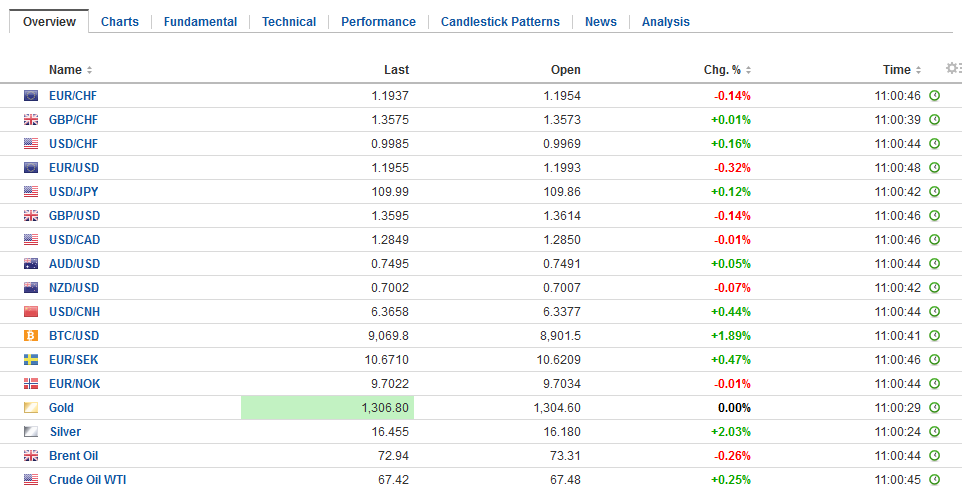

Swiss Franc The Euro has fallen by 0.03% to 1.1944 CHF. EUR/CHF and USD/CHF, May 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There is a brief respite in the powerful short squeeze that has fueled the dollar’s dramatic recovery. The greenback which was nearly friendless a month ago now has many suitors. It is higher on the year against all the major currencies but the yen (~2.6%), the Norwegian krone (~1.6%) and sterling ~0.9%). It is virtually flat against the euro. The contrast between the Federal Reserve, which is likely to confirm its intention to continue to gradually guide US rates higher later today, and the ECB, which sound more cautious than confident,

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, CAD, China Caixin Manufacturing PMI, EUR, EUR-GBP, EUR/CHF, Eurozone Gross Domestic Product, Eurozone Manufacturing PMI, Featured, France Manufacturing PMI, Germany Manufacturing PMI, JPY, newsletter, Spain Manufacturing PMI, U.K. Construction PMI, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.03% to 1.1944 CHF. |

