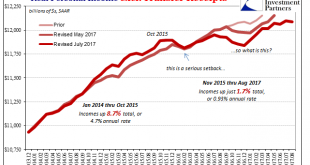

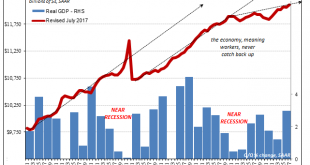

Sometimes economics can be complicated, such as why the labor market has slowed in such lingering fashion since early 2015. Sometimes economics can be easy, such as why there is so much less to the economy this year than thought. The easy part relates to the hard part. The labor market slowed and so did national income. Though so much of official focus is on debt supplementation, it’s always, always about income. US...

Read More »It Was Collateral, Not That We Needed Any More Proof

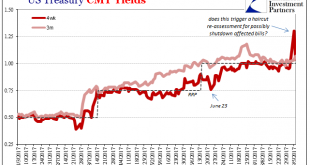

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. US Treasury, Jan - Sep 2017(see more posts on U.S. Treasuries, ) - Click to enlarge Within two days of that move in bills, the GC market for UST 10s had gone...

Read More »Swimming The ‘Dollar’ Current (And Getting Nowhere)

The People’s Bank of China reported this week that its holdings of foreign assets fell slightly again in August 2017. Down about RMB 21 billion, almost identical to the RMB 22 billion decline in July, the pace of forex withdrawals is clearly much preferable to what China’s central bank experienced (intentionally or not) late last year at ten and even twenty times the rate of July and August. The US Treasury Department...

Read More »Retail Sales and the End of ‘Reflation’

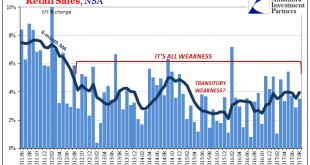

There will be an irresistible urge to the make this about the weather, but more and more data shows it’s not any singular instance. Nor is it transitory. What does prove to be temporary time and again is the upside. The economy gets hit (by “dollar” events), bounces back a little, and then goes right back into the dumps. This, it seems, is the limited extent of cyclicality in these times. Retail sales were again very...

Read More »When You Are Prevented From Connecting The Dots That You See

In its first run, the Federal Reserve was actually two distinct parts. There were the twelve bank branches scattered throughout the country, each headed by almost always a banker of local character. Often opposed to them was the Board in DC. In those early days the policy establishment in Washington had little active role. Monetary policy was itself a product of the branches, the Discount Rate, for example, often being...

Read More »The JOLTS of Drugs

Princeton University economist Alan Krueger recently published and presented his paper for Brookings on the opioid crisis and its genesis. Having been declared a national emergency, there are as many economic as well as health issues related to the tragedy. Economists especially those at the Federal Reserve are keen to see this drug abuse as socio-demographic in nature so as to be absolved from failing in their primary...

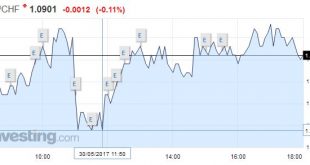

Read More »FX Daily, May 30: Mixed Dollar as Market Awaits Preliminary EMU CPI and US Jobs

Swiss Franc The euro is lower at 1.0901 (-0.11%). EUR/CHF - Euro Swiss Franc, May 30(see more posts on EUR/CHF, ) - Click to enlarge FX Rates With the backdrop of US interest rates unable to get much traction, despite the strong probability of another Fed rate hike in a couple of weeks, the third since last November election, the US dollar mixed today. The chief story today, though, is not the greenback but the...

Read More »FX Daily, August 02: Greenback Slides Despite RBA Rate Cut and 7-year Low in UK Construction PMI

Swiss Franc The euro appreciated against both Swiss Franc and dollar. Swiss retail sales was again very weak, but emphasize our last month comment: The measurement of retail sales (and also GDP) ignore the active second-hand markets in Switzerland. The Swiss SVME PMI was at 50.1 close to contraction, another piece of bad data. Click to enlarge. FX Rates The US dollar is offered against the major currencies, but...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org