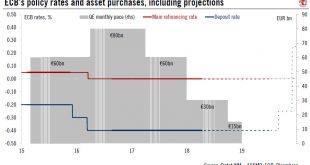

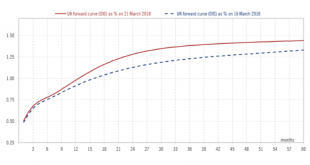

A look at different scenarios for the ECB’s exit from quantitative easing and its expected rate hiking cycle. Our baseline scenario for ECB normalisation still holds. We expect QE to end in December 2018 and a first rate hike in September 2019. The ECB is likely to wait until its 26 July meeting to make its decisions on QE and forward guidance. Still, downside risks have risen to the point where another open-ended QE...

Read More »PMIs point to downside risk to near term euro area growth

Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago. The deterioration...

Read More »Eurosceptic Italian government faces a reality check

More than two months after the general election, the Italian political impasse seems close to being broken, with the League and the Five Star Movement (M5S) likely to form a government. M5S and the League together have a majority in both the upper and lower houses. After several document leaks this week, a final common programme was published today. The document needs the approval of party members. The focus will shift...

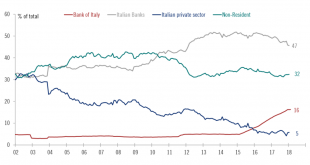

Read More »Europe chart of the week – Italy’s fiscal buffers

The incoming government’s fiscal plans could result in a sharp deterioration of Italy’s public finances. However, broader fiscal metrics are better than they were during the euro sovereign crisis. The M5S-League coalition has committed to a significant degree of fiscal easing and to the reversal of some structural reforms. Such policies will put Italy on course for confrontation with Brussels over deficit reduction...

Read More »Europe chart of the week – Corporate Sector Soft Patch

Next week’s detailed breakdown of ECB QE monthly data will reveal a marked slowdown in the pace of corporate bonds purchases in April (Corporate Sector Purchase Programme, or CSPP). Indeed, weekly holdings data have been consistent with gross purchases of around EUR3bn in April, down from EUR5.8bn on average in Q1. There are several possible explanations for the drop in gross purchases, but redemptions are not one of...

Read More »Russian rouble: significantly undervalued but quite risky

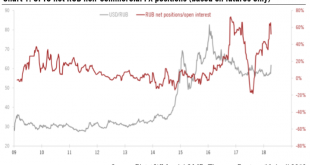

On 6 April, the Trump Administration announced additional and more severe sanctions against Russia “in response to the totality of the Russian government’s ongoing and increasingly brazen pattern of malign activity around the world”. US sanctions target seven Russian oligarchs, 12 companies controlled by them, and 17 high-ranking government officials. The measures freeze any US assets held by those targeted and cut them...

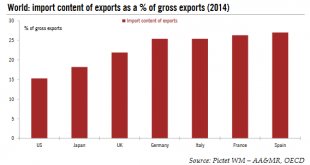

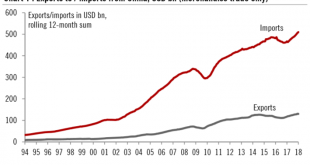

Read More »Europe has a lot to lose from trade wars

Any estimate of the economic costs of protectionist measures, let alone trade wars, is subject to uncertainty given the complexity of global supply chains. A common assumption is that new tariffs on exports will produce small direct effects on GDP growth but more significant indirect effects in the event of escalating trade conflicts, including on domestic investment. Europe looks particularly vulnerable to such...

Read More »Larger-than-expected reduction in French public deficit

France’s public deficit fell to 2.6% of GDP in 2017 according to INSEE’s preliminary assessment, down from 3.4% in 2016 and below the 3% threshold for the first time since 2007. The outcome was better than the government’s estimate of a 2.9% deficit. If confirmed, France will exit the Excessive Deficit Procedure that the European Commission opened in 2009. France’s budget balance ended up about EUR10bn above the level...

Read More »Impact of recent tariffs on US and China’s GDP should be limited for now

The Trump Administration last week announced tariffs of 25% on USD 60bn worth of imports from China (out of USD506bn of total Chinese merchandise imports). The list of products targeted, still has to be thrashed out. The official aim is to sanction China for alleged theft of US firms’ intellectual property; the US Trade Representative (USTR) estimates the damage amounts to USD 50bn. But President Trump also sees the...

Read More »British pound – Smoother transition, stronger sterling

Recent positive developments in the United Kingdom (UK), namely the transitional deal reached between the UK and the European Union (EU) on 20 March and the strong job market report on 21 March, call for a more positive short-term outlook for the sterling than previously thought. We therefore revise our projections upward for the sterling on the entire time horizon. Our new projection for the GBP/USD rate in the next 12...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org