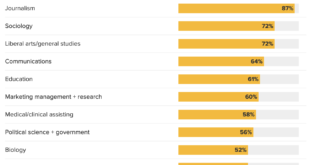

Source: CNBC.

Read More »Jordan Peterson’s “12 Rules for Life”

In 12 Rules for Life, Jordan Peterson argues for the kind of values instilled by a socially conservative parental home: Aim for paradise, but concentrate on today. Meaning is key, not happiness. Assume responsibility. Listen carefully, speak clearly, and tell the truth. And stand straight, even in the face of adversity. Here they are, Peterson’s 12 rules: Stand up straight with your shoulders back Treat yourself like you would someone you are responsible for helping Make friends with...

Read More »Hedge funds: US value strikes back?

Macroview Growth vs. value has been an important theme in long/short hedge fund portfolios--and a recent source of pain for some and profit for others owing to trend reversals this year. Amid slowing growth worldwide, growth stocks have outperformed value both in the US and Europe in the past decade and have been a profitable bet in long/short managers' books. There are some inherent differences in what value stocks represent in the two regions. Looking at the composition of the MSCI US...

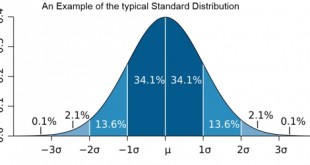

Read More »The Fallacies of Portfolio Volatility Measurements

Standard deviation (sigma σ) measures volatility or the dispersion of random values around the mean of a variable such as a portfolio or individual stock prices, but does not measure the direction of a trend. Standard Deviation as volatility measure What has become the bedrock of finance is an out-of-date almost universally accepted finance theory, which uses the statistical normal distribution (the Gaussian bell curve) as the measure of risk per se. In reality stocks are found not to be...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org