Swiss Franc The euro is lower at 1.0901 (-0.11%). EUR/CHF - Euro Swiss Franc, May 30(see more posts on EUR/CHF, ) - Click to enlarge FX Rates With the backdrop of US interest rates unable to get much traction, despite the strong probability of another Fed rate hike in a couple of weeks, the third since last November election, the US dollar mixed today. The chief story today, though, is not the greenback but the euro. The euro is trading heavily for the fourth session. The single currency approached .1270 last Tuesday and approached .1100 today (~.1110 low in late Asian turnover). It recovered to .1160 in the European morning but may struggle to maintain the upside momentum as the market await the return

Topics:

Marc Chandler considers the following as important: EUR, EUR/CHF, Eurozone Consumer Confidence, Featured, France Gross Domestic Product, FX Daily, FX Trends, Germany, Germany Consumer Price Index, Greece, Italy, Japan Household Spending, Japan Retail Sales, Japan Unemployment Rate, JPY, newslettersent, Spain Consumer Price Index, Sweden, U.S. Case Shiller Home Price Index, U.S. Consumer Confidence, U.S. Consumer Spending, U.S. Personal Income, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe euro is lower at 1.0901 (-0.11%). |

EUR/CHF - Euro Swiss Franc, May 30(see more posts on EUR/CHF, ) |

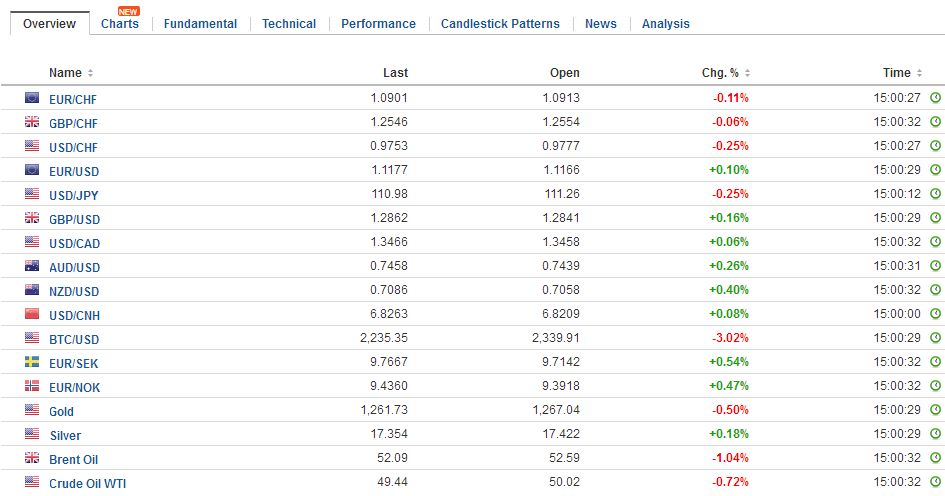

FX RatesWith the backdrop of US interest rates unable to get much traction, despite the strong probability of another Fed rate hike in a couple of weeks, the third since last November election, the US dollar mixed today. The chief story today, though, is not the greenback but the euro. The euro is trading heavily for the fourth session. The single currency approached $1.1270 last Tuesday and approached $1.1100 today (~$1.1110 low in late Asian turnover). It recovered to $1.1160 in the European morning but may struggle to maintain the upside momentum as the market await the return of US participants from the long holiday weekend. Italian assets under performed yesterday. Today, the relative performance is mixed. The debt market and banks shares continue to trade heavily. The 10-year yield is up 10 bp since the end of last week. The two-year yield is up three basis points but is still in negative territory. Banks shares are off for the fourth session, though the FTSE MIB is trying to recover from initial losses. |

FX Daily Rates, May 30 |

| The euro was pulled lower by two main developments: Draghi’s comments to the EU Parliament yesterday and the prospects for an early Italian election. Draghi was clear. While the tail risks have diminished “materially,” the region still requires extraordinary monetary support. The improving economy is necessary but insufficient. The inflation outlook is still not on a self-sustained path toward the target. The removal of the explicit promise to cut rates further if need and/or the adjustment of risk to a more balanced stand would simply confirm what the market already knows.

