Bundesbank has completed a transfer of gold worth €24B from France and U.S. Germany has completed domestic gold storage plan 3 years ahead of schedule In the €7.7 million plan, 54,000 gold bars were shipped and audited In 2012 German court called for inspection of Germany’s foreign gold holdings Decision to repatriate from Paris and New York was ‘to build trust and confidence domestically’ 1,236t or 37% of German holdings remain in New York Fed facility Bundesbank wants to hold gold bullion U.S. government declines to audit gold reserves … doesn’t want world to realise gold’s importance in the global monetary system - Click to enlarge Last Monday, U.S. Treasury Secretary Mnuchin feigned to inspect the U.S.

Topics:

Jan Skoyles considers the following as important: Featured, GoldCore, newsletter, Weekly Market Update

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

|

|

| Last Monday, U.S. Treasury Secretary Mnuchin feigned to inspect the U.S. gold reserves in Fort Knox and joked flippantly that he assumed it was there.

A day later the Bundesbank, announced that they had repatriated much of their gold reserves from the U.S. and France. Coincidence or coordination? |

|

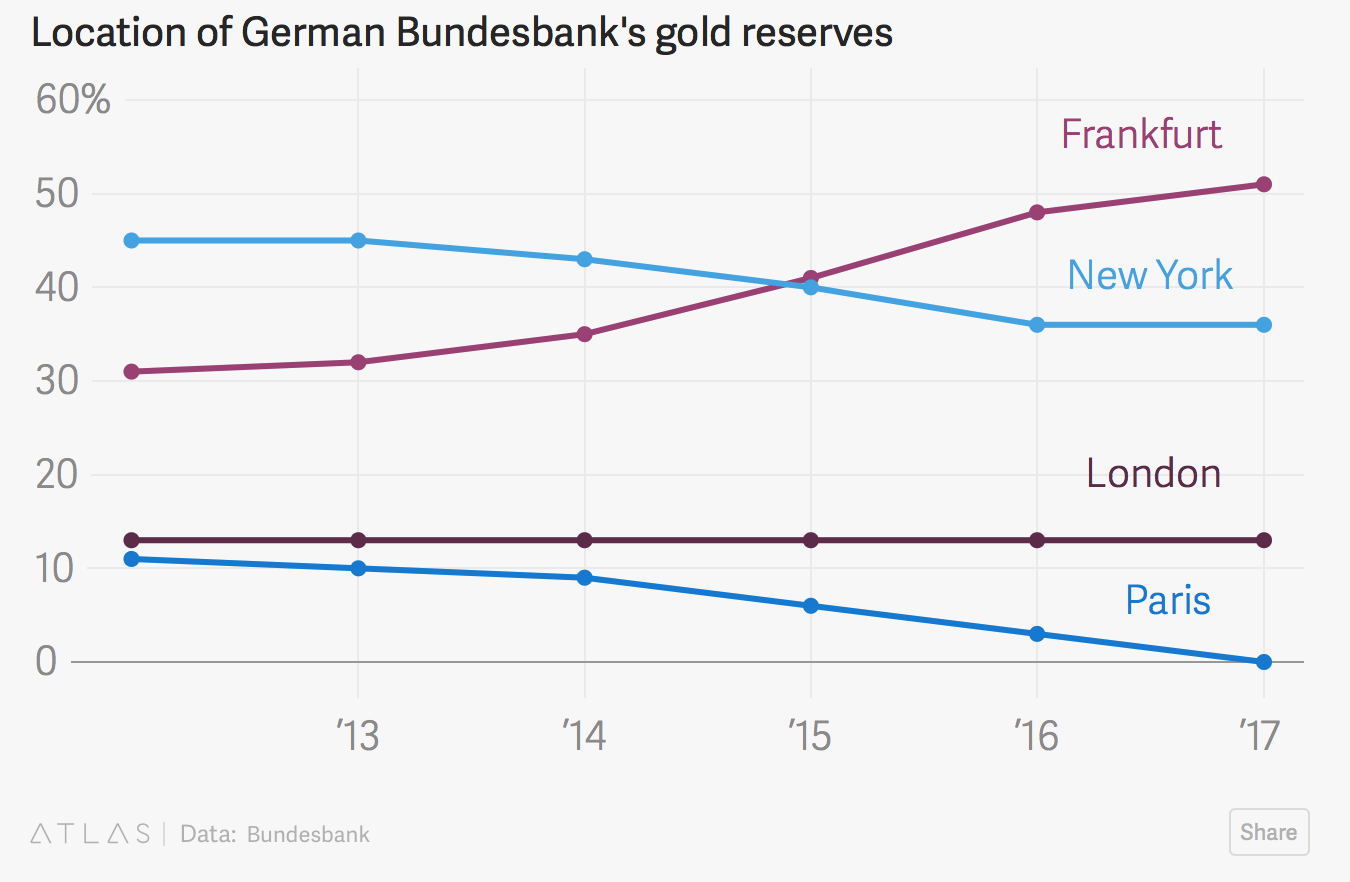

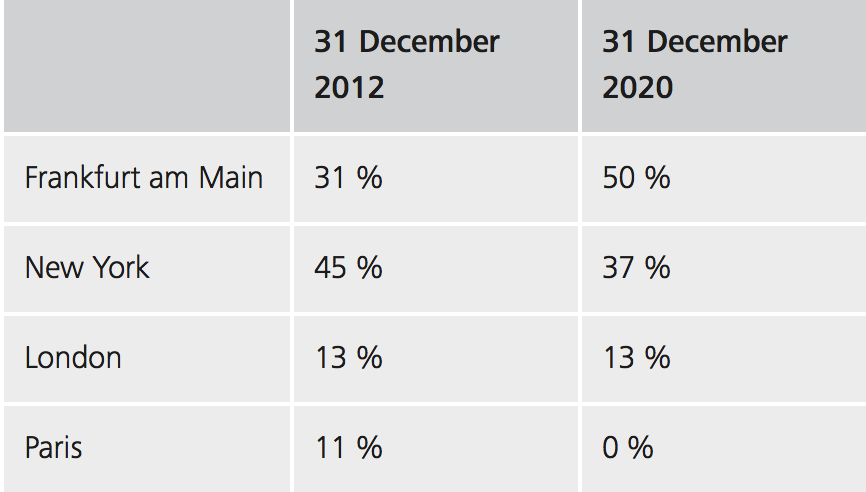

| In 2013 the Deutsche Bundesbank announced plans to store half of its gold reserves in Germany. At the time, only 31% was stored in the country. The Gold Storage Plan involved bringing gold home from both Paris and New York.

