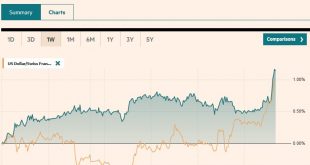

Swiss Franc The Euro has risen by 0.65% to 1.1698 CHF. EUR/CHF and USD/CHF, July 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar has broken out against the Japanese yen. Despite the global equity drop and decline in US yields, which often underpin the yen, the yen fell to its lowest level since early January yesterday and is continuing to sell-off today. The...

Read More »FX Daily, July 11: Escalating Trade Tensions Set Tone for Capital Markets

Swiss Franc The Euro has fallen by 0.06% to 1.1639 CHF. EUR/CHF and USD/CHF, July 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US took the first step in making good its threat to put a 10% tariff on $200 bln of Chinese goods in response to the PRC retaliating for the 25% tariff on $34 bln of its exports. The US provided a list of products that will get the new...

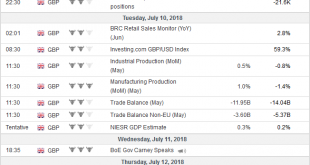

Read More »FX Daily, July 10: May Survives to Fight Another Day, but Sterling’s Recovery Falters

Swiss Franc The Euro has fallen by 0.13% to 1.1632 CHF. EUR/CHF and USD/CHF, July 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro was already trading with a heavier bias, having been turned back after approaching the $1.18 level yesterday. The disappointing Geman survey data encouraged some late longs to be cut, driving the euro to the session low near $1.1715,...

Read More »FX Daily, July 09: Possibility of a Soft Brexit Excites Sterling (too Early?)

Swiss Franc The Euro has risen by 0.17% to 1.164 CHF. EUR/CHF and USD/CHF, July 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a little wobble, sterling has responded favorably to the resignation of the UK Brexit team led by David Davis. The idea is that a path to a softer Brexit is good for sterling. In fairness, it is a bit early to reach this conclusion, and...

Read More »FX Weekly Preview: Macro Considerations for the Capital Markets

The triumphalism that followed the fall of the Berlin Wall nearly three decades ago has evaporated. The Great Financial Crisis and inexorable widening of income and wealth inequalities within countries undermined claims of moral and economic superiority. Liberal democracies are fighting a rearguard action and the rise of illiberal regimes. The president of the country with the strongest military might and largest...

Read More »FX Daily, July 06: Dollar Slips After Tariffs and Before Jobs Data

Swiss Franc The Euro has risen by 0.19% to 1.1629 CHF. EUR/CHF and USD/CHF, July 06(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The first set of US tariffs aims specifically at China were implemented, and the retaliatory actions were also launched. The tariffs cover hundreds of goods, though the initial amount of trade covered is relatively small at $34 bln....

Read More »FX Daily, July 05: Dollar is Mixed on Eve of US Jobs and Tariffs

Swss Franc The Euro has risen by 0.38% to 1.161 CHF. EUR/CHF and USD/CHF, July 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge The US dollar is softer against most of the major currencies and mixed against the emerging market currencies. European currencies firmer, with the continued recovery of the Swedish krona on the back of a more hawkish central bank, and the euro poking...

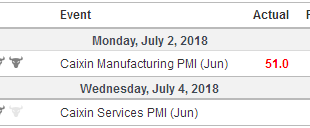

Read More »FX Daily, July 03: Markets Trying to Stabilize

Swss Franc The Euro has risen by 0.03% to 1.1565 CHF. EUR/CHF and USD/CHF, July 03(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets are trying to stabilize. US equities recovered from early losses yesterday but this was not enough to stop Asian equities from extending recent losses. The MSCI Asia Pacific Index slipped 0.2% for the sixth...

Read More »FX Daily, July 02: Third Quarter Begins With a Thump

The window dressing ahead of the end of Q2 failed to signal a turn in sentiment. Equity markets have taken back those gains and more. The US dollar is broadly firmer, though it was coming off its best levels near midday in Europe, and the three-basis-point slippage puts the US 10-year yield at 2.83%, its lowest in more than a month. Investors are wrestling with the implications of escalating trade tensions. The US...

Read More »FX Weekly Preview: Trade and Data Driving Markets

US President Trump is intent on disrupting the post-WWII arrangement that prioritized and ideological conflict over economic rivalries. Last week, it was reported that Trump told his counterparts at the G7 summit that NATO was as bad as NAFTA. NATO’s annual meeting is July 12. Trump seeks a realignment of alliances and appears to prefer the illiberal forces that arisen in recent years. The US Ambassador to Germany was...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org