These expected adjustments to the ECB statement are not the same thing as exiting the unorthodox policies (QE and negative interest rates) anytime soon. That is to say that the Federal Reserve will likely hike rates more than once and begin shrinking its balance sheet by the time the ECB stops its asset purchases (H1 2018?) or have a positive deposit rate. The surprise of the day goes to Sweden. Its Q1 GDP rose half of what was expected, and Q4 16 GDP was revised lower. Growth was estimated at 0.4% in Q1, while the median of the Bloomberg survey was 0.9%. The downward revision trimmed Q4 16 GDP to a still robust 0.7% from 1.0%. The krona is the weakest of the majors, losing about 0.5% against the dollar. The euro had pulled back after testing SEK9.80 last week, its highest level this year. However, it was losing momentum near SEK9.70 and is bouncing off that today. |

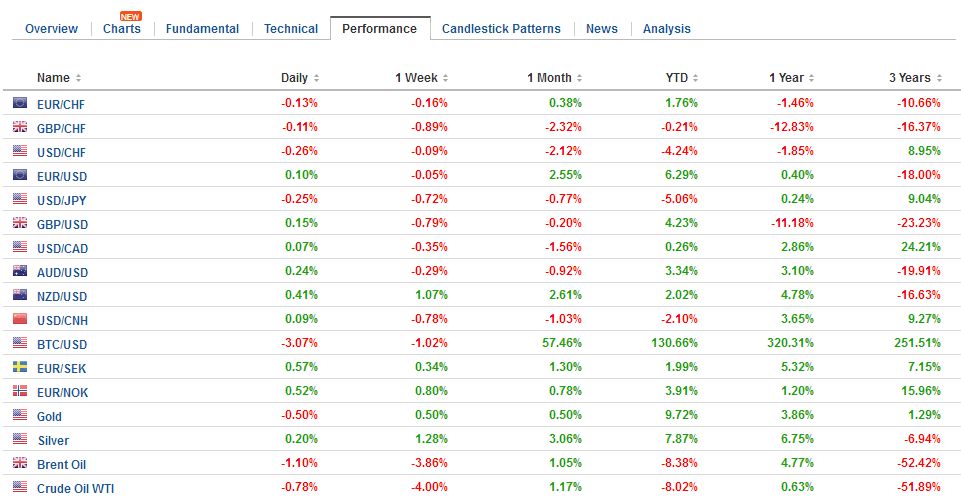

FX Performance, May 30 |

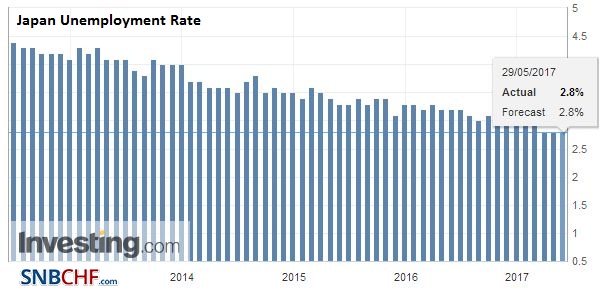

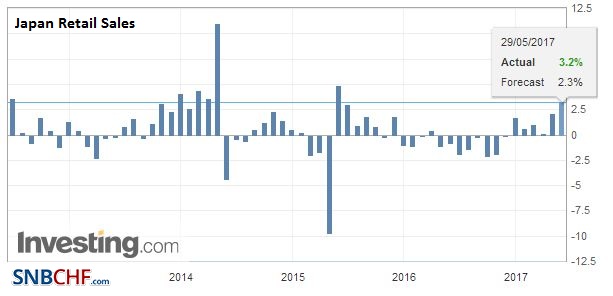

JapanJapan report employment and consumption data. The unemployment rate was unchanged at 2.8% in April. The job-to-applicant ratio jumped to 1.48 from 1.45, which is a bit more than expected. This appears to be a new record high. The tightness of the labor market has not fueled strong wage pressure or consumption. |

Japan Unemployment Rate, April 2017(see more posts on Japan Unemployment Rate, ) Source: Investing.com - Click to enlarge |