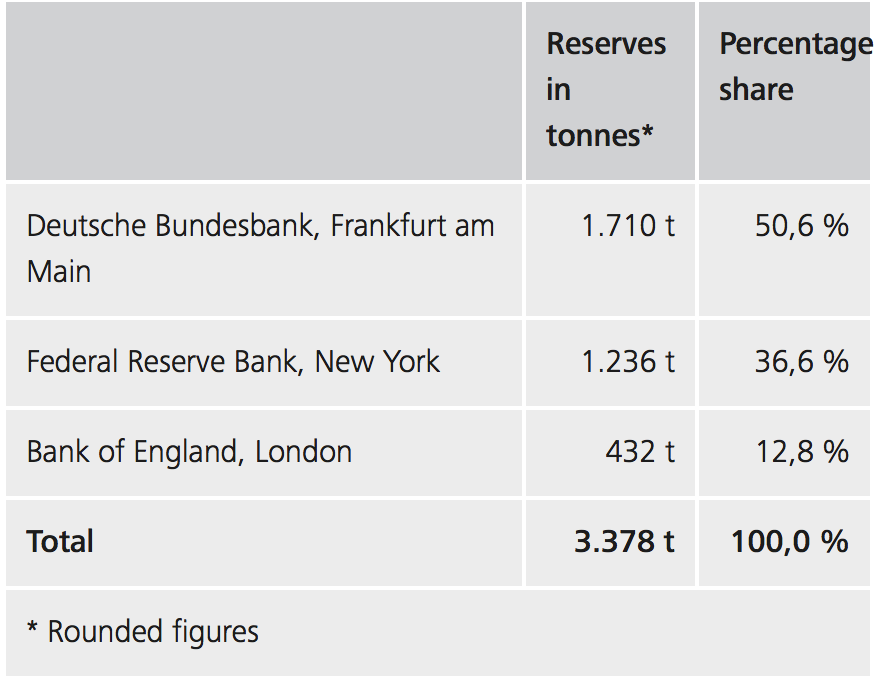

The plan was expected to take seven years. At the time many asked why it would take so long to return just 674t of gold. The Bundesbank has completed the plan three years ahead of schedule. The German gold repatriation was in response to the critics and or in order to safeguard the German gold reserves and ensure they are owned in a safe, allocated and segregated manner by the Bundesbank. In the last five years the German central bank has 374t and 300t from Paris and New York, respectively. The Bundesbank opted to keep 432t in the Bank of England vaults. |

|

| Whilst the tables above (from the Bundesbank) show the repatriation of gold was ultimately successful, it has promoted much discussion about the security of gold in central banks.

The decision to move the gold back to home soil has also vindicated many who have long argued about the murky gold reserve dealings of the United States. |