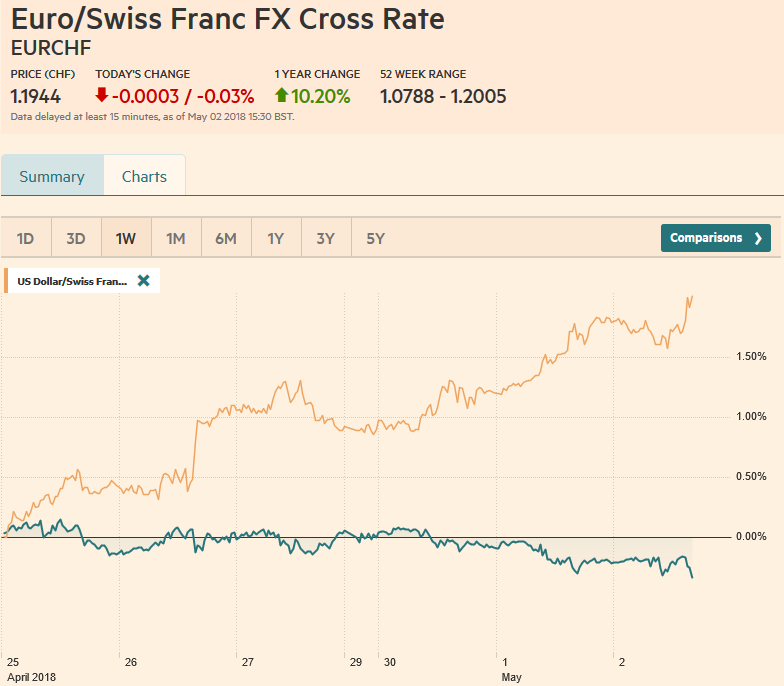

EUR/CHF and USD/CHF, May 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

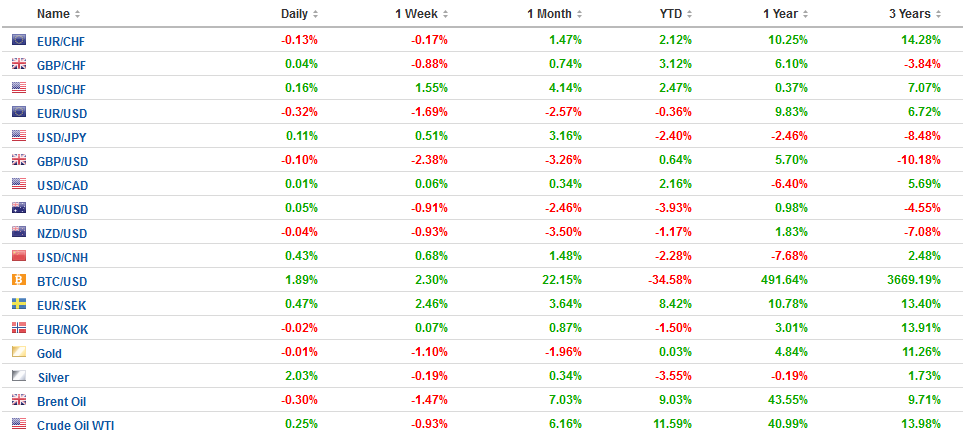

FX RatesThere is a brief respite in the powerful short squeeze that has fueled the dollar’s dramatic recovery. The greenback which was nearly friendless a month ago now has many suitors. It is higher on the year against all the major currencies but the yen (~2.6%), the Norwegian krone (~1.6%) and sterling ~0.9%). It is virtually flat against the euro. The contrast between the Federal Reserve, which is likely to confirm its intention to continue to gradually guide US rates higher later today, and the ECB, which sound more cautious than confident, and the BOJ, which continues to press hard and refuses to even discuss an exit. Then there is the Bank of England, where Carney, and in fairness, some soft data, once again yanked the football away as it was about to be kicked. A rate hike next week now would be more disruptive than standing pat. |

FX Daily Rates, May 02 |

| With the euro straddling the $1.20 level, we note several technical levels converge in the $1.1920-$1.1935 range. There are many with long euro exposures that are trapped from higher levels by the speed of the move. The euro’s recovery to $1.2030 brought in fresh selling. The dollar is knocking on JPY110.00. Above there we see initial potential into the JPY110.50-JPY110.65 area. Sterling is through the neckline of a possible double top (~$1.37), which should offer resistance now. It projects toward $1.30-$1.31 near the 50% retracement of the rally from the flash crash low (on Bloomberg) in October 2016. More immediately, support is seen near $1.3550, a retracement objective of the leg up since last November.

The Australian dollar has recovered from the brief push through $0.7480-$0.7500 area which had held last December. That put the Aussie at its lowest level since last June. It is possible that area corresponds to a neckline of a double top pattern (Sept 2017 and Jan 2018 ~$0.8100). If valid, the would suggest a measuring objective near $0.6850 or where it bottomed in 2016. While the other currencies are trending lower, the Canadian dollar has moved broadly sideways in recent days. With a couple of exceptions, the CAD1.2820-CAD1.2900 has contained the US dollar for the past seven-eight sessions. |

FX Performance, May 02 |

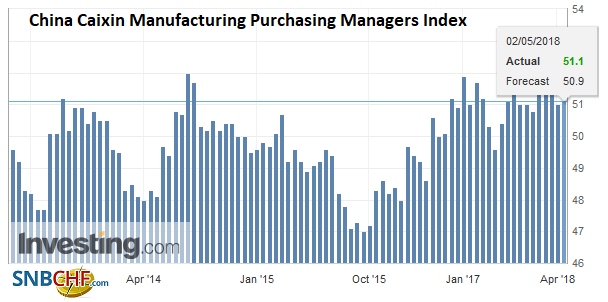

ChinaChina’s Caixin manufacturing PMI ticked up to 51.1 from 51.0. The market had expected a slightly softer report. |

China Caixin Manufacturing Purchasing Managers Index (PMI), May 2013 - 2018(see more posts on China Caixin Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

