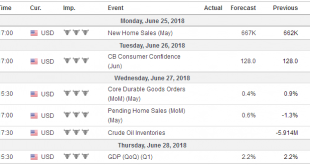

Swiss Franc The Euro has risen by 0.24% to 1.1545 CHF. EUR/CHF and USD/CHF, June 28(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating its gains against most of the major currencies, but the underlying strength remains evident. Several major and emerging market currencies are at new lows for the year, including sterling and the New Zealand...

Read More »FX Daily, June 27: Renminbi Slide Continues and Oil Extends Surge

Swiss Franc The Euro has risen by 0.07% to 1.1542 CHF. EUR/CHF and USD/CHF, June 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly firmer today, though has slipped back below the JPY110 level, as lower yields and equities support the Japanese yen. The main story in the foreign exchange market today is the continued slide in the Chinese renminbi....

Read More »FX Daily, June 26: Trade Tensions and Approaching Quarter-End Cast Pall Over Markets

Swiss Franc The Euro has fallen by 0.08% to 1.1539 CHF. EUR/CHF and USD/CHF, June 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets have stabilized today after yesterday’s rout in equities, softer yields, and US dollar. The implementation of US tariffs on China and China’s retaliatory tariffs on the US is still ten days off. The immediate...

Read More »FX Weekly Preview: Trade Tensions and EU Summit Highlight Q2’s Last Week

We argue there are three major disruptive forces that are shaping the investment climate: the US policy mix in relative and absolute terms, the escalation of trade tensions, and immigration. In the week ahead, trade issues may eclipse the US policy mix, and immigration will compete with the economic and financial agenda at the European heads of state summit at the end of the week. China The People’s Bank of China made...

Read More »FX Daily, June 22: BOE Spurs Dollar Pullback

Swiss Franc The Euro has risen by 0.23% to 1.153 CHF. EUR/CHF and USD/CHF, June 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro and sterling closed above Wednesday’s highs yesterday, and after making new lows for the year, chartists regard the price action as a key reversal and the follow-through buying today confirms it. Although we expected a hawkish hold from...

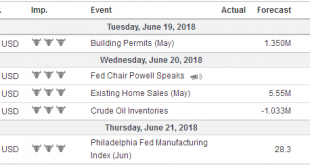

Read More »FX Daily, June 21: Dollar Driven Higher

Swiss Franc The Euro has fallen by 0.27% to 1.1492 CHF. EUR/CHF and USD/CHF, June 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are large options that expire today at $1.1525 (1.2 bln euros) and $1.1550 (1.9 bln). Given the still substantial gross long euro positions in the futures market, it remains an open question of what level would trigger a capitulation. A...

Read More »FX Daily, June 20: Fragile Stability

Swiss Franc The Euro has fallen by 0.03% to 1.1514 CHF. EUR/CHF and USD/CHF, June 20(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The day began out with equity losses in Asia before a sharp recovery, perhaps initiated in China. The MSCI Asia Pacific Index was up a little more than 0.5%. The Shanghai Composite fell more than 1% before closing 0.25% better. Market...

Read More »FX Daily, June 19: America First Clashes With Made in China 2025

Swiss Franc The Euro has fallen by 0.60% to 1.1495 CHF. EUR/CHF and USD/CHF, June 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The escalation of trade tensions between the world’s two largest economies is scaring investors, who are liquidating equities and buying core bonds. The dollar and yen are the strongest of the major currencies. The Swiss franc is mostly steady...

Read More »FX Daily, June 18: Politics and Economics Weigh on European Currencies

Swiss Franc The Euro has fallen by 0.40% to 1.1533 CHF. EUR/CHF and USD/CHF, June 18(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is rising against most of the major and emerging market currencies. The prospects of escalating trade tensions and the divergence of policy that was confirmed by the major central banks are disrupting the markets. Norway’s...

Read More »FX Weekly Preview Warning: Treacherous Week Ahead

All three of the major central banks met last week and confirmed that monetary policy would continue to diverge for at least another year. The clarity of the trajectory of monetary policy reduces the impact of high-frequency economic data. There are three major disruptive forces the make for a challenging investment climate just the same: the US policy mix, trade tensions, and immigration. The mix of tighter monetary...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org