Swiss Franc The Euro has risen by 0.45% to 1.1735 CHF. EUR/CHF and USD/CHF, January 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates As market participants were just getting their sea legs back after the start of the year, it was hit by a one-two punch of ideas that BOJ policy was turning less accommodative and that Chinese officials were wary of adding to their Treasury...

Read More »Cool Video: Bloomberg TV Clip on Central Banks

- Click to enlarge I joined Alix Steel and David Westin on the Bloomberg set earlier today. Click here for the link. In the roughly 2.5 minute clip, we talk about the US and and the monetary cycle in Europe. In the US, Q4 was another quarter of above trend growth. The Atlanta Fed says the economy is tracking 2.7%, while the NY Fed puts it at 4.0%. To my way of thinking about the situation, many observers seem to be...

Read More »FX Daily, January 10: Yen Short Squeeze Extended

Swiss Franc The Euro has risen by 0.31% to 1.1725 CHF. EUR/CHF and USD/CHF, January 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sparked by fears that the BOJ took a step toward the monetary exit by reducing the amount of long-term bonds it is buying, there is an apparent scramble to cover previously sold yen positions. The dollar finished last week near JPY113.00....

Read More »FX Daily, January 09: Dollar Correction Extended

Swiss Franc The Euro has risen by 0.31% to 1.1725 CHF. EUR/CHF and USD/CHF, January 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s upside correction that began before the weekend has been extended in Asia and Europe today. The main exception is the Japanese yen. The yen’s modest gains have been registered despite the firmness in US rates and continued...

Read More »FX Daily, January 08: Dollar Posts Modest Upticks to Start the New Week

Swiss Franc The Euro has risen by 0.04% to 1.1753 CHF. EUR/CHF and USD/CHF, January 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying modest but broad-based gains after trading firmly at the end of last week despite the slightly disappointing jobs report. The dollar’s upticks are understood to be corrective in nature. The Canadian dollar appears...

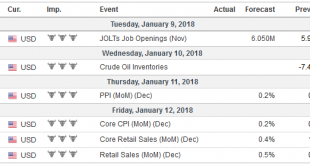

Read More »FX Weekly Preview: Accommodative Officials and Synchronized Upturn Drive Markets

The investment climate is being shaped by two powerful forces. First is the very accommodative policy stance. This includes the United States, where despite delivering the fifth rate hike in the cycle, adjusted by headline CPI, remains negative. The balance sheet has begun being reduced, financial conditions in the US are easier now than a year ago. The ECB’s bond purchase program, which has been cut in half to 30 bln...

Read More »FX Daily, January 05: Dollar Given Reprieve Ahead of Employment Report

Swiss Franc The Euro has risen by 0.04% to 1.1753 CHF. EUR/CHF and USD/CHF, January 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates As the US dollar finished last year, so too did it begin the New Year, and after extending its losses, the bears have paused. Technical factors had been stretched, but it appears to have been old-fashioned macroeconomic considerations to...

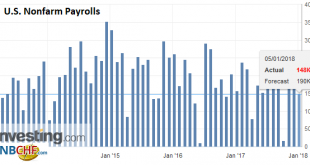

Read More »Headline US Jobs Disappoint, but Earnings as Expected

United States The headline US non-farm payrolls disappointed, rising by 148k instead of the consensus of 180k-200k. However, the other details were largely as expected and are unlikely to change views about the trajectory of Fed policy or the general direction of markets. It is a very much steady as she goes story. The headline miss is not really made up for by the upward revision in the November series from 228k to...

Read More »FX Daily, January 04: Greenback Continues to Consolidate Recent Losses

Swiss Franc The Euro has risen by 0.37% to 1.1755 CHF. EUR/CHF and USD/CHF, January 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is sporting a softer profile across the board, though remaining largely in the ranges seen over the past couple of sessions. At the same time, the news stream suggests that the global synchronized growth cycle strengthened...

Read More »Cool Video: Is the Third Major Dollar Rally Since Bretton Woods Over?

- Click to enlarge To many, the question about the fate of the third major dollar rally since the end of Bretton Woods was resolved last year. The dollar fell broadly. It marked the end the greenback’s ride higher. However, I remain less convinced that this is really the case. And that is what I discuss in this three-minute clip from Bloomberg’s What’d You Miss. What I focused on (here) was two-fold. First, that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org