A “civil society” is a community of individuals who are linked together by common interests and activities. Common interests include being able to walk the streets safely (peace) and to exercise such rights as freedom of speech (individual freedom). These shared interests allow common activities to flourish, including commerce and the education of children. Civil society is possible only because most people want to live securely, protect their loved ones, and...

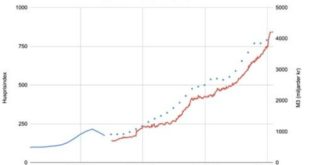

Read More »The Money Supply Has Plummeted in the Biggest Drop Since the Great Depression

With negative growth now falling to near –10 percent, money-supply contraction is now the largest we've seen since the Great Depression. Original Article: "The Money Supply Has Plummeted in the Biggest Drop Since the Great Depression" [embedded content] Tags: Featured,newsletter

Read More »The Lure of a Stable Price Level

One of the reasons that most economists of the 1920s did not recognize the existence of an inflationary problem was the widespread adoption of a stable price level as the goal and criterion for monetary policy. The extent to which the Federal Reserve authorities were guided by a desire to keep the price level stable has been a matter of considerable controversy. Far less controversial is the fact that more and more economists came to consider a stable price level as...

Read More »Finance Discovers Sting: “How Fragile We Are”

Despite the soothing hot air from the White House and Fed officials, the financial system is becoming increasingly fragile and unstable. Maybe all of that intervention the past decade was not wise. Original Article: "Finance Discovers Sting: "How Fragile We Are"" [embedded content] Tags: Featured,newsletter

Read More »Progressives Want to Eliminate Wealthy Entrepreneurs but Need the Wealth They Create

Modern culture is biased against those that are rich even while depending upon the wealth that successful entrepreneurs have created. Original Article: "Progressives Want to Eliminate Wealthy Entrepreneurs but Need the Wealth They Create" [embedded content] Tags: Featured,newsletter

Read More »June 2023 Monthly

June is a pivotal month. The US debt-ceiling political drama cast a pall over sentiment even if it did not prevent the dollar from rallying or the S&P 500 and NASDAQ from setting new highs for the year. It is as if the two political parties in the US are playing a game of chicken and daring the other side to capitulate. Both sides are incentivized to take to the brink to convince their constituents that they secured the best deal possible. No side seems to...

Read More »Where Is That Darn Recession?

Mark takes a look at all the wrong predictions of recession in recent years, including those of Austrian School economists. While the MSM and Fed officials try to downplay the coming of a recession, many of the statistics and facts that Austrian consider important are indicating a looming recession, if not a full-blown economic crisis. Check out Anatomy of the Crash: The Financial Crisis of 2020, edited by Tho Bishop: Mises.org/AnatomyOfTheCrash Be sure to...

Read More »Can We Protect Ourselves from Inflation?

Rulers found out early on that they could debase gold and silver coins for their own gain. As a consequence, the money supply increased, whereas money’s purchasing power fell. This pseudoalchemy is the true definition of inflation and has been a policy for more than a thousand years. What’s more, an increase in the money supply leads to rising prices. This symptom of inflation is often mistaken as inflation itself. The correct term, though, is price inflation....

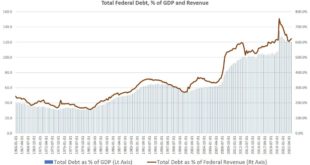

Read More »As Interest Rates Rise, the Era of “Deficits Don’t Matter” Is Over

Back in 2002, then-Vice President Dick Cheney claimed "Reagan proved deficits don't matter" and went on to push for tax cuts combined with more federal spending. Indeed, the Bush administration would go on to push immense amounts of new spending, supporting a huge Medicare expansion and blowing hundreds of millions of dollars on costly and pointless occupations in Iraq and Afghanistan. The national debt grew by 70 percent during Bush's eight years, but no one in...

Read More »Overcoming Government Intervention in the Economy

Once again, the economic system is trying to adjust to political and monetary interventions. The year 2023 marks the end of a historical period characterized by zero-cost credit. The monetary expansion that began in the early 2000s led to the great financial crisis of 2008 and the emerging markets boom. Exaggerated demand expectations and easy access to capital caused an overexpansion of production capacity and the subsequent industrial restructuring between 2015 and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org