certain North Korean has been firing missiles and exploding bombs. The world has, quite understandably, got nervous. And a certain American has been positing (with some justification) various potential responses on Twitter. Is this North Korean affair going to die down and fade away, or is it going to escalate? |

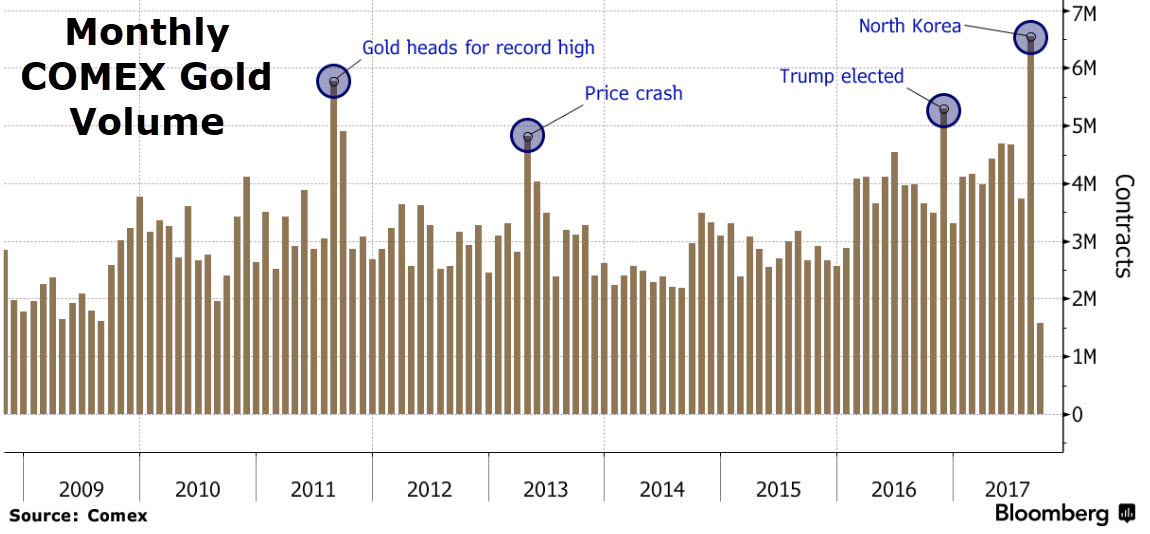

Monthly COMEX Gold Volume, 2009 - 2017(see more posts on Gold, ) |

Regular readers of this column will be aware that I know the answer to most things, but I confess that here I fall short. This is something of which only a select group of informed North Korean insiders will have concrete knowledge.

But how this affair pans out will determine gold’s direction in the short term. If it escalates, gold goes up. If it doesn’t, then that $30 or $40 of war premium will be given back.

I’d wager that this is just noise, albeit rather scary noise, and that it will pass. But this is no more than a guess, and not even an informed one.

Aside from North Korea, over the last 45 years, September has proved a good month for gold, rising by an average of about 2.5%. The given reason for this is that gold buying increases as we head into the Indian wedding season, which runs from October to December. Indians are the biggest buyers of physical metals. About a third of global physical gold demand comes from India, half of which is spent on jewellery for their ten million weddings each year.

However, over the past five years, the reverse has been the case. September has been a bad month for gold with falls averaging around 1.5% for the period. That might be simply because we have been in a bear market. It might be because Indian gold-buying has been upset by various changes in legislation and new taxes, and is down some 10%-15% from the heady heights of 2010 and 2011.

Gold has the potential to roar higher – but it could easily stall, too

I was intrigued by this chart (chart above) from Jordan Roy-Byrne over at the Daily Gold. In the top pane you see the gold price since last 2009. In the bottom one you see the net speculative position of Comex traders.

Currently, the net speculative position has hit 248,000 contracts, which amounts to an open interest of 46%. You can see by the red arrows Jordan has drawn that the 55% marked the 2011 top, the 2012 top and the 2016 top.

If the net speculative position rises to that level from here I would venture that that is a level from which to be selling quite aggressively.

In the longer term, there are constructive things to see in the chart. The 2017 low was higher than the 2015-16 low. Each of the 2017 lows has been higher than the last. However, for me to come out and declare myself a full-blown bull, I’d like to see us break above the 2016 highs around $1,370. For us to make a higher high, in other words.

That high is not far off – only $30. But until that point, I’m going to take the cautious-and-hope-I’m-wrong stance and say we are still trading in a range, and no new multi-year bull market has yet begun.

From a Comex point of view there is room to go higher – gold is hot, but not yet bubbly. From a seasonal point of view there is also room to go higher. The same applies from a trend point of view – and certainly from a Korean point of view.

An ongoing stand-off out east could cause another $30 surge from here. Speculative interest could grow. And this whole thing could run out of steam in a few weeks’ time close at the 2016 highs. That would make my buy-in-July-sell-in-the-autumn call look like genius.

Then again, we might be near $1,450 before speculative interest gets to the scary 55% mark. And that would make for a nice higher high, within a new price-definable bull market.

Finally, on the downside for gold (and the upside for the rest of us), this whole Korean thing could blow over, and with it, this summer’s renewed interest in gold.

I’m hedging my bets as you can guess. My inner trader says take some money off the table now, and leave a bit to ride out the next few weeks. What happens in Korea defines where we go next.

My inner investor, however, says own gold.

Fiat money is doomed. It’s just a matter of time before gold comes good again. But don’t expect to be a millionaire by tomorrow.

Tags: Daily Market Update,Featured,Gold,newslettersent