Wicked Don Giovanni GUALFIN, Argentina – Tuesday evening, we went to the main opera house in Buenos Aires, the Teatro Colón, to see Mozart’s Don Giovanni. On our way over, our taxi driver told us that Luciano Pavarotti rated it as the second best opera house in the world (after La Scala in Milan). The Teatro Colón in Buenos Aires. Sorry, chaps, only second best. Still, that makes it the best this side of the great pond. Photo credit: Arnaldo Colombaroli Your editor’s wife has a tendency...

Read More »Double Whammy Economics

Consumer Ambivalence Photo credit: Pixelrobot What’s up with U.S. consumers? They seem to have come to their senses at the worst possible time. They can no longer be counted on to push economic growth up and to the right. Specifically, they’re not spending money on stuff.A little public service on etymology: “Double whammy” was reportedly first used in a 1941 Oakland Tribune article related to boxing. It means a devastating blow, setback or catastrophe. In today’s economy, it often...

Read More »Why All Central Planning Is Doomed to Fail

Positivist Delusions [ed. note: this article was originally published on March 5 2013 – Bill Bonner was on his way to his ranch in Argentina, so here is a classic from the archives] We’re still thinking about how so many smart people came to believe things that aren’t true. Krugman, Stiglitz, Friedman, Summers, Bernanke, Yellen – all seem to have a simpleton’s view of how the world works. A bunch of famous people with a simpleton view of how the world works…who not only seriously think...

Read More »China – A Reversal of Urbanization?

Economic and Demographic Changes We have discussed China’s debt and malinvestment problems in these pages extensively in the past (most recently we have looked at various efforts to keep the yuan propped up). In a way, China is like the proverbial “watched pot” that never boils though. Its problems are all well known, and we have little doubt that they will increasingly find expression. China’s credit bubble is one of the many dangers hanging over the global economy’s head, so to speak....

Read More »Argentina – The Times, They Are A-Changing

Our Argentine “Ranch Rebellion” Is Over… for Now… Mauricio Macri shortly after his election – indicating that he actually has a plan. Photo credit: Enrique Marcarian / Reuters BUENOS AIRES, Argentina – Not much action on Wall Street yesterday. The Dow sold off slightly. Gold and oil were up a bit. How about here in Argentina? “Everything has changed. Everything.” One of the analysts in our Buenos Aires office explained how the recent election of business mogul Mauricio Macri as...

Read More »Going Into Debt to Invest Into Debt…

Bankers Hate It When You Hold Cash In an extraordinary turn of events, last week we were contacted by our local bankers. Since we were turned down for a mortgage in 1982 (our business finances were thought to be “too shaky”), we have had little truck with them. We pay cash. They mind their own business. Too many Benjamins! Photo credit: Andrew Magill / Flickr But for the first time we can recall, not just one but three suits came to visit. Personable and intelligent, they were worried...

Read More »Rotten to the Core

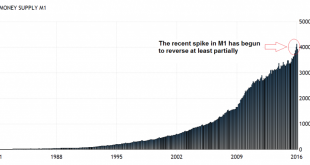

Poison Money BALTIMORE – We live in a world of sin and sorrow, infected by a fraudulent democracy, Facebook, and a corrupt money system. Wheezing, weak, and weary from the exertion of trying to appear “normal,” the economy staggers on. Staggering on…. Image credit: David Sidmond Last week, we gained some insight into the ailment. Something in the diagnosis has puzzled us for years: How is it possible for the most advanced economy in the history of the world to make such a mess of its...

Read More »A Tribute to the Jackass Money System

A Witless Tool of the Deep State? Finance or politics? We don’t know which is jollier. The Republican presidential primary and Fed monetary policies seem to compete for headlines. Which can be most absurd? Which can be most outrageous? Which can get more page views? Politics, led by Donald J. Trump, was clearly in the lead… until Wednesday. Then, the money world, with Janet L. Yellen wearing the yellow jersey, spurted ahead in the Hilarity Run. A coo-coo for the stock market…...

Read More »The Other Problem with Debt No One is Talking About

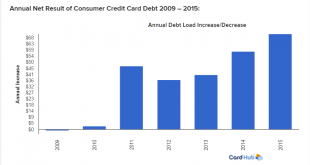

Faux Growth Recovery Nearly 7 years have elapsed since the official end of the Great Recession. By now it’s painfully obvious the rising tide of economic recovery has failed to lift all boats. In fact, many boats bottomed out on the rocks in early 2009 and have been taking on water ever since. Last week, for instance, it was reported that U.S. credit card debt topped $917 billion in the fourth quarter of 2015. That’s up $71 billion from the year before. Shouldn’t the economic recovery...

Read More »The Path to the Final Crisis

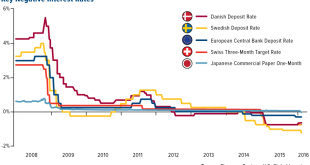

Reader Questions on Negative Interest Rates Our reader L from Mumbai has mailed us a number of questions about the negative interest rate regime and its possible consequences. Since these questions are probably of general interest, we have decided to reply to them in this post. The NIRP club – negative central bank deposit rates – click to enlarge. Before we get to the questions, a few general remarks: negative interest rates could not exist in an unhampered free market. They are an...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org