|

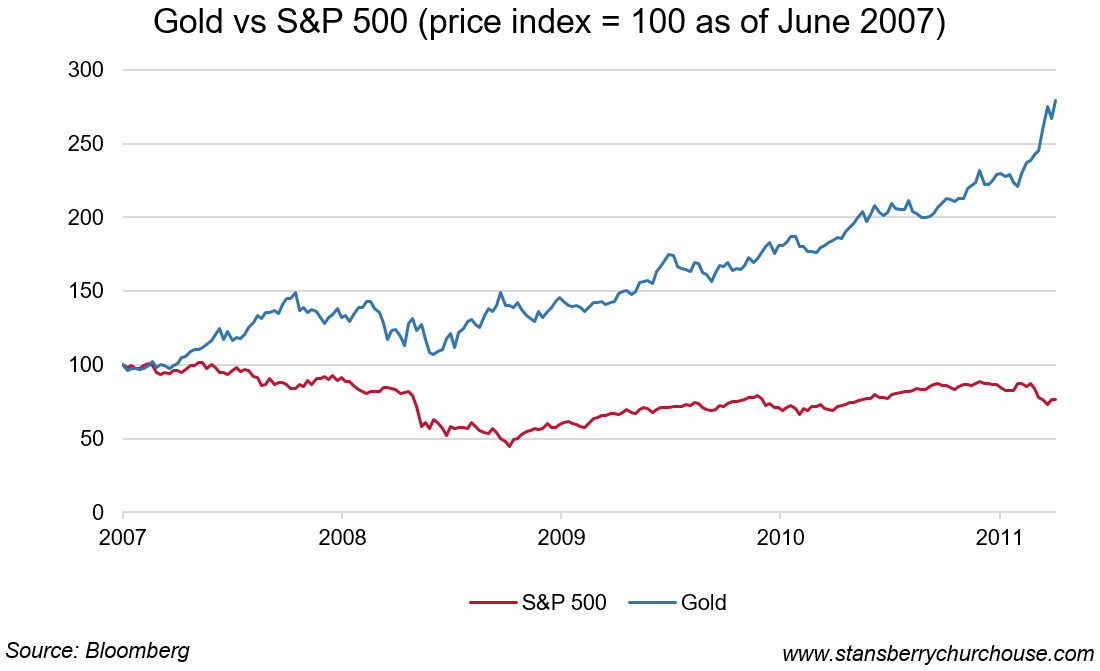

Conclusion: Protect your goldThe move by the Bundesbank was a prudent one, whether there was ever any real cause for concern or not. The fact is the US may well have all the gold that was ever stored there, or they may not. It is also true that the eurozone is near breaking point and the continent is increasingly under threat from various geopolitical forces. It makes sense to have the gold in a place where they can audit and access it. When you own gold you should expect to have access to it whenever you so wish. You should not expect others to have access to it and you should certainly expect to receive regular reports on its existence, security and your outright ownership of individual coins and bars that can be taken delivery of with a phone call. All reports suggest that this was not the case. It suits the majority of countries to avoid pushing the debate on the existence of gold holdings. Should a country like the US be unable to meet requirements when Germany demands its gold back in one go then it could place the two major world currencies (USD and Euro) at risk. The whole world would wonder what farce had been going on all this time. However, Germany clearly wanted their gold back because of concerns about both how the US were looking after it and the future of global stability both politically and financially. Individual investors should take the same approach. The main lesson of note here is that central banks want to own gold. They see it as the ultimate safe haven. Because of this Germany want to hold it in a segregated and allocated manner. Luckily for savers, that secure bullion storage option is readily available. |

Gold vs S&P 500(see more posts on Gold, S&P 500 Index, ) |

Why was the gold abroad and why move it?

Many countries choose to hold proportions of their gold on foreign soil for both security and practical reasons.

Practical reasons as it makes sense to have reserves in diversified locations so you have access to markets should you need to trade the reserves.

In 2013 a Bundesbank spokesman said “we have no intention to sell gold” adding that the decision to relocate the foreign held gold “is in case of a currency crisis.”

This leads on to security reasons. During the Cold War the Bundesbank wanted to keep its gold in the West in case of an invasion from the Soviet Union. It was also a way of supporting the country’s currency knowing there were reserves held securely abroad, should the country need to use them.

Campaigns and concerns in the last decade have made the German population and central bank rethink what the modern security and practical threats are, prompting them to bring some of the gold home.

It was in the wake of the U.S. subprime crisis, the Lehman collapse and then the ensuing eurozone and global debt crisis in 2012, that prompted voices in Germany to call for an audit of the precious metal held abroad.

