Several months ago, as Venezuela’s hyperinflating, imploding economy was spinning in freefall, leading to the dramatic episodes of total social collapse such as those profiled in “Scenes From The Venezuela Apocalypse: “Countless Wounded” After 5,000 Loot Supermarket Looking For Food“, we wrote that the country which recently had “run out of money to print its own money” was preparing to liquidate its remaining gold holdings to pay coming debt maturities. Then, courtesy of an analysis by our friends at Bullionstar, we found just how Venezuela was quietly exporting tons of its gold to Switzerland, as it prepared to conclude the transaction with whoever the end buyer of Venezuela’s bullion would end up being. Swiss Gold Imports/Exports with Venezuela And now it’s official – the “gold for fiat” transaction has been officially concluded, and as the FT writes, Venezuela’s gold reserves have plunged to their lowest level on record after the country sold .7 billion of the precious metal in the first quarter of the year to repay debts. The country is grappling with an economic crisis that has left it struggling to feed its population. The OPEC member’s gold reserves have dropped almost a third over the past year and it sold over 40 tonnes in February and March, according to IMF data. Gold now makes up almost 70% of the country’s total reserves, which fell to a low of .

Topics:

Tyler Durden considers the following as important: China, creditors, Debt and the Fallacies of Paper Money, default, Featured, Hugo Chávez, newsletter, OPEC, PDVSA, Pérez Abad, Sovereign Default, Swiss gold export, Swiss gold import, Switzerland, World Gold Council

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Several months ago, as Venezuela’s hyperinflating, imploding economy was spinning in freefall, leading to the dramatic episodes of total social collapse such as those profiled in “Scenes From The Venezuela Apocalypse: “Countless Wounded” After 5,000 Loot Supermarket Looking For Food“, we wrote that the country which recently had “run out of money to print its own money” was preparing to liquidate its remaining gold holdings to pay coming debt maturities.

|

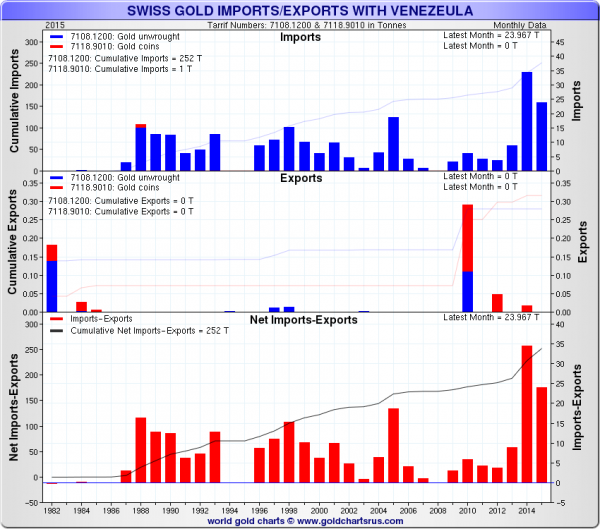

Then, courtesy of an analysis by our friends at Bullionstar, we found just how Venezuela was quietly exporting tons of its gold to Switzerland, as it prepared to conclude the transaction with whoever the end buyer of Venezuela’s bullion would end up being. |

And now it’s official – the “gold for fiat” transaction has been officially concluded, and as the FT writes, Venezuela’s gold reserves have plunged to their lowest level on record after the country sold $1.7 billion of the precious metal in the first quarter of the year to repay debts. The country is grappling with an economic crisis that has left it struggling to feed its population.

The OPEC member’s gold reserves have dropped almost a third over the past year and it sold over 40 tonnes in February and March, according to IMF data. Gold now makes up almost 70% of the country’s total reserves, which fell to a low of $12.1 billion last week.

The OPEC member’s gold reserves have dropped almost a third over the past year and it sold over 40 tonnes in February and March, according to IMF data. Gold now makes up almost 70% of the country’s total reserves, which fell to a low of $12.1 billion last week.

At this point it is only a matter of time before Maduro, scrambling to preserve his regime from both domestic political opposition and foreign creditors, sell all of the Venezuela gold which his late predecessor diligently scrambled to repatriate so it would avoid precisely this fate. The late president Hugo Chávez had said he would free Venezuela from the “dictatorship of the dollar” and directed the central bank to ditch the US dollar and start amassing gold instead. In 2011, as a safeguard against market instability, Chávez brought most of the gold stored overseas back to Caracas.

It must be an double slap in the face of the impoverished local population to watch as Maduro undoes everything Chavez had achieved, if only when it comes to the country’s gold reserves.

Venezuela began selling its gold reserves in March 2015, according to IMF data. At roughly 367 tonnes, Venezuela has the world’s 16th-biggest gold reserves, according to the World Gold Council.

While Venezuela was selling, China and Russia were buying – perhaps from Maduro – and both have added to their gold holdings this year, the data show.

As a reminder, last year Venezuela’s central bank swapped part of its gold reserves for $1 bilion in cash through a complex agreement with Citi As the FT unnecessarily notes, the gold swap is another indication the country is desperate for cash… in case it was not obvious from the surge in murders, violence and general social unrest.

But the main reason why the gold liquidation will continue is that Venezuela and its national oil company PDVSA have some $6bn to repay in principal and interest payments this year. Amid fears of default, PDVSA is attempting to restructure some of its debt, sources say.

Seeking to reassure investors this month, Miguel Pérez Abad, Venezuela’s economic tsar, told news agencies that the country has reached a deal with its main financier China to extend loans, and that he would further cut imports, even if shortages of basic goods are ravaging the country. Which is notable because as we further reported recently, the main reason why China is being flooded with oil is because countries like Venezuela are sending far more oil to repay their debt which was issued when oil was trading at $100, and as a result Caracas has to ship out double or triple the amount of oil to Beijing to satisfy the terms of the loan.

“We have a cash flow problem, but we have sufficient assets for the short-term and will reprofile the debt levels in an intelligent manner. There are various scenarios, and all of the proposals are extraordinary for the bondholders. They have the absolute assurance that their securities are guaranteed,” Mr Pérez Abad told Bloomberg. Ecoanalítica, a Caracas-based consultancy, said in a note that “we consider that the payments of external debt is a priority for the executive.”

In other words, Venezuela, which is now effectively a failed state, will soon part with its last liquid reserve of worth, when it sells its remaining gold to repay its Developed nation lenders, while it continues to pump oil to keep Beijing happy as it repays its energy loans to China.

Finally, for those who need a quick and easy primer, here is a quick clip explaining in under 100 seconds how Venezuela’s sovereign default is just a question of when.

Previous post