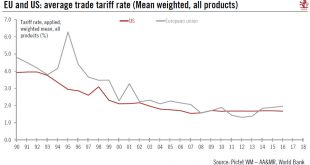

The two sides have agreed to discuss lowering barriers to transatlantic trade, helping to de-escalate tensions. While positive, the US’s dispute with China still needs watching. US President Trump and EU Commission President Juncker this week struck an unexpected deal to de-escalate the trade dispute between the EU and the US. Importantly, Trump agreed to put his threat of tariffs on EU cars on hold as bilateral trade...

Read More »What will the rest of the year bring?

Risk assets have disappointed this year and global equities were trendless, but as long as fundamentals can re-assert themselves, there could still be some life in risk markets. Global equities were trendless and the overall performance of risk assets lacklustre in the first half of 2018. But while trade tensions have been causing jitters and could continue to do so in the short term, as long as fundamentals are able...

Read More »Europe chart of the week – UK GDP growth

Short-term rebound in the UK, driven by services. The Office for National Statistics (ONS) published this week a new rolling monthly estimate of UK GDP. The release pointed to a rebound of growth in Q2 (quarterly data will be published on August 8). According to the ONS, the rolling three-month growth to end-May was 0.2%, compared to 0% in the three months to end-April (see chart below). Looking at the details, the...

Read More »European cars at a crossroad

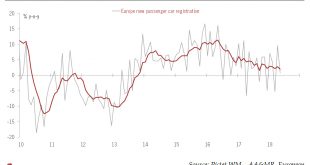

Falling momentum in new car sales, together with the threat of US tariffs is adding to the uncertainty facing the European car industry. The motor vehicle industry is of major importance to the EU economy and to global trade. According to Eurostat, total exports (to countries outside the EU) amounted to EUR205bn in 2017. Germany accounted for 52% of total motor exports. The US was the largest destination for EU motor...

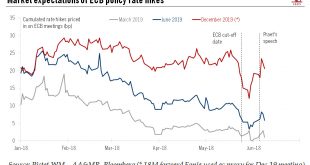

Read More »ECB gets ready to make the leap

The ECB has had essentially two options going into the June meeting: either a dovish decision but a hawkish communication (hinting at an imminent QE tapering), or a hawkish decision but a dovish communication (counterb alancing a tapering announcement with dovish sweeteners). Ever since economic indicators have started to deteriorate this year and risks to global trade have accumulated, ECB rhetoric has been...

Read More »Europe chart of the week-German new orders

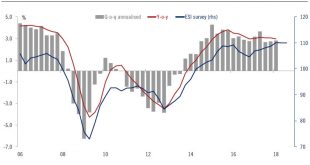

This is not what we ordered! German factory orders collapsed in April, suggesting that the economic slowdown could extend into Q2. The underlying pace of domestic demand expansion looks more resilient. The main downside risks relate to net exports, in our view. Still, the most recent data releases have not been fully consistent with the ECB’s “hawkish moderation” scenario. A rebound in soft and hard data will be...

Read More »Europe chart of the week – Spanish growth

Amid domestic political uncertainty, Spanish growth remains strong. This week saw the final release of Spanish GDP growth for Q1. The economy again managed to post robust growth, the highest among the four largest euro area economies (+0.7% q-o-q versus 0.4% q-o-q for the euro area). The breakdown of figures showed that domestic demand was once again the main growth driver. The carryover effect for 2018 reached 2.8%,...

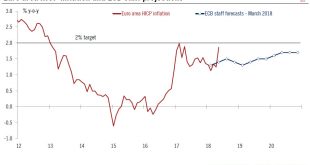

Read More »Euro area inflation close to ECB target in May

Euro Area HICP Today’s release of euro area flash HICP surprised to the upside both in terms of headline inflation (which surged from 1.2% to 1.9% y-o-y in May, above consensus expectations of 1.6%) and, crucially, in terms of core inflation (HICP excluding energy, food, alcohol and tobacco rose from 0.7% to 1.1%). This sharp rebound in inflation will provide the ECB with a critical input for its looming decision on...

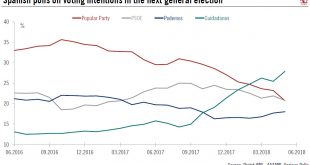

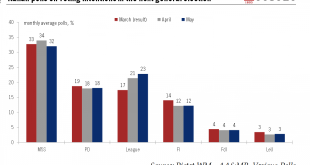

Read More »Spain Snap Elections in Sight

Political instability in Spain has added to turmoil in other peripheral countries. The situation is not comparable with the one that Italy is experiencing at the moment, but since it comes at the same time it is increasing market volatility. Last Friday, Spain’s main oppositionparty, the Socialist party (PSOE) filed a no confidence vote against Prime Minister Mariano Rajoy. The debate will start on May 31 with a vote...

Read More »Italy heads towards new elections

Fragmented politics and the risk of a financial crisis continue to hang over the country. This weekend, the Five Star Movement and the League decided to pull the plug on their attempt to form a coalition government after the President of the Republic Sergio Mattarella vetoed the appointment of anti-euro professor Paolo Savona as minister of finance. Mattarella has granted ex-International Monetary Fund official, Carlo...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org