Campaigners also suspected the gold might have been tampered with or not be fully allocated and non leased. In response to the calls for greater transparency the Bundesbank agreed to hold 50% of the gold in Germany.

When the Bundesbank announced their plans to keep 50% of the gold at home it came just three months after they had defended their reasons for keeping the gold on foreign soil:

‘To function as reserve assets, it would have to be possible for the gold holdings to be exchanged, if necessary, into a commonly used reserve currency without any logistical constraints. That is the reason for storing parts of the gold reserves at partner central banks in other countries.’

Then, in early 2013 the central bank announced:

‘By 2020, the Bundesbank intends to store half of Germany’s gold reserves in its own vaults in Germany. The other half will remain in storage at its partner central banks in New York and London. With this new storage plan, the Bundesbank is focusing on the two primary functions of the gold reserves: to build trust and confidence domestically, and the ability to exchange gold for foreign currencies at gold trading centres abroad within a short space of time.’

It is also worth mentioning that in 2012 the German Court of Auditors ordered an audit of the gold reserves. The court clearly wanted to ensure that the nearly 3,400 tons of gold existed – ‘because stocks have never been checked for authenticity and weight‘.

Why were the Germans worried about the safety of their gold?

Few people have raised eyebrows about Germany’s decision to bring gold back from Paris. The Bundesbank gave the following reason for doing so:

‘Given that France, like Germany, also has the euro as its national currency, the Bundesbank is no longer dependent on Paris as a financial centre in which to exchange gold for an international reserve currency should the need arise. As capacity has now become available in the Bundesbank’s own vaults in Germany, the gold stocks can now be relocated from Paris to Frankfurt.’

However, no specific reason was given for the US, other than the need to ‘build trust and confidence domestically.’

The announcement by the Bundesbank to move 300t of gold from New York sent ripples through the gold community. Many wondered if the plan was expected to take seven years because New York did not have Germany’s gold. Was this where the need to build trust and confidence came from?

More recently, with the election of President Trump, there might have been more cause for concern when it comes to the safety of a country’s gold.

“We have a lot of discussions about (U.S. President Donald) Trump, regarding implications on monetary policy, macroeconomics, etc., but we trust the central bank of the U.S.,” Bundesbank board member Carl-Ludwig Thiele told a news conference in February of this year. But, “Trump has not triggered a discussion about the storage facility in New York.”

