One of the most notable events in Russia’s precious metals market calendar is the annual “Russian Bullion Market” conference. Formerly known as the Russian Bullion Awards, this conference, now in its 10th year, took place this year on Friday 24 November in Moscow. Among the speakers lined up, the most notable inclusion was probably Sergey Shvetsov, First Deputy Chairman of Russia’s central bank, the Bank of Russia. In...

Read More »Maybe Hong Kong Matters To Someone In Particular

Hong Kong stock trading opened deep in the red last night, the Hang Seng share index falling by as much as 1.6% before rallying. We’ve seen this behavior before, notably in 2015 and early 2016. Hong Kong is supposed to be an island of stability amidst stalwart attempts near the city to mimic its results if not its methods. Thus, most kinds of turmoil are noticeable. Most. My own brief survey of this morning’s news from...

Read More »Bonds And Soft Chinese Data

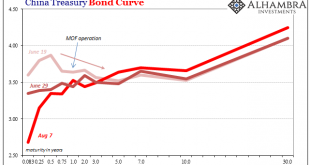

Back in June, China’s federal bond yield curve inverted. Ahead of mid-year bank checks, short-term govvies sold off as longer bonds continued to be bought. It was for some a rotation, for others a reflection of money rates threatening to spiral out of control. On June 19, for example, the 6-month federal security yielded 3.87% compared to a yield of 3.525% for the 10-year. China Treasury Bonds(see more posts on china...

Read More »An Unexpected (And Rotten) Branch of the Maestro’s Legacy

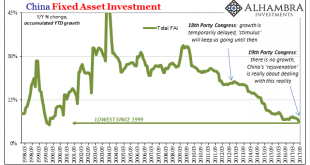

The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied. Without any objection,...

Read More »Global Inflation Continues To Underwhelm

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months...

Read More »China Exports/Imports: Enforcing A Global Speed Limit

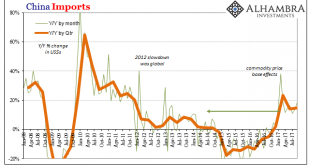

Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month. What is becoming very clear is that China’s economy is behaving no differently than the global economy. Most of that increase for...

Read More »Location Transformation or HIBORMania

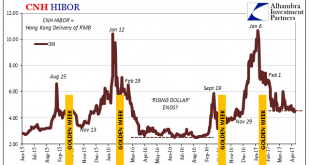

The Communist Chinese established their independence on September 21, 1949. The grand ceremony commemorating the political change was held in Tiananmen Square on October 1 that year. The following day, October 2, the Resolution on the National Day of the People’s Republic of China was passed making October 1to be China’s National holiday. It typically kicks off the second of China’s Golden Week holidays. The first...

Read More »Little Behind CNY

The framing is a bit clumsy, but the latest data in favor of the artificial CNY surge comes to us from Bloomberg. The mainstream views currency flows as, well, flows of currency. That’s what makes their description so maladroit, and it can often lead to serious confusion. A little translation into the wholesale eurodollar reality, however, clears it up nicely. Demand for foreign exchange outstripped that for yuan for...

Read More »PBOC RMB Restraint Derives From Experience Plus ‘Dollar’ Constraint

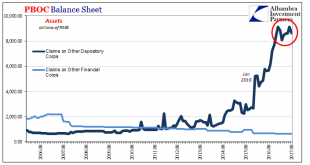

Given that today started with a review of the “dollar” globally as represented by TIC figures and how that is playing into China’s circumstances, it would only be fitting to end it with a more complete examination of those. We know that the eurodollar system is constraining Chinese monetary conditions, but all through this year the PBOC has approached that constraint very differently than last year.The updated balance...

Read More »Swimming The ‘Dollar’ Current (And Getting Nowhere)

The People’s Bank of China reported this week that its holdings of foreign assets fell slightly again in August 2017. Down about RMB 21 billion, almost identical to the RMB 22 billion decline in July, the pace of forex withdrawals is clearly much preferable to what China’s central bank experienced (intentionally or not) late last year at ten and even twenty times the rate of July and August. The US Treasury Department...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org