In his 1922 book, Gemeinwirtschaft, Ludwig von Mises unmasks the intellectual distortion that is social Darwinism. Based on determining the dynamics of socialization through the principle of the division of labor, Mises shows that society is cooperative; that peace, not war, is the father of human progress. Socialization Mises believes socialization proceeds through expansion and deepening. Through societal expansion, people are increasingly drawn into the system of...

Read More »Inflation Firestorm Fuels Sound Money Movement

Sound money, in the form of physical gold and silver, look to be ending the year on a bullish footing. Meanwhile, things are looking positive on the sound money public policy front as well, thanks to some big wins at the state level in 2022 combined with renewed enthusiasm among our legislative allies as we head into the 2023 legislative season. Looking back on 2022, one reality has emerged: Sound money is clearly a winning issue at the state level. At a time of...

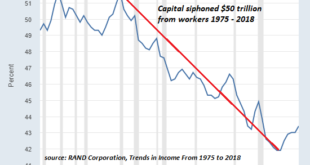

Read More »The Blowback from Stripmining Labor for 45 Years Is Just Beginning

The clueless technocrats are about to discover that unfairness and exploitation can’t be measured like revenues and profits, but that doesn’t mean they’re not real. Economists and financial pundits tend to make a catastrophically flawed assumption. They tend to believe the technocratic myth that all human behavior boils down to financial incentives, data and metrics, as if all people make decisions based on interest rates, tax breaks and greed, the desire to maximize...

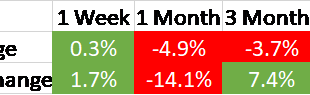

Read More »Weekly Market Pulse: Envy

Legendary investor and Berkshire Hathaway vice-chair Charles Munger recently stated: “The world is not driven by greed. It’s driven by envy.” I think this perfectly encapsulates our current investing era. In a day and age where social media has replaced not only traditional news media but human interaction, where influencers and gamers are top career aspirations for the nation’s youth, where artists (content creators) are paid by the number of followers, likes, and...

Read More »The World Needs More Energy and Less Energy Regulation

Energy is a highly regulated industry across the world. There is less debate about the need for government control when it comes to the oil and gas sector. The arguments that most people accept for government intervention in energy, whether in the name of energy access, national security, or climate change mitigation, all share the same general premise: that energy is too important to be left to the whims of the free market. But this year, the world has been thrust...

Read More »Markets Await Central Banks and Data

Overview: There are two themes today. First, there has been a modest bout of profit-taking on Chinese stocks (and yuan) after last week’s surge. Second, the ahead of the five G10 central bank meeting this week a series of market-sensitive economic reports, a consolidative tone is seen in most of the capital markets. Most of the large bourses in the Asia Pacific region fell, led by a 2.2% loss in Hong Kong and 3% loss in its index of mainland shares. Europe’s Stoxx...

Read More »Week Ahead: Highlights include Fed, US CPI; ECB, BoE, SNB, Norges Bank

It is a huge week for major central bank policy announcements, where downshifts are expected from the Fed, ECB, BoE, SNB. Heading into the announcements, US CPI will help shape expectations. MON: UK GDP Estimate (Oct), Chinese M2/New Yuan Loans (Nov). TUE: OPEC MOMR; BoE Financial Stability Report; German CPI Final (Nov), UK Unemployment Rate (Oct)/Claimant Count (Nov), EZ ZEW (Dec), US CPI (Nov), Japanese Tankan (Q4), New Zealand Current Account (Q3). WED: FOMC...

Read More »Syz Crypto: Bank Syz Selected Taurus for Its New Digital Asset Offering

Bank Syz has collaborated with Taurus to launch its new digital asset offer Syz Crypto. It will cover the safekeeping and trading of digital assets to the Bank’s private, professional and institutional clients. Concretely, the Bank has integrated Taurus-PROTECT, a technology that allows the custody of digital assets such as cryptocurrencies, tokenized securities as well as NFTs and Taurus-EXPLORER for the connectivity to >15 blockchain protocols, including Bitcoin...

Read More »How Things Fall Apart

That’s how things fall apart: insiders know but keep their mouths shut, outsiders are clueless, and the decay that started slowly gathers momentum as the last of the experienced and competent workforce burns out, quits or retires. Outsiders are shocked when things fall apart. Insiders are amazed the duct-tape held this long.The erosion of critical skills and institutional knowledge is invisible to outsiders, while everyone inside who saw the unstoppable decay...

Read More »The Yuan Puts Together its Strongest Two Week Rally in Decades and it has Nothing to do with its Trade Surplus (which Shrank more than expected)

The G10 currencies traded with a heavier bias against the dollar last week. The Swiss franc was the sole exception, and it edged up about 0.25%. The thwarted putsch in Germany and the relaxation of vaccine and quarantine protocols in China were notable developments. The weakness in European and American equities and oil helped account for the underperformance of the Norwegian krone and Canadian dollar. At the same time, the recovery in US 10-year yields after a more...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org