Eurozone Last week the focus was on Europe. Prospects of a delay in Brexit helped extend sterling’s gains to 11-week highs. Disappointing flash PMI for the eurozone and a dovish Draghi pushed the euro below $1.13 for the first time since mid-December. Speculation that the Reserve Bank of Australia would be forced to cut interest rates saw the Australian dollar punch through $0.7100. For its part, the yen was...

Read More »FX Daily, January 23: Markets Walk Tightrope after Yesterday’s US Equity Drop

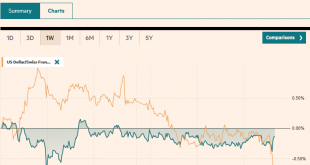

Swiss Franc The Euro has risen by 0.03% at 1.1327 EUR/CHF and USD/CHF, January 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities have fared better than the 1.4% slide in the S&P 500 yesterday may have implied. Asian markets were mixed, with China, Korea, Hong Kong, Thailand advancing. The Dow Jones Stoxx 600 from Europe is a little changed...

Read More »ECB Preview: Worries Increase but Not Quite Ready to Act

The ECB meets Thursday, and it may be best conceived as a transition meeting. It will lay the rhetorical groundwork for two things: a likely downgrade to the staff’s growth forecasts and moving toward a new round of long-term loans (targeted long-term refinance operations). Draghi’s speech last week to the European Parliament anticipated the themes he can be expected to develop in his press conference on Thursday. The...

Read More »FX Daily, January 22: Dollar Consolidates and Equity Rally Stalls

Swiss Franc The Euro has fallen by 0.02% at 1.1328 EUR/CHF and USD/CHF, January 22(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is firmer against most major and emerging market currencies. The yen is a notable exception, and it is firmer, but well within recent ranges. The dollar-bloc currencies and the Norwegian krona are the weakest of the...

Read More »FX Daily, January 21: Chinese Data and UK Brexit Start New Week

Swiss Franc The Euro has risen by 0.12% at 1.1332 EUR/CHF and USD/CHF, January 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Mixed data from China and the anticipation of Prime Minister May’s “Plan B” are the main talking points, while US stock and bond markets are closed today. Asia Pacific equities were higher, while European markets have failed to follow...

Read More »FX Weekly Preview: Things to Watch in the Week Ahead

“The sky is falling. The sky is falling,” they cried, as equities plunged in December. It is signaling a recession, we were told. Instead, global equities have begun the year with a strong advance. The S&P 500 gapped higher ahead of the weekend, extending this year’s rally to about 14%. It has now retraced more than 50% of the decline, not from the December high but from the record high in late September. It has...

Read More »FX Daily, January 17: Risk Assets Underperform as Investors Await Fresh Developments

Swiss Franc The Euro has risen by 0.32% at 1.1319 EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets remain relatively subdued as fresh trading incentives are awaited, including US corporate earnings. Some of the enthusiasm for risk-assets has diminished. The MSCI Emerging Markets Index has stalled after...

Read More »FX Daily, January 15: New Phase Begins with UK Vote

Swiss Franc The Euro has risen by 0.17% at 1.1272 EUR/CHF and USD/CHF, January 15(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Several of the equity benchmarks are flirting with six-week highs, including MSCI Asia Pacific Index and the Emerging Markets Index. The Dow Jones Stoxx 600 is trying to extend its advancing streak for a third week, something not...

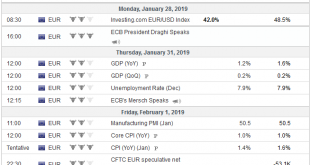

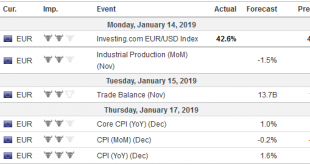

Read More »FX Weekly Preview: Europe Moves to the Center Ring

In recent weeks, the macro story focused on the shifting outlook for Fed policy and the Sino-American trade relationship. There is unlikely to be further progress on either issue in the week ahead. The Fed won’t raise interest rates until toward the middle of the year at the earliest. The government shutdown will limit new readings on the US economy. US and Chinese officials just met. Mid-level Chinese officials can...

Read More »FX Daily, January 09: Equities Continue Recovery, Greenback Remains Heavy

Swiss Franc The Euro has risen by 0.08% at 1.1233 EUR/CHF and USD/CHF, January 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities have extended the New Year rally. The MSCI Asia Pacific Index advanced for the fifth consecutive session and the 10th in the past 11. The Dow Jones Stoxx 600 in Europe is rising for the second consecutive session,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org