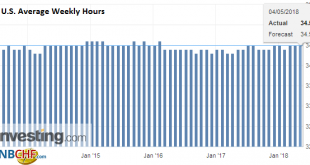

The US jobs report was broadly disappointing. However, the Federal Reserve will look through it and investors should too. A June hike is still by far the most likely scenario. The US created 164k net new jobs in April, and when coupled with the 32k upward revision in March, it was near expectations. The source of disappointment hourly earnings. March’s 2.7% year-over-year pace was revised to 2.6%, and there it remained...

Read More »FX Daily, May 04: US Jobs-Not the Driver it Once Was

The US dollar fell last month in response to the disappointing non-farm payroll report. However, in general, the jobs report is not the market mover that it was in the past. With unemployment is at cyclical lows of 4.1% and poised to fall further. Weekly jobless claims and continuing claims at or near lows in a generation, though over qualification is more difficult than previously. The monthly net job creation is a...

Read More »FX Daily, May 03: Respite to Dollar Short Squeeze

Swiss Franc The Euro has fallen by 0.03% to 1.1944 CHF. EUR/CHF and USD/CHF, May 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Australian dollar is higher for a second session. It has been helped today by stronger than expected data in the form of a larger than expected March trade surplus (A$1.57 bln vs. expectations for A$865 mln) and building permits up...

Read More »FX Daily, May 02: Confident Fed Key to New Found Respect for the Dollar

Swiss Franc The Euro has fallen by 0.03% to 1.1944 CHF. EUR/CHF and USD/CHF, May 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There is a brief respite in the powerful short squeeze that has fueled the dollar’s dramatic recovery. The greenback which was nearly friendless a month ago now has many suitors. It is higher on the year against all the major currencies but...

Read More »FX Daily, May 01: Little Help on May Day

Most of the world’s financial centers are closed for the May Day holiday, but the lack of participation has not prevented the extension of the US dollar’s recovery. The Dollar Index has traded above its 200-day moving average for the first time in a year. No new catalyst has emerged. The widening interest rate differential in the dollar’s favor over Germany, for example, is unprecedented. Just like Fed officials can...

Read More »FX Daily, April 30: Merger Monday

Swiss Franc The Euro stood unchanged at 1.1967 CHF. EUR/CHF and USD/CHF, April 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Three large corporate deals were announced. T-Mobile appears to have finally figured a way to secure Sprint. It is a $26.5 bln equity tie-up. Marathon Petroleum is reportedly taking Andeavor for $20 bln in cash and stock. Sainsbury is...

Read More »FX Weekly Preview: Next Week in Context

A year ago, the Dutch and French elections signaled that UK referendum to leave the EU and the US election of Trump did not usher in a populist-nationalist epoch, such as the one that proceeded the last great financial crisis. The euro gapped higher and did not look back. We have contended that Macron’s victory, in particular, sparked a correction to the euro’s decline that began in mid-2014. Using technical tools, we...

Read More »FX Daily, April 26: Euro Remains Soft Ahead of Draghi

Swiss Franc The Euro has risen by 0.03% to 1.1957 CHF. EUR/CHF and USD/CHF, April 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro made a marginal new low early in European turnover and held barely above the spike low on March 1 to $1.2155. So far, today is the first session since January 11 that the euro has not traded above $1.22. The euro stabilized as the...

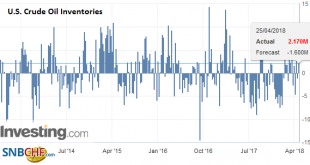

Read More »Oil: Supply and Demand Drivers

Oil prices have recovered more than 50% of the decline since the mid-September peak. The next retracement objectives are found near $82 a barrel for Brent and $76.5 for WTI basis the continuation futures contract. The immediate consideration is that supplies have tightened. OPEC compliance to its agreement has exceeded targets, and Venezuelan output has been halved over the past two years to levels not seen in a more...

Read More »FX Daily, April 25: Dollar Regains Luster, but Consolidation Likely Ahead of Key Events and Data

Swiss Franc The Euro has risen by 0.12% to 1.1984 CHF. EUR/CHF and USD/CHF, April 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge GBP/CHF The Swiss Franc has been weakening recently as global investors appear to be moving away from the safe haven of the Swiss banking system. The US Federal Reserve have continued to increase interest rates during last year and have already...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org