The Gold Anti-Trust Action Committee (GATA) and Germany’s homegrown ‘Repatriate our Gold’ movement have been the loudest voices when it comes to concerns over the existence of gold and the nature of that gold’s ownership in the US Treasury’s possession.

In 2017 Sputnik News reported on the successful repatriation of Germany’s gold from the US. In the report, a Russian commentator suggested Germany had received the wrong gold.

Russian economist Vladimir Katasonov, a professor at the International Finance Department at the Moscow State Institute of International Relations, told Sputnik that the U.S. had not been ready to give the bullion back. The professor suggested Germany’s gold bars had been disposed of at the United States’ own discretion.

“There are a lot of signs that the gold was not physically present in the New York vaults when Germany called it back. Of course, the U.S. began to return it to Germany but there is one interesting detail. When you leave your suitcase in the luggage storage, you expect to get back the same suitcase. But Germany took the wrong ‘suitcase,’” Katasonov told Radio Sputnik.

According to the economist, the gold bars that Bundesbank repatriated have different labels. He suggested that the U.S. might have replaced the German bullion with different gold bars bought from the market.

Katasonov explained that the U.S. managed to return the yellow metal thanks to favorable conditions in the precious metal market.

“I think there was a favorable environment in the market and the Americans managed to quickly buy the gold and give it back to Germany. They were not ready for this, but finally managed this replacement,” he concluded.

It is worth mentioning that Carl-Ludwig Thiele told journalists that there were no issues with the gold received, ”We’ve checked every ingot against authenticity, fineness, and weight. We have nothing to complain about.”

Why did it take so long?

The Banca d’Italia, the Bundesbank and the International Monetary Fund make up the three largest gold holders at the New York Federal Reserve. Together they account for over 4,000 tonnes.

However, there has not been (to our) knowledge an audit to confirm that this is the case. There is no evidence these holdings have changed or been audited since the 1970s.

When it came to the 374t to be repatriated from New York many asked ‘If you have the gold why would you not just return it all in one ago, straight away?’ Why was it expected to take seven years? Previously Germany had repatriated 940 tons of its gold from the Bank of England without delays.

Theories abound as to why this could not happen. But they all centre around the theory that the gold is not there or if it is it may have two or more owners in gold leasing arrangements.

This is something we briefly mentioned earlier in the week. The move to repatriate the gold to Germany was partly driven by rumours that much of the gold held offshore may have been “rehypothecated” as suggested by GATA.

In fact, the US has appeared to have repatriated all of the requested gold to Germany three years ahead of schedule.

If the gold not been in the vaults then the US would have had to buy the gold or unravel gold leasing contracts.

Was there reason to be concerned?

Earlier this week we reported on the US Treasury Secretary’s visit to Fort Knox. His jokes about the existence of the gold prompted much coverage about the debate surrounding this very issue.

In response, respected commentator Jim Rickards argued that ‘all the evidence tells me that the gold is in Fort Knox and at West Point.’

‘Let me say it right now: Yes, the gold is there. I actually have some evidence that the gold is there from military sources.’

Now, some people like billionaire precious metals trader Eric Sprott argue that the gold could very well be at Fort Knox, but it’s been leased out to commercial banks. And yes, it could very well be leased. But leasing is a paper transaction. It doesn’t mean the government surrenders possession of the gold.

And what about the lack of audit?

If you are the Fed or the Treasury and you want people to think that gold is unimportant — which they do — why would you audit it?

You audit things that are important. You do not audit things that are unimportant. If the Fed doesn’t want you to think that gold is important, it follows that they would not audit it. Auditing it pays gold too much respect.

I am in favor of an audit, just to be clear. But the fact that the government does not audit the gold does not tell you that the gold is not there. They just do not want you to pay any attention to it.

Audit or no audit, gold or no gold, the fact is the Germans felt the need to bring back some of their gold.

Tags: Featured,newsletter,Weekly Market Update