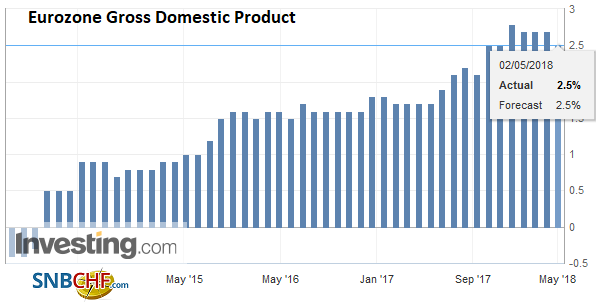

EurozoneThere were several new data points in Europe. The eurozone reported a 0.4% increase in Q1 GDP, in line with expectations, down from 0.6% in Q4 18, and the slowest pace since Q3 16. We suspect that part of the moderation was spurred by transitory factors, like the weather. At the same time, though, we suspect that the cyclical growth momentum peaked last year. This assessment implies better data in Q2. |

Eurozone Gross Domestic Product (GDP) YoY, Nov 2013 - May 2018(see more posts on Eurozone Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

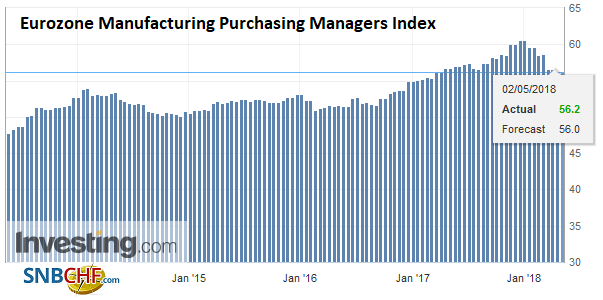

| Lending support to this hypothesis, the April manufacturing PMI for the eurozone was revised to 56.2 from the 56.0 flash reading. It stood at 56.6 in March. |

Eurozone Manufacturing Purchasing Managers Index (PMI), May 2013 - 2018(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

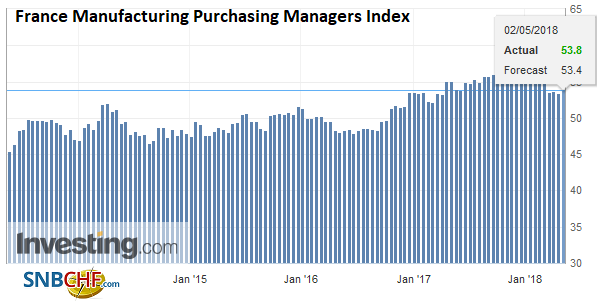

FranceFrance’s reading was revised higher (53.8 vs. 53.4 flash and 53.7 in March). |

France Manufacturing Purchasing Managers Index (PMI), May 2013 - 2018(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

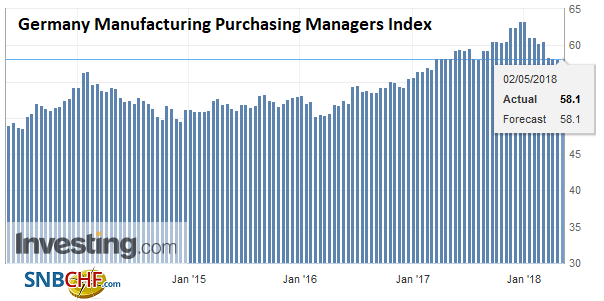

GermanyGermany was unchanged at 58.1 (vs. 58.2 in March). |

Germany Manufacturing Purchasing Managers Index (PMI), May 2013 - 2018(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

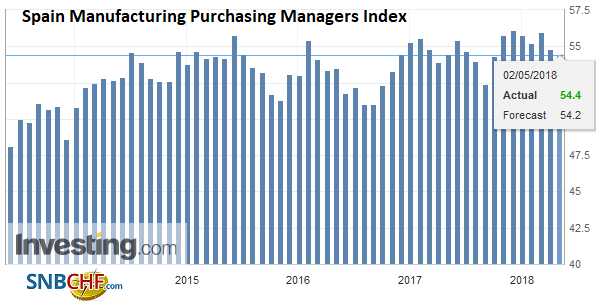

SpainSpain surprised on the upside (54.4 vs. 54.1 expected) but still softer from the 54.8 report in March. Italy was the main disappointment. Its manufacturing PMI fell to 53.5 from 55.1 (54.5 expected). It is the lowest since January 2017. |

