Swiss Franc The Euro has risen by 0.40% to 1.1576 CHF. EUR/CHF and USD/CHF, June 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge The Dollar Index edged higher to its best level this year before turning down as market attention shifts from central banks to trade tensions. Reports confirm that the US will go ahead with the 25% tariff on $50 bln of Chinese goods and provide some...

Read More »FX Daily, June 14: Dollar Punished Ahead of ECB

Swiss Franc The Euro has risen by 0.43% to 1.1568 CHF. EUR/CHF and USD/CHF, June 14(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge The US dollar is slumping against all the major currencies in the aftermath of the hawkish Federal Reserve. In fact, the inability of the greenback to hold on to the gains scored in the initial reaction to the Fed’s hike, optimism on the economy,...

Read More »FX Daily, June 13: Dollar Edges Higher Ahead of FOMC

The US dollar is trading firmly as the FOMC decision looms. In many ways, the actionable outcome of this meeting has hardly been in doubt this year. By all accounts, the Fed will deliver its second hike of the year today. The question is not so much about the next meeting in August. The Fed has only hiked rates at meetings that a press conference follows. This is the source of one of our persistent criticisms of the...

Read More »FX Weekly Preview: Busy Week Ahead

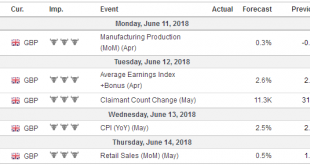

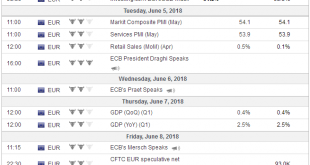

The week ahead is eventful. The Federal Reserve, the European Central Bank, and the Bank of Japan hold policy meetings. This would make for a busy week by themselves, but there is more. Trade tensions are likely to escalate further, if the US, as scheduled provides a list of $50 bln of Chinese goods that will face another 25% tariff for intellectual property violations. If the US does so, China has threatened to retract...

Read More »Europe’s Woes Multiply

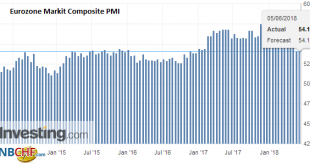

The Markit group that provides many of the PMI surveys noted with today’s reports that the eurozone outlook has “darkened dramatically.” This makes for a poor backdrop for the ECB, which meets next week. However, with price pressures recovering from the Easter-related distortions, the ECB is still on track to finish its asset purchases at the end of the year. This seems largely taken for granted. The real issue is when...

Read More »Greenback Corrects Lower

The consensus narrative is that with rising inflation it is understandable that next week’s meeting is live and that the confirmation of such has lifted the euro to ten-day highs, dragging the dollar broadly. However, to accept this is to accept the debasement of language. Until now, we dubbed central bank meeting that could result in action as “live.” For example, given that the Fed has not changed interest rates since...

Read More »More Color on Japanese Capital Flows and the Euro

The euro put in a low on May 29 a little above $1.15. That is nearly a 10.5 cent decline since the three-year high was set in mid-February. The thing that is difficult for investors and analysts to get their head around is that the speculators in the futures market, who as seen as proxies for trend-followers and momentum traders, continue to carry large euro exposure. Too many observers mistakenly focus on the net...

Read More »FX Daily, June 5: Sterling Jumps Ahead, While US Equities Have Small Coattails

Swiss Franc The Euro has fallen by 0.23% to 1.1526 CHF. EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are several euro options that expire today and are stacked every quarter of a cent from $1.1675 to $1.1750. The size of the options increase with the price beginning with 688 mln euros at $1.1675, then 775 euros at $1.17, 1.1 bln euros...

Read More »FX Weekly Preview: Macro Matters Now, Just Not the Data

The main concerns of investors do not arise from the high-frequency data that are due in the coming days. Last week, the somewhat firmer than expected preliminary May CPI for the EMU failed to bolster the euro. The stronger than expected US jobs data, even if tipped by the President of the United States, and the pendulum of market sentiment swinging back in favor of two more Fed rate hikes this year did not trigger new...

Read More »FX Daily, June 01: Ironic Twists to End the Tumultuous Week

Swiss Franc The Euro has risen by 0.30% to 1.1558 CHF. EUR/CHF and USD/CHF, June 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The week is ending quite a bit different than it began. The main banking concern is not in Italy but in German, where shares in Deutsche Bank shares fell to a record low yesterday, and S&P Global cut its credit rating one step to BBB+...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org