In his recent address, President Joe Biden claimed that “wind and solar are already significantly cheaper than coal and oil.” This is flat-out wrong. There are many arguments that can be made for Biden’s claim. However, not only can they all be refuted, but they have all already been refuted. Alex Epstein, in his book Fossil Future: Why Global Human Flourishing Requires More Oil, Coal, and Natural Gas—Not Less, explains that two facts are ignored when pretending that...

Read More »The Backstops for Banks Are Full of Holes

The Federal Home Loan Bank (FHLB) is the latest "weapon" in the government's so-called arsenal to keep the banking system afloat. But the system needs much more than just "liquidity." It needs sound money and sound banking practices. Original Article: "The Backstops for Banks Are Full of Holes" [embedded content] Tags:...

Read More »Bond Rally Continues, Greenback Consolidates with Softer Bias

Overview: The main development in the capital markets is the decline in yields. In Europe, benchmark 10-year yields are off 7-11 bp today, extending the move that began last week. The 10-year Germany Bund yield peaked last Thursday near 2.68% and is near 2.40% now. Similarly, the 10-year Italian yield has fallen from 4.42% to below 4.05% today. The 10-year US Treasury yield fell in five of the last six sessions and is off almost five basis points today. The yield...

Read More »Censorship through the Centuries: Free Speech Suppression by the Government and the Mainstream Media

The United States government, which prides itself in being the leading force in defending freedom throughout the world, has a history of putting a muzzle on news organizations and individuals throughout its history. From the early colonial period to the beginnings of the internet, the state has consistently silenced its critics, which seems to be its true nature. The Sedition Act of 1798 Signed into law by the Federalist Party president John Adams on July 14, 1798,...

Read More »How US States Could Pave the Way for Currency Competition

The fiat US dollar, while still the world's "reserve" currency, is being imperiled by reckless actions by monetary authorities. Other countries are taking notice—and action. Original Article: "How US States Could Pave the Way for Currency Competition" [embedded content] Tags: Featured,newsletter

Read More »Myth #7: Deflation — Falling Prices — Is Unthinkable, and Would Cause a Catastrophic Depression

Recorded by the Mises Institute in the mid-1980s, The Mises Report provided radio commentary from leading non-interventionists, economists, and political scientists. In this program, we present another part of "Ten Great Economic Myths". This material was prepared by Murray N. Rothbard. The public memory is short. We forget that, from the beginning of the Industrial Revolution in the mid-18th century until the beginning of World War II, prices generally went...

Read More »The BRICS Currency Project Picks Up Speed

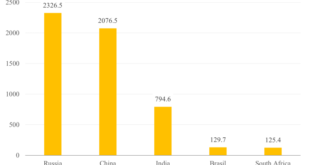

On Friday, July 7, 2023, news broke in the financial market media that the “BRICS” (that is, Brazil, Russia, India, China, and South Africa) will implement their plan to create a new international currency for trading and financial transactions, and that this new currency will be “gold-backed”. Most recently, on June 2, 2023, the foreign ministers of the BRICS – as well as representatives from more than 12 countries – met in Cape Town, South Africa (interestingly at...

Read More »The Government vs. the People, Kamala Harris Version

It is no surprise to libertarians that what is in the interest of the government might not be in the interest of people in general. More often than not, the government’s interest is directly at odds with the interests of people in general. The countless wars waged by governments throughout history, for which common people paid ultimately with their lies, bear witness to this fact. Wars are also waged on the domestic populations that the government supposedly serves...

Read More »Euro Edges Higher

Overview: The US dollar has mostly steadied at the start of the week after last week's sharp losses. The yen, euro, and Swiss franc are enjoying a firmer tone, but only the euro has thus far extended last week's gains, and then, only marginally. Uninspiring data from China pressed the yuan lower, while the firm euro is helping the central European currencies. A typhoon shut Hong Kong markets and Japan's markets were closed for a national holiday. The Ukraine...

Read More »Week Ahead: For the Millionth Time, Markets Exaggerate

After experiencing one of its worst weeks of the year, the US dollar is stretched from a technical point of view while the short-term interest rate adjustment has gone as far as it can without resurrecting ideas of a Fed rate cut this year. Given the lighter economic calendar in the coming days, we suspect that the greenback may consolidate ahead of the FOMC meeting that concludes on July 26. The derivatives market shows that a quarter-point hike is seen as a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org