Spain Manufacturing Purchasing Managers Index (PMI), Jun 2013 - May 2018(see more posts on Spain Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

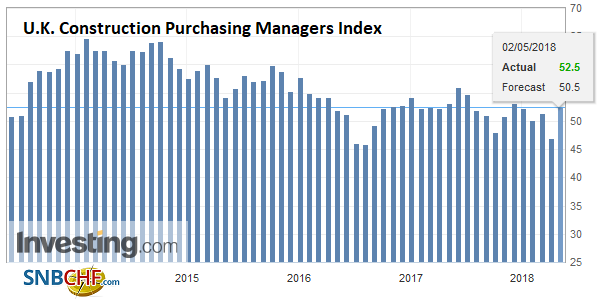

United KingdomThe UK reported stronger than expected April construction PMI. It rose to 52.5 from 47.0 in March. The median forecast in the Bloomberg survey was for a 50.5 reading. Of the three main Markit surveys (manufacturing, services, and construction), today’s covers the smallest part of the UK economy and does little to offset the impact of a recent string of disappointing data. The UK holds local elections tomorrow, and Brexit continues to cast a pall over many issues. The hard exit camp is pushing back against some recent successes of the pro-Europe camp that is pushing to stay in the customs union. |

U.K. Construction Purchasing Managers Index (PMI), Jun 2013 - May 2018(see more posts on U.K. Construction PMI, ) Source: Investing.com - Click to enlarge |

Asia’s economic reports included Japanese auto sales, which rose (0.5%) for the first time since last September. South Korea reported higher April CPI (1.6% vs. 1.3% in March), led by food and transportation. The central bank targets 2%. The core rate, which excludes oil and agriculture, edged up to 1.4% from 1.3%. New Zealand reported a drop in the unemployment rate (4.4% v. 4.5%), to a new nine-year low. The participation rate eased (70.8% vs. 70.9% and was initially 71%), and private sector wages slowed in Q1.

China’s markets re-opened after a two-day holiday. The Shanghai and Shenzhen composites slipped fractionally, but the CSI 300 managed to eke out a small gain. An index of H-shares fell over 1%. The yuan declined by 0.5% and saw its lowest level in more than three months. The PBOC set the reference rate 0.44% lower, which is a little more than the market expected. Some observers seem to be seeing an implicit threat ahead of the talks with a team of senior US Administration officials, led by Treasury Secretary Mnuchin, and including Lighthizer and Navarro.

It is possible, but that is not the most likely interpretation. As of the end of last week, the yuan was at a two-year high against its basket. It would help if the PBOC made the basket more transparent, though Singapore Monetary Authority has a similar practice. The yuan’s decline this week is less than the other reserve currencies in the SDR. That said, the same fundamental and technical considerations behind the dollar’s recovery broadly as also at work against the yuan. These include increase interest rate differentials and market positioning, and the prospects for further dollar appreciation may spur Chinese companies and investors to adjust hedges.

The US ADP private sector job estimate may draw some attention, but it provided poor guidance in March by not giving a warning of the dramatic slowing in non-farm payrolls. Moreover, a disappointing report will also be shrugged off like yesterday’s softer ISM manufacturing reading, which at 57.3 is the lowest since last July. Given the inflation print seen at the start of the week (core PCE deflator 1.9% vs. Fed target of 2%) and the possibility that unemployment and underemployment ticked lower in April, investors have begun discounting a chance for three more rate hikes this year.

We anticipate that the FOMC statement will look through the softness seen in some recent economic readings, including the April Philly and Empire State Fed surveys the disappointing manufacturing PMI. The Fed’s assessment of price pressures will likely be tweaked higher. We have characterized our expectation as a hawkish hold, whereby the Fed does not change policy today but leaves no doubt in the market’s mind about the next moves in rates.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$CAD,$CNY,$EUR,$JPY,China Caixin Manufacturing PMI,EUR/CHF,EUR/GBP,Eurozone Gross Domestic Product,Eurozone Manufacturing PMI,Featured,France Manufacturing PMI,Germany Manufacturing PMI,newsletter,Spain Manufacturing PMI,U.K. Construction PMI,USD/CHF