Swiss Franc The Euro has fallen by 0.03% to 1.1858 CHF. EUR/CHf and USD/CHF, April 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates It had looked to many investors that world was headed for a trade war and an escalating risk war in Syria. But now it seems less clear. US President Trump’s rhetoric on trade took a more constructive tone, and a divided Administration...

Read More »FX Daily, April 11: Mr Market Waits for Other Shoe to Drop

Swiss Franc The Euro has risen by 0.20% to 1.1846 CHF. EUR/CHF and USD/CHF, April 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Between Syria, trade tensions, and the US special investigator into Russia’s attempt to influence the US election, market participants are cautious as they wait for another shoe to drop. The US equity market recovery yesterday has short...

Read More »Understanding the Latest International Reserve Figures

At the end of every quarter, the IMF publishes the most authoritative reserve data with a three-month lag. On Good Friday, the IMF published Q4 17 reserve holdings. A recent article on Bloomberg played up an economist’s forecast that euro reserves would increase by $500 bln over the next couple of years. A review of the reserve data may help us evaluate such a claim, which if true, could have important implications for...

Read More »FX Daily, April 10: XI’s Day, but Not So Good for Putin

Swiss Franc The Euro has risen by 0.25% to 1.1807 CHF. EUR/CHF and USD/CHF, April 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates It did not look so good. The S&P 500 fell about 1.65% in the last couple hours of trading yesterday paring its gains. Press reports indicated that President Trump’s lawyer’s office, house and hotel were the subject of search warrants. A...

Read More »US Jobs Data Optics Disappoint, but Signal Unchanged

The US jobs growth slowed in March more than expected, but the details of the report suggest investors and policymakers will look through it. The poor weather seemed to have played a role. Construction jobs fell (15k) for the first time since last July, and the hours worked by production employees and non-supervisory worker slipped. United States The 103k net new jobs were the least since last September when storms...

Read More »FX Daily, April 09: Asian and European Equities Shrug Off US Decline

Swiss Franc The Euro has risen by 0.10% to 1.1786 CHF. EUR/CHF and USD/CHF, April 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US shares slumped before the weekend amid concern that Trump Administration was prepared to escalate the trade tensions with China. However, cooler heads are prevailing, and there is a recognition that the conflict is still in the posturing...

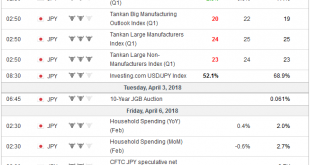

Read More »FX Daily, April 03: Markets in Search of Footing

Swiss Franc The Euro has risen by 0.04% to 1.1754 CHF. EUR/CHF and USD/CHF, April 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The sell-off in US tech shares dragged the market lower. The S&P 500 fell for the sixth session of the past eight and closed below the 200-day moving average for the first time in a couple of years. The sell-off in Asia and Europe is...

Read More »Cool Video: Bloomberg Double Feature

Many are still celebrating the Easter holiday today, but not Tom Keene and Lisa Abramowicz and the Bloomberg team. They hosted me on Bloomberg TV today. As is often the case, the discussion was broad, covering the pressing economic and financial issues. In the first clip, which runs about 2.5 minutes, I sketch out the argument for the US economy being in a late-stage expansion. I cite the 12-month moving average of...

Read More »FX Daily, April 02: Monday Blues

Swiss Franc The Euro has fallen by 0.03% to 1.1746 CHF. EUR/CHF and USD/CHF, April 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar drifted a little lower in Asia to start the week while equities had a slightly heavier bias. The MSCI Asia Pacific Index slipped 0.1%. European bourses are mostly closed for the extended Easter holiday, while the S&P is...

Read More »FX Weekly Preview: The Start of Q2

The chief uncertainty has shifted from monetary policy and macroeconomics to the increase of volatility in the stock markets and the prospects of a trade war. Some of the major benchmarks, including the S&P 500, the MSCI Asia Pacific Index, the MSCI Emerging Markets Index, and Shanghai Composite held above the February lows in the retreat during the second half of March. Other bourses did not. These include the DAX,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org