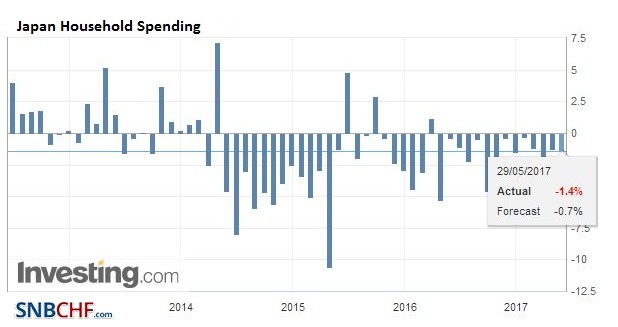

| Overall household spending fell 1.4% from a year ago. The market was looking for improvement after a 1.3% drop in March. The last time overall household spending was higher than a year ago was in February 2016, which itself was the first time since August 2015. |

Japan Household Spending, April 2017(see more posts on Japan Household Spending, ) Source: Investing.com - Click to enlarge |

Japan Retail Sales YoY, April 2017(see more posts on Japan Retail Sales, ) Source: Investing.com - Click to enlarge |

|

The United StatesThe US reports April personal income and consumption data. Personal spending is the key to GDP forecasts, and a 0.4% increase is expected after a flat March. The upward revision to Q1 GDP reported last week was in part due to an improved picture of consumption, and this could be picked up in back month revisions today. The core PCE deflator may tick down to 1.5% from 1.6% but is still not sufficient to reduce the odds of a Fed hike in a couple of weeks. |

U.S. Personal Income, Spending YoY, April 2017(see more posts on U.S. Consumer Spending, U.S. Personal Income, ) Source: Zerohedge.com - Click to enlarge |

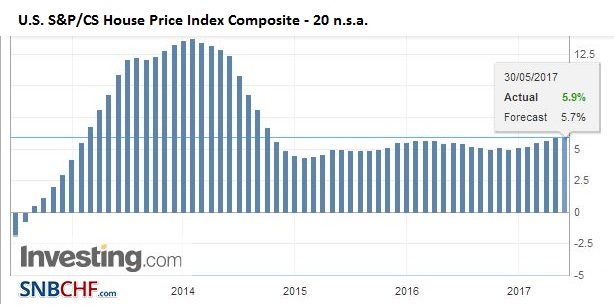

| S&P CoreLogic house prices |

U.S. S&P-CS HPI Composite - 20 n.s.a. YoY. March 2017(see more posts on U.S. Case Shiller Home Price Index, ) Source: Investing.com - Click to enlarge |

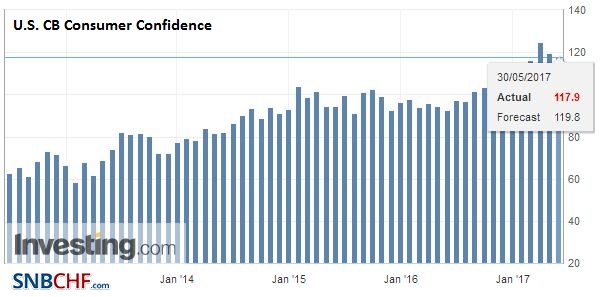

| and the Conference Board’s consumer confidence measure are not the stuff the usually moves the foreign exchange markets. The main economic focus is on this week’s employment data, where solid even if not spectacular report is expected. |

U.S. CB Consumer Confidence, May 2017(see more posts on U.S. Consumer Confidence, ) Source: Investing.com - Click to enlarge |

