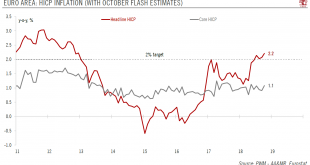

Strong wage growth should support the recovery of euro area inflation in the coming months. Euro area flash HICP rose from 2.1% year on year (y-o-y) in September to 2.2% in October, in line with expectations and the highest level since December 2012. Crucially, core inflation (HICP excluding energy, food, alcohol and tobacco) rebounded from 0.9% to 1.1% in October. Energy inflation rose to 10.6% y-o-y from 9.5% y-o-y in...

Read More »Euro area’s initial growth figures for Q3 prove disappointing

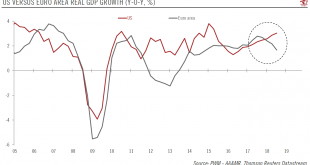

While growth in France rebounded, Italy stalled in Q3. Our full-year forecast for the euro area remains unchanged but is clearly at risk. According to initial estimates, growth in the euro area slowed in Q3 to 0.2% q-o-q (quarter on quarter) from 0.4% in Q2. These latest GDP results were below consensus expectations and our own forecast. This was the weakest quarterly growth figure for the euro area since Q2 2014 and...

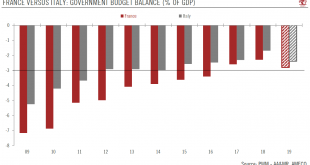

Read More »Devil is in the details: Italian and French deficits are not quite comparable

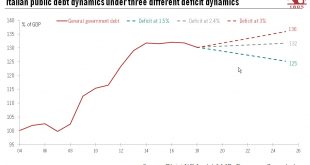

Italy’s structural weakness explain higher level of concern around its deficit target. Each EU member state is currently preparing 2019 budget plans for formal submission to the European Commission (EC) before mid- October. Among them, France and Italy’s budget plans have been raising eyebrows. Why is the EC concerned about Italy’s proposed 2.4% GDP deficit target for 2019 and not France’s target of 2.8%? Is Italy being...

Read More »Squaring off over the Italian budget

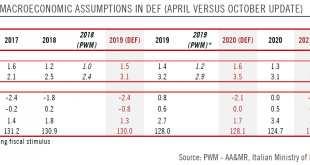

The Italian government’s budget plans set it on a collision course with the European Commission. The road to some kind of agreement is likely to be long and bumpy. The Italian government has confirmed its deficit target at 2.4% of GDP for 2019. This represents significant slippage from a previous budget deficit target of 0.8% in 2019. The deficit target has been set at 2.1% for 2020 and 1.8% for 202. But it is not the...

Read More »German September PMIs surprisingly weak

Blame the German automotive industry for the fall in manufacturing orders. Recent German soft and hard data in the manufacturing sector has been surprisingly weak. Data released today showed that the final manufacturing PMI fell to 53.7 in September, from 55.9 in August. Factory orders rose by 2.0% month-on-month (m-o-m) in August, having contracted for six out of the seven previous months. The increase in August...

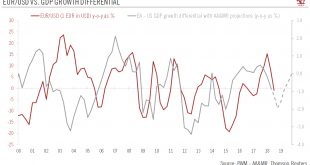

Read More »Further consolidation of EUR/USD rate likely

Short-term noise means we are neutral on the euro over the next three months, but see potential for its gradual appreciation against the dollar thereafter We have long argued that growth and interest rate differentials are two key components for the direction of the US dollar. Both these drivers should continue to support the dollar over the short term. Indeed, economic growth in the US is likely to be strong thanks...

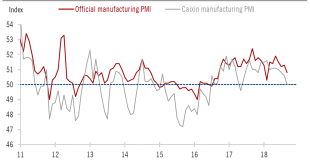

Read More »Chinese PMI data points to further growth moderation

More policy support is expected, and may lead to slight rebound in Q4. China’s manufacturing PMIs softened further in September, indicating that growth momentum is likely continued to moderate in Q3 and that the weakness may extend into Q4. In response to the weakening growth momentum, especially in the context of escalating trade tensions with the US, the Chinese government has turned to policy easing since June. The...

Read More »Italy tests the EU’s tolerance

The populist government’s plans to increase the deficit could set it on a collision course with Brussels. We remain bearish Italian bonds and euro peripheral bonds in general. Leaders of Italy’s coalition government and the finance minister yesterday agreed on a 2.4% GDP deficit target. The new target is higher than our expectation of a deficit “above but close to 2.0%” in 2019. For us, the key issue is not so much the...

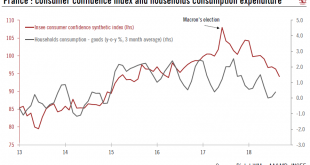

Read More »A bit too early to be worried about French consumers

Despite the recent fall in French consumer confidence, spending should pick up in the second half of the year. The French economy disappointed in the first half of this year. While there was a widespread ‘soft patch’ in the euro area, the source and size of the slowdown in France stands out. The real GDP growth rate fell by 0.5 points, much more than the rest of the euro area. Moreover, while the slowdown in the other...

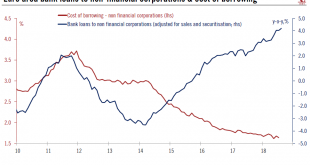

Read More »Credit Growth Remains Buoyant in the Euro Area

Financial conditions remain supportive and are not expected to tighten much in the coming months. Lending to non-financial corporations in the euro grew by an annual 4.2% in August, its fastest rate since April 2009. Forward-looking indicators suggest that euro area credit growth should remain strong over the coming months. Overall, domestic demand is likely to continue to be the main driver of growth in the euro area,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org