At 2099.06 points the S&P 500 is now in a confirmed uptrend and on the cusp of attacking the 19 April high of 2100.80. If it conquers this pressure point, the index will enter a zone of resistance up to 2126.64 points. This range will certainly be treated by the market with due trepidation, when it returns from the Memorial Day holiday on Tuesday! According to my stochastics indicator, the market appears to be over-bought and my Grail momentum indicator is swinging a bit to the...

Read More »Switzerland’s Gotthard Base Tunnel: Swiss Engineered, Foreign Made

Earlier we introduced the Gotthard Base Tunnel, the longest and deepest tunnel in the world. The 35 mile long tunnel which cuts underneath the Alps helps remove natural barriers to trade and tourism, and is undoubtedly a testament to Swiss precision engineering. Interestingly, as Bloomberg reports, the tunnel that was 17 years in the making and had workers on three shifts working around the clock to build, was built primarily by foreigners. Only 14 percent of the workers were from...

Read More »The Stunning Idiocy of Steel Tariffs

Steel factory Photo credit: Laurentiu Iordache Victims of the Boom-Bust Cycle The world is drowning in steel – there is huge overcapacity in steel production worldwide. This is a direct result of the massive global credit expansion that has taken place over the past 15 years. Much of this capacity is located in China, but while the times were good, iron ore and steel production (and associated lines of production) was expanded everywhere else in the world as well. Heavy industries like...

Read More »Gold and Silver Aren’t Getting Stronger

The buck. The Dollar Increases in Value The dollar moved up, though most people would say gold fell about $40, and silver 32 cents. In the mainstream view, the value of the dollar is 1/N (N is the quantity). So how could the dollar go up? Certainly, the quantity keeps on increasing. Our view is different. If you borrow dollars to buy an asset, and the asset doesn’t generate enough yield to pay the interest, you have to sell or default. It should go without saying that it is an...

Read More »A Thank You to the Jackasses Running the Economy

Two of many symptoms of the much-bewailed “populist backlash”… Image via economyincrisis.org Rolling Back 200 Years of Growth BALTIMORE, Maryland – The press reported mixed financial news on Thursday. House sales, oil, unemployment figures… up, down… the news left investors puzzled. Stocks went mostly nowhere. But amid the confusing noise was the sound of an alarm: “Fall in U.S. productivity sparks fears of populist backlash as wages stagnate,” says a lumbering headline in the...

Read More »Emerging Market Preview

EM ended last week on a soft note. The icing on the cake was Yellen’s speech Friday afternoon, which confirmed the more hawkish stance seen in the FOMC minutes and other recent official comments. We warn that with the FOMC meeting and Brexit vote next month, markets are likely to remain volatile and that risk assets (such as EM) are the most vulnerable. Looking at country-specific EM risk, the Brazilian political outlook remains murky as more reports have surfaced of other PMDB officials...

Read More »Venezuela’s Gold Reserves Plunge To Lowest Ever As Maduro Repays Debt With Gold

Several months ago, as Venezuela’s hyperinflating, imploding economy was spinning in freefall, leading to the dramatic episodes of total social collapse such as those profiled in “Scenes From The Venezuela Apocalypse: “Countless Wounded” After 5,000 Loot Supermarket Looking For Food“, we wrote that the country which recently had “run out of money to print its own money” was preparing to liquidate its remaining gold holdings to pay coming debt maturities. Then, courtesy of an analysis by...

Read More »FX Weekly Preview

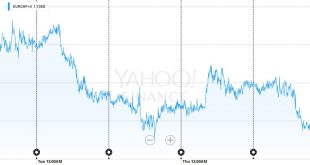

The US dollar bottomed against nearly all the major currencies on May 3. The hawkish April FOMC minutes that began swaying opinion about the prospects for a summer rate hike were not published until two weeks later, and the confirmation by NY Fed President Dudley was not until May 19. Nevertheless, the shift in expectations for a resumption of the Fed’s gradual normalization of monetary policy is a potent force that has fueled the greenback’s recovery. The place to look for investors’...

Read More »Weekly Speculative Positions: Speculators Slash Yen and Aussie Longs, Net CHF nearly unchanged

Speculators remain Long CHF against USD. The figure is nearly unchanged at 4.0 k CHF contracts. For CHF, both shorts and longs increased.This weeks major change was in the yen and in AUD. Speculators strongly reduced their longs. Yen and Aussie There were only two significant speculative position adjustments in the latest CFTC reporting week ending May 24. Speculators liquidated 31.4k gross long yen contracts, leaving the bulls with 54.8k contracts. It is the largest weekly...

Read More »FX Weekly: Dollar Set to Snap Three-Month Decline

EUR/CHF The EUR/CHF moves lower, following the descent of EUR/USD. This happens often, when European and global growth is sluggish. USD/CHF But the Swiss franc weakened against the dollar. Continued by Marc Chandler: The US dollar was mostly firmer over the past week. There were two exceptions among the major currencies: Sterling and the Canadian dollar. GBP/USD Many linked sterling’s outperformance (+0.8%) to a growing sense that the UK will vote to remain in the EU,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org