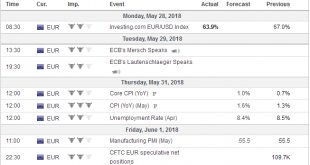

Swiss Franc The Euro has fallen by -0.42% to 1.1485 CHF. EUR-CHF and USD-CHF, May 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets that were in panic mode on Tuesday stabilized yesterday, and corrective forces have carried into today’s activity. However, the underlying issues in Italy and Spain are hardly clarified in the past 48 hours. ...

Read More »FX Daily, May 30: Italian Reprieve, Euro Bounces, Trade Tensions Rise

Swiss Franc The Euro rise by 0.38% to 1.1479 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After what could be described as a 15-sigma event yesterday in the Italian bond market, a reprieve today has seen the euro recover a cent from yesterday’s lows. While the...

Read More »What Happened Monday?

Italian politics dominated Monday’s activity. Initially, the euro reacted positively in Asia to news that the Italian President had blocked the proposed finance minister. A technocrat government would be appointed to prepare for new elections. The euro reversed course by midday in Asia, several hours before European markets opened. The move accelerated and by midday in Europe, with London markets on holiday as well as...

Read More »FX Weekly Preview: Political Crises in Europe Rivals Economic Data and Trade to Drive Capital Markets

The end of the Greek assistance program that allowed them to keep their primarily official creditors whole, and the broad expansion in the eurozone, was supposed to usher in a new period of convergence. Monetary union was once again feted as a success, and some observers were forecasting a substantial increase in the euro as a reserve asset. Instead, the economy lost momentum, core inflation returned to its trough,...

Read More »FX Daily, May 25: US Dollar Loses Momentum Ahead of the Weekend

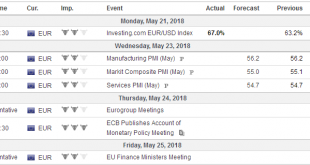

Swiss Franc The Euro is down by 0.63% to 1.1545 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Italian stocks are flat, while most European bourses are higher, with the Dow Jones Stoxx 600 up 0.5% in late morning turnover in Europe. The benchmark is lead by real estate,...

Read More »FX Daily, May 23: Greenback Pushes Lower

Swiss Franc The Euro is down by 0.34% to 1.1601 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is pulling back after recording new highs for the year against the euro and sterling. The greenback is lower against nearly all the major currencies, but the...

Read More »FX Daily, May 24: Greenback Pushes Lower

Swiss Franc The Euro is down by 0.34% to 1.1601 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is pulling back after recording new highs for the year against the euro and sterling. The greenback is lower against nearly all the major currencies, but the...

Read More »FX Daily, May 23: Dollar and Yen Surge, European Data Disappoints

Swiss Franc The Euro is down by 0.53% to 1.1628 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. Italy political drama is has spurred a significant rally in the Swiss franc. Over the past five days, it has been the strongest of the majors, rising 1.1% against the dollar and 1.8% against the euro. Today, it is the only major currency beside the yen that is gaining ground. Italian assets were...

Read More »FX Weekly Preview: Dollar Power

There are several trends in the capital markets at a high-level. The euro and yen’s decline has coincided with sustained rallies in European and Japanese equity benchmarks. Emerging market equities and currencies have been trending lower. There are two other trends that arguably are reinforcing if not causing the other trends. Both oil prices and U0S interest rates have been trending higher. It is unusual but not...

Read More »FX Daily, May 18: EUR/CHF Continues the Collapse

Swiss Franc The Euro is down by 0.54% to 1.1743 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. Reasons are: Weaker than expected euro zone GDP growth in Q1, in particular in Germany. However this “soft-patch” should have been clear to everybody. So it cannot be the main reason. Still the weak German GDP was the trigger for EUR weakness. A dovish European Central Bank. Already at the press...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org