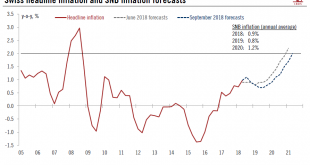

The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019. At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged. Also unchanged from the last quarterly meeting in June was the central bank’s assessment of the Swiss franc as “high valued” and its characterisation...

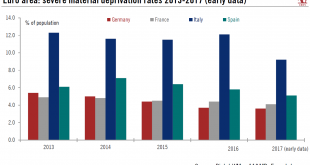

Read More »Italian material deprivation rates still the worst among large euro area economies

Latest poverty figures provide government with an argument for fiscal stumulus. Severe material deprivation rates gauge the proportion of people whose living conditions are severely affected by a lack of resources. According to Eurostat, “it represents the proportion of people living in households that cannot afford at least four of the following nine items: mortgage or rent payments, utility bills, hire purchase...

Read More »Contrasting Fortunes within the Euro Area

While the recent economic ‘soft patch’ has hurt all the main euro area economies, some have been more affected more than others. A divergence in fortunes can be seen across asset classes. The four biggest euro area economies slowed in H1 2018 due to a number of factors, including weak exports. We expect a rebound in H2—except in Italy, where political uncertainty has been denting business confidence. Forward indicators...

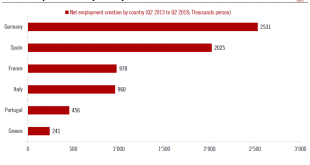

Read More »European labour market remains in rude health

But there is room for further improvement. This week euro area employment data confirmed that labour market recovery remains on track. Employment grew at 0.4% q-o-q in Q2 2018, marking the 20th consecutive quarter of expansion. Employment is now 2.4% above its pre-crisis (2008) level. Since Q2 2013, 9.2 million jobs have been created in the euro area. One development of note is that employment growth has been broad,...

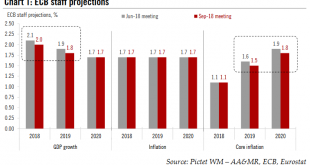

Read More »A successful bank should be boring

The main risk facing ECB watchers is that the next few meetings of the Governing Council will be increasingly boring and predictable. However, from the central bankers’ perspective, this may considered a sign of success, “like a referee whose success is judged by how little his or her decisions intrude into the game itself”, to quote former BoE Governor Mervyn King. Back to the economy, downside risks stemming from...

Read More »Switzerland Q2 growth numbers are impressive, but details are mixed

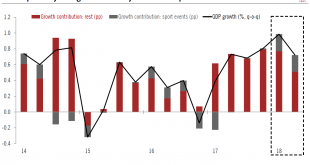

The latest headline Swiss GDP figures were impressive. According to the State Secretariat for Economic Affairs’ (SECO) quarterly estimates, Swiss real GDP grew by 0.7% q-o-q in Q2 (2.9% q-o-q annualised, 3.4% y-o-y), slightly above our 0.6% projection and consensus (0.5% q-o-q). This was the fifth consecutive quarter with an above average rate. Q1 GDP growth was significantly revised up to 1.0% q-o-q (from 0.6%). Thus,...

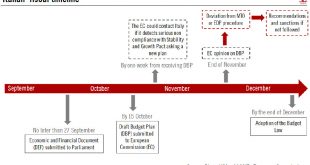

Read More »Italian 2019 draft budget: a bumpy road ahead

Tensions between Rome and Brussels could lead to significant market volatility before an agreement is found. September will be a key month for gauging the Italian government’s budgetary plans for 2019. The government has communicated neither a precise timeline for implementing the measures announced in its ‘contract for government’ nor a precise cost analysis for these measures. In this contract, the governing...

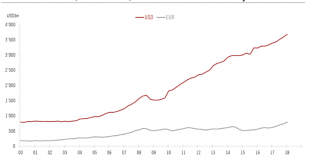

Read More »A trying time for euro

The euro has hit new lows against the US dollar. We are revising down our EUR/USD projections for the next few months. The euro broke to the downside from its tight trading range relative to the US dollar since the end of May. These new lows go against our expectations of a gradual appreciation of the single currency relative to the greenback in the second half of the year and indicate that we have underestimated the...

Read More »Revising our euro area 2018 GDP growth forecast down

The cut to our growth forecast reflects slippage in euro area data. According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018 (0.346% q-o-q unrounded, 1.4% q-o-q annualised, 2.1% y-o-y), below consensus expectations (0.4%). This was the weakest growth in two years and comes after a GDP growth of 0.4% q-o-q in Q1. The carryover effect for 2018 reached 1.7 %, meaning that...

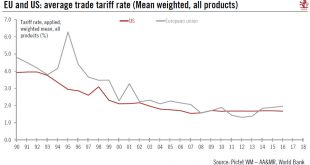

Read More »Ceasefire in US/EU tariff dispute

The two sides have agreed to discuss lowering barriers to transatlantic trade, helping to de-escalate tensions. While positive, the US’s dispute with China still needs watching. US President Trump and EU Commission President Juncker this week struck an unexpected deal to de-escalate the trade dispute between the EU and the US. Importantly, Trump agreed to put his threat of tariffs on EU cars on hold as bilateral trade...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org