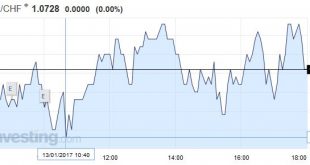

Swiss Franc EUR/CHF - Euro Swiss Franc, January 16(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The euro has been sold to $1.0580 in the European morning, a cent lower from the pre-weekend high. In addition to the drag from sterling, the euro appears to have been sold in response to the interview in two European papers of the next US President. Among other things, Trump reported claimed that NATO...

Read More »Tourism accommodation statistics in November 2016: Slight increase in overnight stays in November

Neuchâtel, 16.01.2017 (FSO) – The Swiss hotel industry registered 1.9 million overnight stays in November 2016, which corresponds to a slight growth of 0.5% (+9300 overnight stays) compared with the same period a year earlier. Domestic visitors generated 878,000 overnight stays, representing an increase of 0.9% (+7900). Foreign visitors generated 999,000 overnight stays, i.e. a very slight increase of 0.1% (+1400)....

Read More »Swiss franc less overvalued according to latest Big Mac index

On 12 January 2017, the Economist came out with its latest Big Mac index. Also known as the burger benchmark, the index compares the price of a Big Mac around the world. This catchy, if highly incomplete means of comparing the relative purchasing power of different currencies, uses the United States and the US$ as its base. Countries where Big Macs cost less than in the United States (in US$ terms) have weak currencies,...

Read More »Will Our Grandchildren Wonder Why We Didn’t Build a Renewable Power Grid When It Was Still Affordable?

In the logic of the market, it makes no sense to sacrifice trillions of dollars in current energy and income to build something we don’t yet need. Anyone seeking clarity on the energy picture a decade or two out is to be forgiven for finding a thoroughly confusing divide. On the one hand, we have reassuring projections from the U.S. Energy Information Administration (EIA) that assume current production of fossil fuels...

Read More »FX Weekly Review, January 09 – 14: Dollar Correction may be Over or Nearly So

Swiss Franc Currency Index For the first week since the election of Trump, the Swiss Franc index had a clearly better performance than the dollar index. It improved by 1.5% in the last ten days. Trade-weighted index Swiss Franc, January 14(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted...

Read More »Crony Socialism and Failed CEOs

Blind to Crony Socialism Whenever a failed CEO is fired with a cushy payoff, the outrage is swift and voluminous. The liberal press usually misrepresents this as a hypocritical “jobs for the boys” program within the capitalist class. In reality, the payoffs are almost always contractual obligations, often for deferred compensation, that the companies vigorously try to avoid. Believe me. I’ve been on both sides of...

Read More »Trump’s Trade Catastrophe?

“Trade Cheaters” It is worse than “voodoo economics,” says former Treasury Secretary Larry Summers. It is the “economic equivalent of creationism.” Wait a minute – Larry Summers is wrong about almost everything. Could he be right about this? Summers is referring to the paper written by two members of Trump’s trade team: his pick for secretary of commerce, billionaire investor Wilbur Ross, and the director of Trump’s...

Read More »Dear Self-Proclaimed “Progressives”: as Apologists for the Neocon-Neoliberal Empire, You Are as Evil as the Empire You’ve Enabled

Sorry, pal, you’re evil. Self-righteous indignation counts for nothing in the strict accounting of real progressivism. Dear Self-Proclaimed “Progressive”: I love you, man, but it has become necessary to intervene in your self-destruction. Your ideological blinders and apologies for the Establishment’s Neocon-Neoliberal Empire are not just destroying your credibility, they’re destroying the nation and everywhere the...

Read More »How Derivatives Markets Responded to the De-Pegging of the Swiss Franc

In a Bank of England Financial Stability Paper, Olga Cielinska, Andreas Joseph, Ujwal Shreyas, John Tanner and Michalis Vasios analyze transactions on the Swiss Franc foreign exchange over-the-counter derivatives market around January 15, 2015, the day when the Swiss National Bank de-pegged the Swiss Franc. From the abstract: The removal of the floor led to extreme price moves in the forwards market, similar to those...

Read More »FX Daily, January 13: Corrective Forces Persist

Swiss Franc EUR/CHF - Euro Swiss Franc, January 13(see more posts on EUR/CHF, ) - Click to enlarge Supreme Court Judgement expected imminently The Supreme Court Judgement on whether parliament will have to O.K the triggering of article 50 is ongoing and when the ruling is announced expect big swings on GBP/CHF. I think the likely outcome will be that parliament will get the vote, most broad sheet papers have...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org