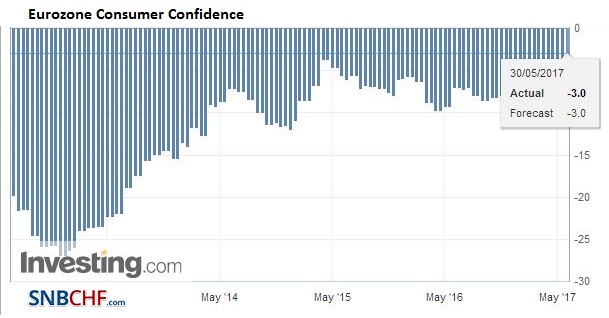

EurozoneWhile political anxiety has eased in Europe following Macron’s victory in France, and the CDU’s strong showing in state elections, the prospects of an early Italian election has emerged as a new political risk. It will be clearer in a week’s time, but the major political parties appear to be moving to an agreement on political reform that will pave the way for an election in the September-November period. Secondarily, the failure of the official creditors to agree on a debt relief deal with Greece continue is beginning to take a toll on the short-end of the Greek curve. The ECB still does not include Greek bonds in its asset purchases. A new payment for the aid package is needed for the country to service its official debt in the coming months. Meanwhile, despite talk of Greece wanting to bring a debt offering to market, it continues to look as if the country will need a new aid package next year, but ahead of the German election, it may not be discussed. The inability to agreed on debt relief does not auger well for IMF participation, even though the German and Dutch Parliament requires it. Meanwhile, the social media is still fawning over Merkel’s weekend campaign speech in which she called upon Europe to recognize that its Fate is in its own hands, and it could not entirely rely on the US. Many insist that this is some sort of watershed. Yet we have heard both the calls for a strong independent Europe and the “unreliability” of the US many time. Recall the Suez Crisis where the US threatened the UK with intervention against sterling and denying it an IMF package unless it withdrew its forces from Egypt. And there was the French exit from the joint command of NATO. When Reagan insisted on deploying theater nuclear weapons in Germany, the alliance was strained. The war in Vietnam and the invasion of Iraq after 9/11 also tested the relationship. |

Eurozone Consumer Confidence, May 2017(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

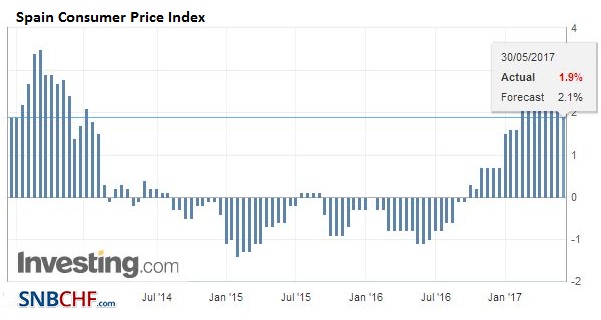

SpainAhead of this week’s preliminary eurozone CPI, German states and Spain have reported their figures. Spain’s CPI was flat in May, pushing the year-over-year rate to 2.0% down from 2.6%. |

Spain Consumer Price Index (CPI) YoY, May (flash) 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

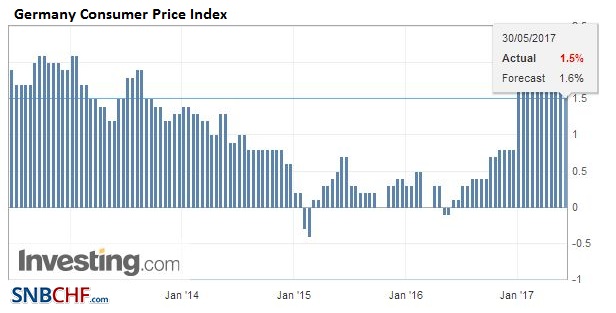

GermanyGerman states reported a 0.4-0.5% decline in the year-over-year rates. The table is set for a decline in the year-over-year rate for the country to 1.5% from 2.0%. |

Germany Consumer Price Index (CPI) YoY, May (flash) 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

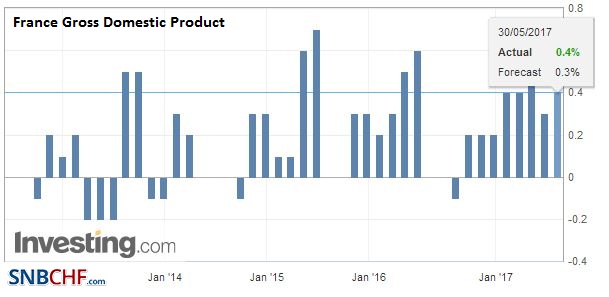

France |

France Gross Domestic Product (GDP) QoQ, Q1 2017(see more posts on France Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$EUR,$JPY,EUR/CHF,Eurozone Consumer Confidence,Featured,France Gross Domestic Product,FX Daily,Germany,Germany Consumer Price Index,Greece,Italy,Japan Household Spending,Japan Retail Sales,Japan Unemployment Rate,newslettersent,Spain Consumer Price Index,Sweden,U.S. Case Shiller Home Price Index,U.S. Consumer Confidence,U.S. Consumer Spending,U.S. Personal Income